Differential Diagnosis of Pricing Symptoms for Churn

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

Many companies come to Ibbaka with pricing challenges. Pricing is associated with all sorts of business symptoms. But before one decides if and how to take a pricing action one needs to diagnose the root causes.

Watch the PeakSpan & Ibbaka Master Class and see how you can diagnose and treat churn

Diagnosis is not always easy. Fans of the TV medical drama House will be familiar with differential diagnosis. The same approach can be used when faced with business challenges like churn. Before jumping to a solution, one that can make the problem worse, it is important to have a diagnosis and to test one’s assumptions.

https://house.fandom.com/wiki/Differential_diagnosis

A differential diagnosis follows the following process. The doctor

Gathers all information about the patient and creates a symptoms list. The list can be in writing or in the physician's head, as long as they make a list.

Lists all possible causes (candidate conditions) for the symptoms. Again, this can be in writing or in the physician's head but it must be done.

Prioritizes the list by placing the most urgently dangerous possible causes at the top of the list.

Rules out or treats possible causes, beginning with the most urgently dangerous condition and working down the list. Rule out — practically—means using tests and other scientific methods to determine that a candidate condition has a clinically negligible probability of being the cause.

Let’s try applying this to a common business problem, churn. Churn sucks the life out of a SaaS business. The SaaS business model is built around recurring revenue. The business won one year and continues to contribute to revenue in future years. The result is a steady build in value. Unless that is, churn steps in, and customers are lost. As Ibbaka VP of Growth, Harp Dhaliwal said in a recent post, GRR (Gross Revenue Retention) still matters (see The OG of Retention Metrics: Why GRR Still Matters).

Churn is the first symptom, the one that gets leadership’s attention and shows up on the board’s agenda. Before trying to fix churn it is important to dig deeper and look for other symptoms that can tell us what is really happening.

One sign that churn may be a problem is that NRR (Net Revenue Retention) is below target. The first thing to check is churn. Churn is virtually never zero. There is a natural level of churn for every business and trying to drive churn lower than this can be counterproductive. Factors that determine the natural level of churn include

Bankruptcies in target industries

Mergers in target industries

Cross price elasticity in the target industries (see note)

Overall business conditions in target industries

Cross-price elasticity is one of those pricing concepts that is surprisingly simple and powerful. Buyers tend to switch vendors in response to a price differential. When cross price elasticity is high churn tends to be high. Cross-price elasticity interacts with price elasticity of demand to create market dynamics. See Understand your market's dynamics before you set your pricing strategy.

Assuming churn is higher than acceptable the next step in the diagnosis is to investigate the causes of churn. Start with value.

A customer who is getting value and is aware that they are getting value is less likely to churn. If a customer is not getting the value that they think they have paid for they are more likely to churn. But is the problem with the customer or with the product/solution?

Many early-stage companies end up selling to a wide range of different companies. Early on, any sale looks like a good sale and there is not enough information to differentiate between good and bad customers. Part of growing up as a SaaS company is knowing who you should sell to and organizing your revenue generation process to target the customers to whom you can deliver the most value.

Of course, the problem could be with your product/solution. It may not be providing enough value to justify a renewal. There are several possible reasons for this.

The solution may be too large and unwieldy

Solution may have too many dependencies before it can deliver value

The solution may take too long to deliver value

Solution is incomplete

Understanding which of these is responsible for churn throws light on what is needed in the product roadmap.

Only focus on price once customer and solution issues are understood.

Some companies have a gut reaction that the solution to churn is to lower prices. This is almost seldom the case and a price cut can make churn worse as buyers lose trust in the fairness of the pricing and the value of the solution.

The most common ways in which price contributes to churn are

Price does not track value

Price and value delivery are out of synch

Price is hard to explain

Price is unpredictable

Price is too high (relative to value and competitive alternatives)

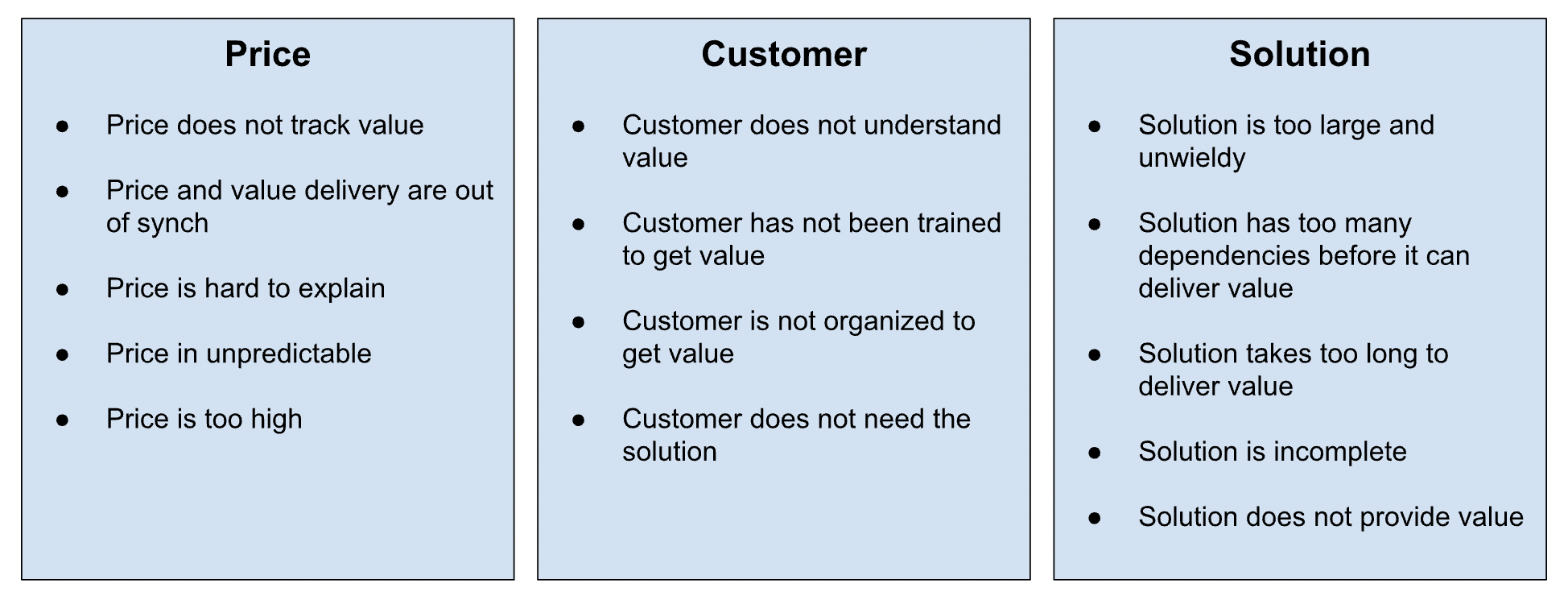

Another way to organize these ideas is as a list of possible causes. Work through all three of the lists systematically to come up with a diagnosis.

For the initial analysis, it helps to simplify things by considering price, customer, and solution one at a time. But in the real world the three interact and need to be considered together.

To solve churn, ask:

Does the customer fit the solution?

Can the solution provide value for the customer?

Does the price track the value of the solution?

Is the solution packaged in a way that lets buyers buy the parts most relevant to their needs?

Is the value to the customer higher than the price they will pay?

Is the price within the customer’s willingness to pay (WTP)?

If you can get to a place where the answer to all of these questions is yes, then problems with churn will go away.