Some companies are still driving outstanding NRR performance

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

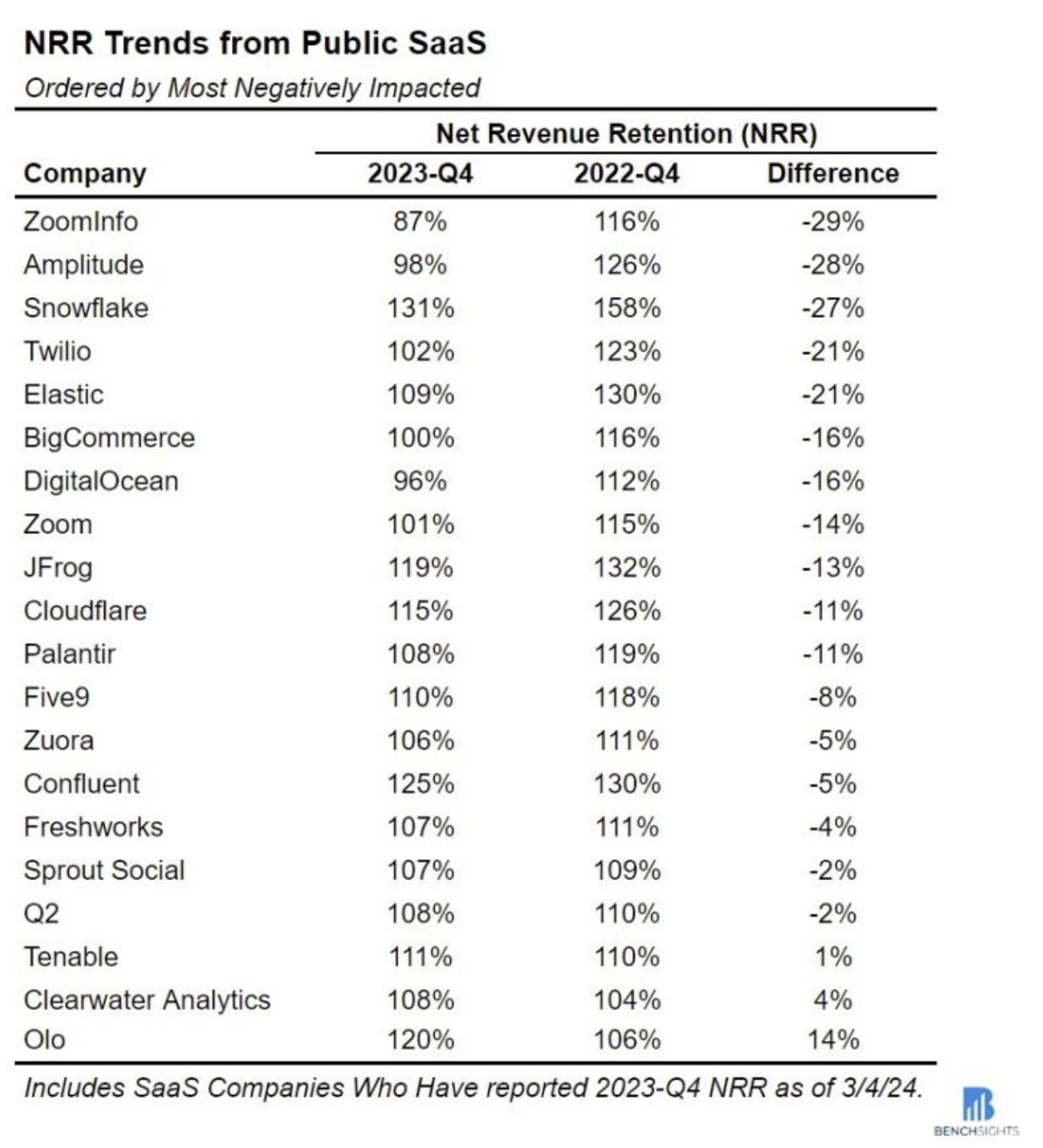

There has been a lot of sturm and drang about trends in B2B Net Revenue Retention (NRR). Strum and drang and gloom and doom. One reason for this is the contraction (some are saying collapse) of NRR at public SaaS companies between fiscal Q4 2022 and fiscal Q4 2023 (January to March 2024). Ibbaka is more focussed on private companies, and we currently have our second annual survey open. The survey is sponsored by PeakSpan and you can get the report for 2023 here.

Please take the 2024 NRR survey.

Of the 20 public SaaS companies covered by BenchSights, 17 saw NRR contract.

More importantly, all of these companies had NRR of more than 100% in Q4 2022. In Q4 2023 three companies fell below the critical threshold of 100%.

There are still some stellar performers here. Snowflake may have seen a large decline in NRR, but this is from a very high level of 158% and on substantial revenues. In Q1 FY 2025 NRR was down to 128% (a drop of 3 percentage points from the number reported by BenchSights) on quarterly revenue of just under $790 million.

NRR is often used as an indicator of the health of the customer base and a measure of product-market fit. High NRR companies have a sustainable growth model as they do not have to be going out and finding new companies. They generally have lower customer acquisition costs (CAC) but often have a higher cost to serve (as they invest more in customer success).

NRR Factors

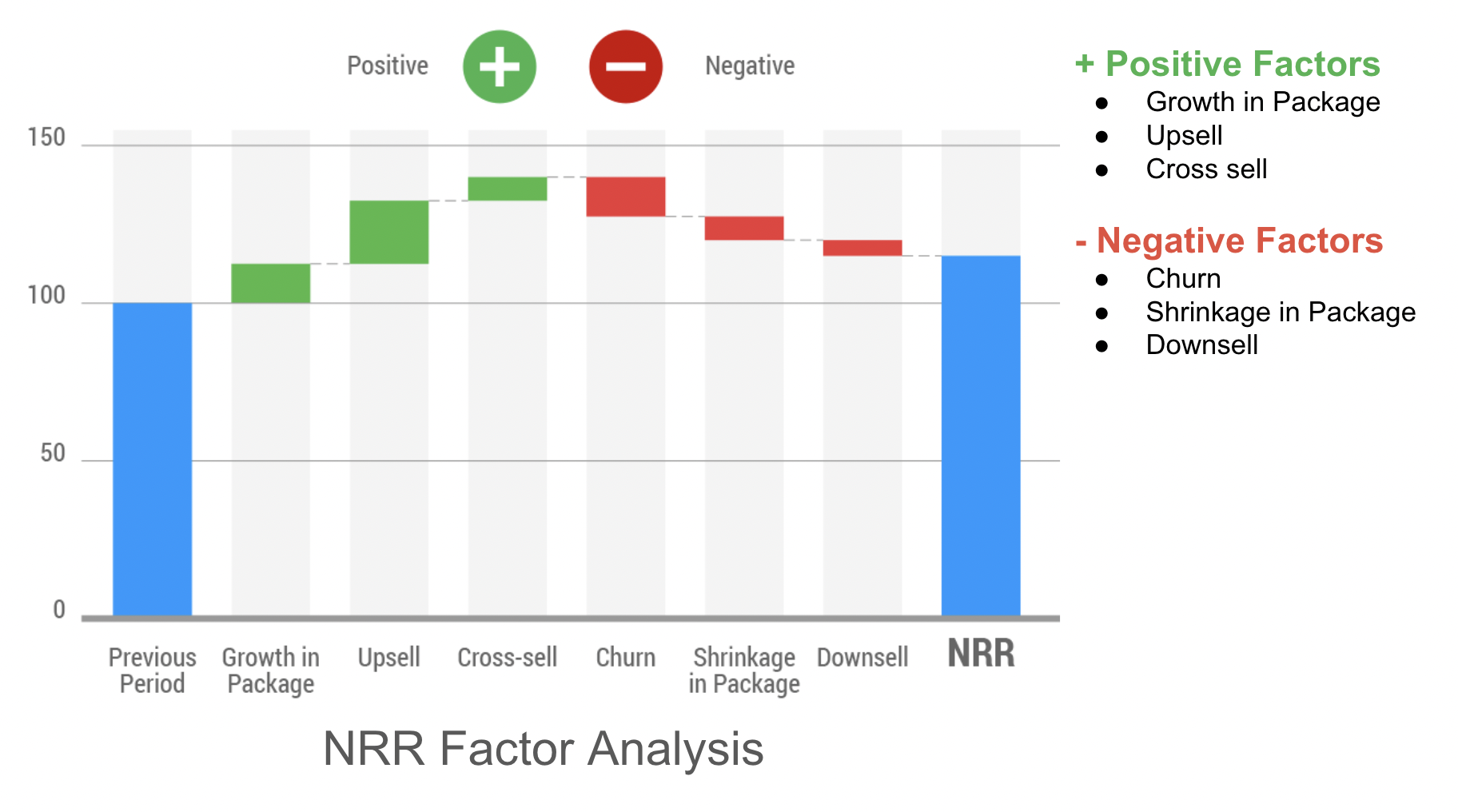

Top-line NRR numbers are important, but they don’t tell the full story. One needs to get down in the weeds and look at how each of the six NRR factors contributes (or takes away from) the top-line number. There are very different patterns possible, as discussed in Which NRR factor are you prioritizing?

High churn with high NRR

One of the truisms of running a SaaS business is that churn is bad, or as it is said, ‘churn sucks the life out of a SaaS business.’ We assume that companies with high churn will have low NRR. This is not always true.

Of the 200 or so companies that have taken the survey to date, the company with the highest NRR had an impressive score of 171% last year and a target of 190% for the current year.

This was with churn of 17% in last year and forecast churn of 20% in the current year!

These are among the highest churn numbers reported so far.

Churn is not top of mind for this company. When asked to rank the importance of the six NRR factors churn was third behind Grown in Package and Increase Cross Sell (the packaging pattern for this company is two or more independent modules).

I am sure you can guess the SaaS vertical for this company: General AI.

The pricing metrics are:

Per User

Input Tokens

Output Tokens

Model and Model Complexity

This is a company focused on growth, high growth, in a fluid market that is still defining itself.

In such a market attracting plenty of new customers, letting them experiment and grow, and letting the companies that do not discover value churn out can be a very successful strategy.

Interpreting NRR numbers requires an understanding of market conditions and business strategy. We are in a phase where generative AI is disrupting many (all) B2B SaaS markets. The most successful companies will be the ones that optimize for experimentation and growth and do not over-obsess with protective strategies.

On Wednesday, June 26th, I will be joining Saurabh Agrawal from Zenskar for a webinar on how to Unlock the Power of Usage-Based Pricing for Enhanced NRR. We will take a look at some of the early insights from the survey.

You can sign up for the webinar here!

Read other posts on pricing and Net Revenue Retention

Maximizing NRR: Introducing Ibbaka’s Revenue Retention Maturity Model

Protect Revenue Retention - Look at Churn

Differential Diagnosis of Pricing Symptoms for Churn

The OG of Retention Metrics: Why GRR Still Matters

What is driving your Net Revenue Retention (NRR)? Poll Results

Questions (and answers) from the PeakSpan Ibbaka webinar on Net Revenue Retention

Pricing and NRR: Five Questions About The PeakSpan Ibbaka NRR Survey Results

Net Revenue Retention Webinar - Unlocking the Secrets to SaaS Success

Pricing and NRR: The PeakSpan Ibbaka NRR Survey Results

Pricing and NRR: The Six Factors to Manage

Pricing and NRR: What are the key questions?

NDR Growth Tactics 6: Managing Churn

NDR Growth Tactics 5: Reduce Package Down-sell

NDR Growth Tactics 4: Avoid Package Shrinkage

NDR Growth Tactics 3: Promote Cross-Sell

NDR Growth Tactics 2: Drive Up-sell

NDR Growth Tactics 1: Grow in Package

NDR Growth Tactics Webinar | May 11, 2023

Managing Package Performance to Optimize SaaS NDR

How pricing can help fix NDR challenges

Net Revenue Retention impacts the value of your company