Pricing AI: What role could AI play in pricing?

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

AI has been the focus of many pricing conversations over the past few years. The launch of Open.ai’s ChatGPT and its use in Microsoft Copilot in November 2022 has galvanized the imaginations of investors and innovators. Almost all SaaS companies are investing heavily in AI-based applications with some completely rewriting their applications with AI as the platform.

In my April 26th talk at the Professional Pricing Society event in Chicago, I will be looking at how the direction some of these innovations are taking and how they are getting priced. Hope to see you there, but if you can’t attend, Mark Stiving and I will be doing a webinar where we discuss the presentation and Mark pokes holes in my thinking. Watch for that on Thursday, May 23.

Watch our How New AI Functionality is Getting Priced webinar here.

Today I want to open up my thinking and ask not what role does AI play in pricing, or what role AI should play in pricing, but what role it could play.

Path 1 - Improving what we do today

The most common use of AI today is to automate things we already do.

From The Information: “At Google’s Cloud Conference, Lofty AI Visions Meet Customer Reality: For now, businesses are using AI largely for mundane tasks like summarizing correspondence or finding information buried in internal documents.”

What that means for pricing will depend on how you go about designing pricing (or do you set prices) and how you evolve pricing (or are you trying to optimize price). Ibbaka has a formal process for designing pricing. We begin by getting alignment and establishing pricing KPIs and a baseline. We then work with customers to understand value, move on to packaging, design pricing, and then create a value story. AI can play a role in each of these activities.

Align on pricing strategy

Stakeholder interviews

Strategic choice cascade

Understand customers

Who gets value

How they get value

How they buy

How they adopt and use

Analysis of existing pricing and usage data

Model value then validate the model with customers

Use Economic Value Estimation EVE

Validate with customer interviews

Apply to existing customers and pipeline

Find patterns

Develop packaging

Identify functionality

Build a design structure matrix DSM to understand dependencies

Map functions to value drivers

Segment using K-Means or Leiden

Design pricing

Decide on the variables that can be used in pricing

Construct pricing equations for each

Look for interactions

Between value, price and cost across different configurations and scales

Enable marketing and sales

Migration strategies

Value stories and communication

Adapt the value and pricing models as more data is gathered

Wow, that is a lot. Your own process is no doubt different, but I am sure there are overlaps as well. There are many places where AI and generative AI can help here. At Ibbaka, our current focus is on using generative AI to summarize customer interviews and other textual information. We already use a variety of clustering algorithms to help understand customer data (K-Means, Leiden, Fuzzy), and we build predictive models for things like Net Revenue Retention. We also want to follow Mark Stiving’s example of training a language model on our own work. See Pricing GPT (you will need a ChatGPT 4 subscription).

One of the great things about using AI in this work is that it gives time and generates the space to explore new options. In pricing design, we usually only explore two or three of the many, many different ways one could price. With AI I am hoping we can quickly explore more and more of the design space.

Design Space: The multidimensional combination and interaction of input variables and process parameters that define the range of possible solutions. Design can be thought of as an exploration of the design space. Within the design space there can be many workable solutions, local maxima, and one of the goals of any design process is to find algorithms and heuristics to move towards these maxima.

Path 2 - Different ways to price

Automation is just the first step in the adoption of a new technology. We begin by getting better at what we already do well. But that is not where we want to stop. If all AI does is make what we already do easier, faster, and of higher quality it is just a sustaining innovation, and not disruptive.

An innovation is disruptive when it expands the design space making new solutions possible.

Does AI expand the design space for pricing and packaging?

I think yes. We are just at the beginning of this exploration, and no one knows how this will play out.

Some ideas …

Dynamic configuration of B2B software will remove the need for packages and bundling, every customer will get a customized configuration generated by an AI, for an early glimpse at this see Totogi: Your Custom BSS generated by advanced AI. This will change how we need to generate pricing.

API composition where applications are composed from APIs, possibly from more than one vendor, and pricing is based on a shared agreement of the value created by the contribution of each API.

Outcomes-based pricing will become the norm once we have the AIs available to support it.

The many things not yet imagined …

As we turn more and more processes over to AIs we are going to see prices negotiated between two or more AIs. This is the emerging field of Machine to Machine pricing.

Machine 2 Machine

In certain fields, Machine to Machine pricing is not new. Every day billions of shares and other assets change hands through algorithmic trading. When Machines Become Customers by Don Scheibenreif and Mark Rasinko gives a history of M2M pricing that goes back to the 1950s and LEO, the world’s first order collating computer.

In machine-to-machine pricing, machines negotiate a price between each other. This could be as simple as an auction (mechanism design is going to be central to M2M pricing), or a calculation of value, or an agreement on how to define and share outcomes. M2M pricing could become an enabler of outcomes-based pricing.

One of Ibbaka’s customers, Servitly, is bringing to market a new module that enables M2M pricing and can make any industrial machine a customer for its own supplies, spare parts, and services.

Path 3 - A world without pricing?

Pricing serves many functions but the most important is that it facilitates the exchange of goods and services and the allocation of scarce resources. Is the price mechanism the best way to do this?

It is not the only way. Barter existed long before currency and in fact one reason currency, and with it pricing, was introduced was to make it easier for central states to stake a claim on every transaction.

The Internet has already opened up new ways to barter and exchange. Free software and open-source software is one example. The Internet, and the AI infrastructure, would not work without open-source software and several of the most powerful Large Language Models (LLM) are offered open source. Go to Hugging Face and find more than 600,000 models available under a confusing variety of licenses. There is already talk of extending Creative Commons to find better ways of licensing content for use in building LLMs and for providing access to LLMs, which are, after all, a kind of meta content (content created from other content, collages at scale, or as some have said, ‘a fuzzy JPEG of the web’).

In the past, barter was too clumsy to scale. Attempts to create modern barter systems, such as local tool exchanges, have been only moderately successful, and they still need a pricing component to support the platform (often framed as membership or access fees).

Could AI change that? Possibly. If enough things of value can be represented and connected and systems be put in place for the multidimensional exchange of value. You may find this notion utopic, or dystopic, but it is part of the possibility that the widespread adoption of connected AI makes possible.

What Data? What frameworks?

AI needs data to work. Not just any data, but data that is organized in some way (categorized, tagged, clear payout matrixes, measurements for stochastic gradient descent to act on). The data and the frameworks are both important. One of the most difficult challenges to developing an AI, especially a deep learning AI, is to have a data format that the AI can work with. Solving this is what let Google Deepmind sole Go and ImageNet spark the current deep learning ascendency.

What frameworks will be used in pricing AIs?

This is the most important question. What data is relevant to pricing? How should that data be organized?

At Ibbaka we believe that ‘pricing’ data needs to be organized with a system of models. We are a model-driven company. See SaaS Pricing is Model Driven. What models do we use?

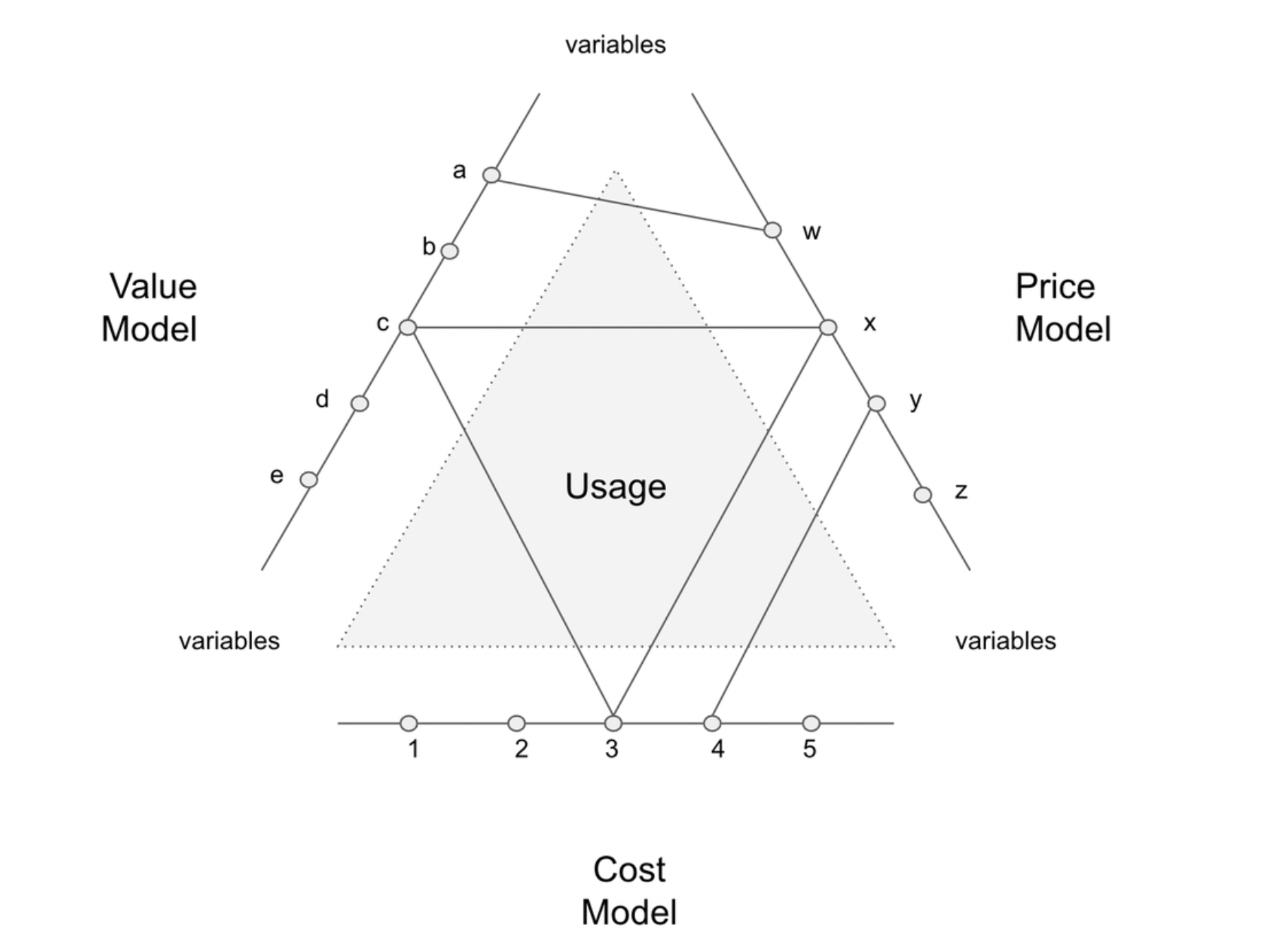

At the center is the Value Model, for which we use Tom Nagle’s Economic Value Estimation or EVE framework. We complement this with a model to estimate the externalities (the impacts a solution has on entities other than the buyer and seller). ESG and sustainability come into this. As the goal is to optimize pricing we also have a Price Model (not a price list, but a dynamic model driven by a set of equations and algorithms) and as a controller a Cost Model to make sure that we satisfy the constraint Value > Price > Cost.

Usage sits at the center of this. Being able to connect usage to value, price, and cost is the key to B2B price optimization.

The secret sauce here is to find the variables that connect value and cost through usage and use these to design price.

What is missing here? A demand model. This what the conventional heavy metal pricing engines focus on. These software engines try to infer price elasticity of demand and in some cases cross price elasticity from historical data. If one has enough data, with enough variation, and there are good substitutes in the market, this approach can give useful estimate for willingness to pay (WTP). This is not the world that Ibbaka’s customers operate in though. We need to work with much sparser data sets where WTP is shaped by value.

Where will the data come from?

So where will the data needed to train these models come from? The key will be to gather as much of the data needed for the value, pricing, and cost models in the usage model and then to enrich this with third-party data. For training the AI, it may be necessary to generate synthetic data. This is a fraught issue. At Ibbaka we do this to test scaling and interactions but not to train the AI. Understanding if and how synthetic data can be used in training B2B pricing AIs is an area that needs more research.

What is synthetic data? Synthetic data is information that's artificially manufactured rather than generated by real-world events. It's created algorithmically and is used as a stand-in for test data sets of production or operational data, to validate mathematical models and to train machine learning models.

AI is going to change pricing at a fundamental level - it will change what is priced, how it is priced, and even if price is the best way to allocate and share value. The next decade will be transformative. Pricing will change in ways we do not yet imagine.