Pricing and Planning: Explore Pricing Actions

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

There are 3 steps to developing your pricing plan for 2024 and integrating it into the rest of your business planning.

The 3rd step in planning pricing for 2024 is to map out the pricing actions you want to consider, including how you will respond to possible competitor actions and changes in the market environment.

The goal of the planning phase is not to make all of your ‘How to Win’ choices. But what you want to do is to:

Figure out what you need to learn to make effective choices

Develop a portfolio of actions that you could take

Have a pricing playbook so that you can take action quickly

Explore scenarios about what could happen in 2024 and how you would respond

What do you need to learn about your pricing in 2024?

What are 5 things that you would like to know so that you could take more effective pricing actions in 2024? Part of your pricing work is to get answers to these questions. What you need to learn will depend on your business model, where you sit in the technology adoption lifecycle, market dynamics, the impact of AI, and so on. Some common questions are shared below but you will want to develop your own list.

How does a price change impact demand?

How does a price change impact revenue?

How does a price change rebalance demand for different packages?

How do competitors typically respond to a price change?

Is our price fair given the value we are providing our customers?

What packages or functionality do our customers value most? … value least?

Do we really need to discount? If so, how much?

One of the first questions to ask is how your current customer base is distributed when you segment them by the value you are providing (value to customer or V2C) and the value you are capturing through price.

Doing this will help you answer one of the key pricing questions.

What will happen if we increase prices?

The answer to this question will differ for each quadrant. For customers in the top left quadrant, one should probably be looking at a price increase. For those in the bottom right you need to improve the value you are delivering before you increase prices. For companies in the bottom left, you need to either move them to the top right or bottom left or let them churn out. A price increase is often a good way to prune low-value customers that you are not providing a lot of value for.

Another common question turns on pricing metrics (the pricing metric is the unit of consumption for which the customer pays; the value metric is the unit of consumption by which a user or buyer gets value).

Should we add a pricing metric or change our metric?

The most common thing is to add some form of usage pricing metric. There are 3 good reasons for doing this.

Research by many companies (Maxio, OpenView-Paddle, PeakSpan-Ibbaka, Zuora) has found that companies that include a usage-based pricing metric outgrow similar companies with a one-dimensional pricing metric.

Having a usage-based pricing metric activates the ‘grow in package’ lever for Net Revenue Retention (of course it also switches on the shrink in package lever).

A usage-based pricing metric, properly designed and implemented, makes it possible to better connect price and value, at least when the form of use correlates with value.

One of the plagues of B2B SaaS is undisciplined or ad-hoc discounting. In the Establishing a Baseline step of planning one of the first things to do is to analyse current discounting practices and their impact on revenue.

Do we need better discipline around discounting?

When you were establishing your baselines in the first part of your planning process one of the things you did was to look at discounting. About 70% of B2B SaaS companies have ad-hoc or undisciplined discounting. If you have disciplined discounting you will be able to predict the discount based on a small number of factors.

Pricing & Packaging Actions

What pricing actions should you be considering in 2024?

The basics are the ones that you are already considering.

Increase or Decrease prices

Add a pricing metric

Rebalance packages

Redesign packages

Redesign packaging

Control discounting

Increase or decrease prices

It is always worth considering a price change. If one is going to increase prices ask

How much volume can I afford to lose and earn the same revenue?

When you do this calculation for SaaS make sure you factor in your Net Revenue Renewal and consider the upsell and growth in package that you may lose.

Ask the inverse question for a price cut.

How much volume do I need to win in order to earn the same revenue?

SaaS pricing is more complex than conventional pricing as the unit economics and impact on recurring revenue have to be taken into account.

Add a pricing metric

Adding a pricing metric can be a much more effective way to grow revenues than simply increasing prices.

One of the trends that Kyle Poyar and I identified for 2023 was Hybrid Pricing. See Your guide to pricing transformations in 2023.

The most common pricing metric that people are adding is some form of usage-based pricing. As noted above, companies that include a usage-based pricing metric tend to outperform their competition. If you are not already doing this you need to consider it.

Rebalance packages

When you designed and priced packages you had a clear view of the role each package was to play. There were expectations around volume share and revenue share, and each package had its role to play in attracting, converting, and growing revenue. Over time, packages tend to drift and lose focus.

A fence is one of those restrictions on use or volume that guide buyers to one package or another.

You can rebalance packages by adjusting price levels, moving fences or changing functionality. Before you do this, check and see if the package roles also need to change and if a more fundamental package redesign may be needed.

See Are your pricing tiers doing their job?

Redesign packages

Packages frequently need to be changed to respond to changing market conditions. This is where the modular operators come into play. Look at each package you offer and see how it can be simplified.

There are several ways to simplify packaging. John Maeda’s laws of simplicity offer a good way to do this.

Of course, one doesn’t always need to simplify. As new functionality is added and new market opportunities are identified one sometimes needs to evolve the model. Here one can look at the modular operators and see how these should be applied to each existing package.

At Ibbaka, we have developed new functionality that we plan to add to Valio in 2024. This will lead to the creation of new packages and options.

Discounting analytics

Machine learning for discounting prediction

Net Revenue Retention Analytics

Machine learning for Net Revenue Retention prediction

Customer Lifetime Value analytics

Machine learning for Customer Lifetime Value prediction

Scale testing and interaction testing for value and pricing model

Pricing model comparison and optimization

Monte Carlo modeling of value drivers

Value-based pricing process as an alternative to value-based pricing models

Value driver aggregation and value driver-based segmentation

Value driver aggregation and value driver-based segmentation visualization

That is a lot of new functionality to boil down into the simplest possible set of packages.

If ‘software is eating the world’ (Marc Andreessen, 2012) then AI is eating software. It may not be enough to enhance existing packages with AI or to have an AI module. Companies that are committed to AI are redesigning their packaging with AI as the platform. See

Control discounting

You need to invest in better discounting management if your ability to predict discounting based on discounting factors (five or less) has an R-squared < .9. The way to do this is to have clear reasons for why discounts are being given and to enforce them.

Some reasons given for discounting include

Strategic investment in a sector (customer will bring in additional customers and act as a reference)

Concession to procurement (allow procurement to feel they are doing their job)

Low-value use case (the use case will create less value than standard use cases)

Competitive pressure (provide a small price concession)

Pricing Scenarios

We are fooling ourselves if we think we know what will happen in 2023. (How many of us predicted that Sam Altman would lose his job as CEO of Open.ai on November 17?)

There is an established way of planning for uncertainty, scenario planning. It is seldom used in pricing work, but perhaps it should be.

In scenario planning, one begins by identifying the well-established trends that we can be confident of.

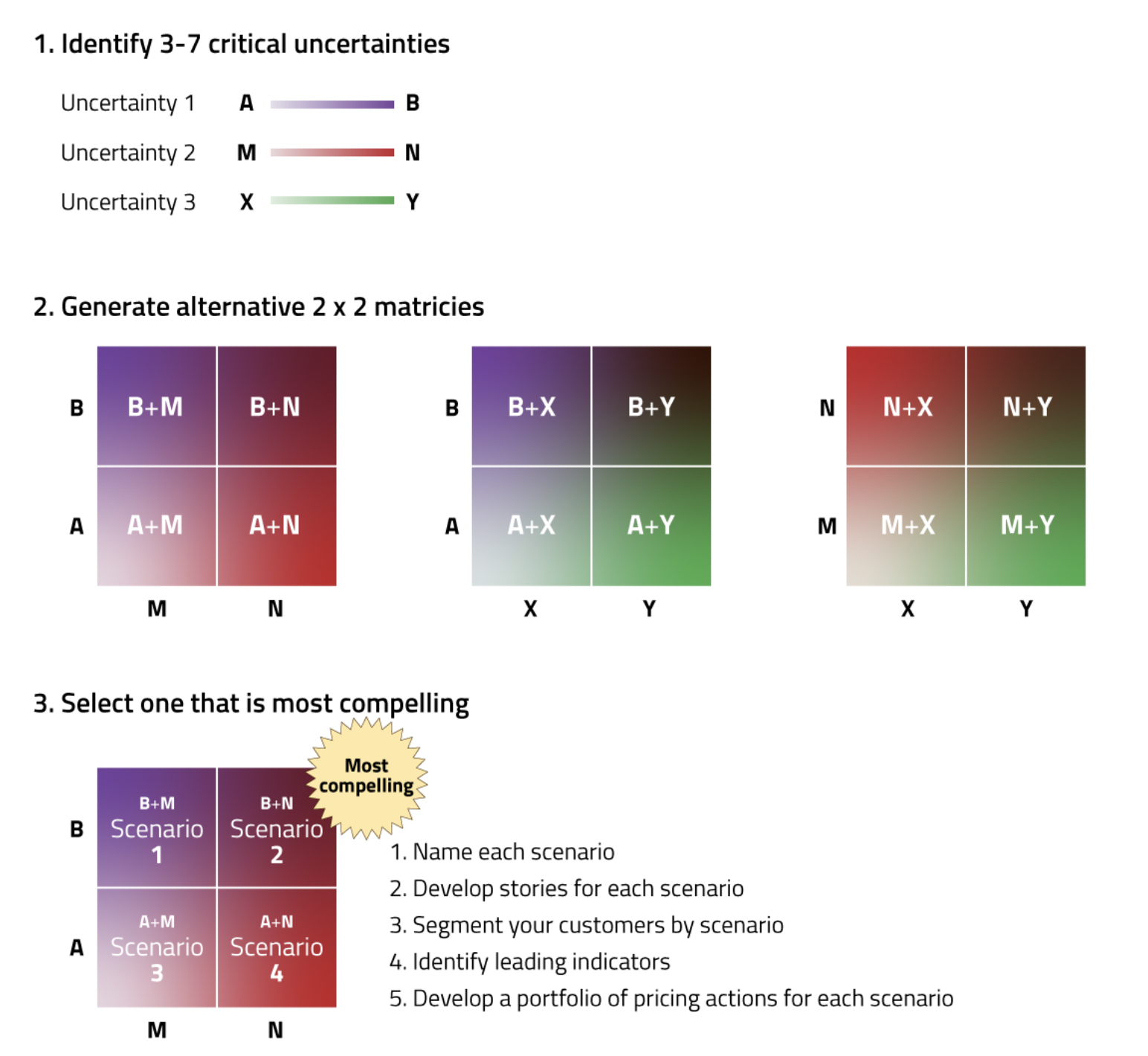

One then brainstorms a list of five to seven critical uncertainties that could go either way.

The scenarios are then created by combining 2 critical uncertainties to generate four to nine alternate scenarios.

See Scenario planning for pricing (managing through uncertainty)

What critical uncertainties are we facing in 2024? Here is a list to get you started.

Customers will find ways to implement AI in ways that make your solution irrelevant

Competitors will find ways to implement AI in ways that make your solution irrelevant

Costs increase (computing, storage, bandwidth, perhaps as a result of AI usage)

A competitor cuts prices

A competitor raises prices

A new competitor emerges with a different business model (maybe a multi-sided market)

Government introduces new regulations on data sharing across customers