How will a recession change market dynamics and impact your pricing strategy

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talent.

Part 6 in a series of posts on pricing and inflation - preparing for 2023

Part 1 Pricing and Inflation: How to Respond

Part 2 SaaS Companies plan to raise prices in 2023, do they know how to do this?

Part 3 Inflation does not give you a Carte Blanche to raise prices

Part 4 Value Driver Priority and Pricing Under Growth and Interest Rate Scenarios

Part 5 Pricing in consolidating markets

Part 6 How will a recession change market dynamics and impact your pricing strategy (this post)

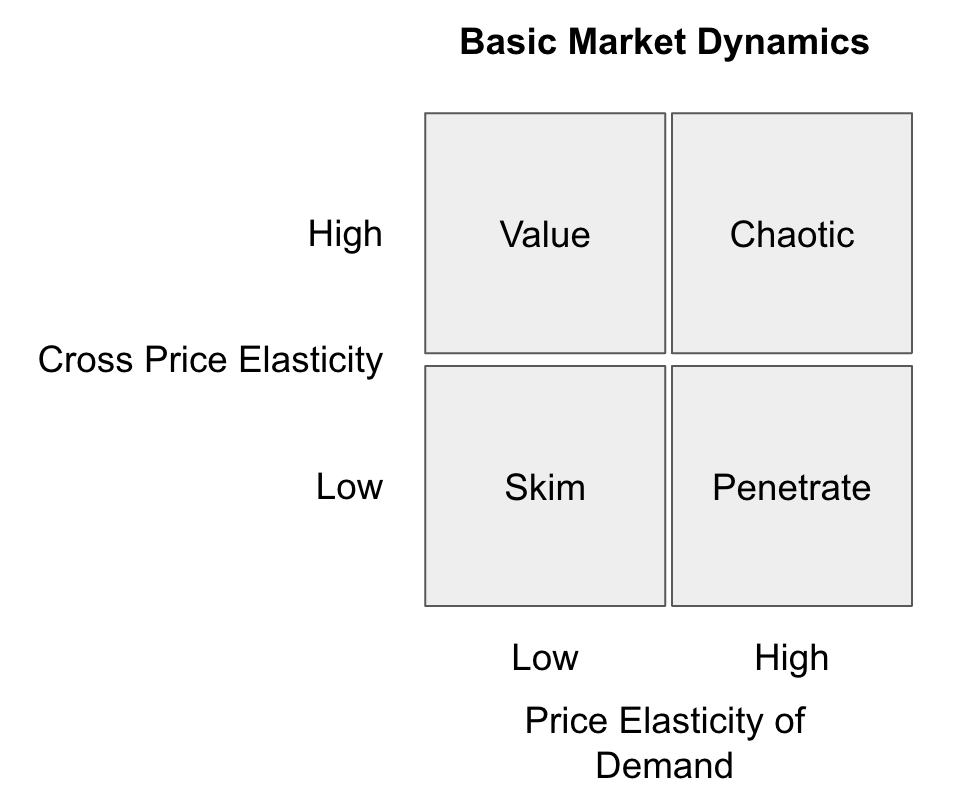

In pricing work, market dynamics refers to the interplay between price elasticity of demand and cross price elasticity.

Price elasticity of demand refers to how demand changes in response to a change in price. The basic assumption is that lower prices lead to higher demand and this is generally true, but the shape of the demand curve is almost never linear. Demand flattens off, one can only use so much of almost anything, and there are cases where I higher price leads to higher demand - for example with luxury goods and where price is a strong signal of quality.

Cross price elasticity is the tendency of a buyer to change suppliers when a price differential changes. If my CRM provider becomes 3X more expensive than the alternative I will likely switch at some point. Cross price elasticity is different for commodities versus differentiated goods and often takes more time to play out than straight price elasticity of demand.

Market dynamics can change in a recession and a change in market dynamics can motivate a change in pricing strategy. Market dynamics differ by segment and customers can change segments with a recession. Let’s look at some of the possibilities.

Pricing and Market Dynamics

The basic model for market dynamics is a 2x2 grid. One can apply lots of fancy mathematics to the curves to come up with complex and usually inaccurate predictions. Understanding the basic principles is usually enough. Let’s look at the four basic cases.

Price Elasticity of Demand Low x Cross Price Elasticity Low

The market is not price sensitive. You will generally want to have a skimming pricing strategy and to use value based pricing.

Price Elasticity of Demand High x Cross Price Elasticity Low

Here the lower the price the larger the market volume. One wants to find the right balance to optimize either revenue or gross margin. This is generally not the lowest price (lots of value but not enough revenue) or the highest price (which could damp down long term demand) but the happy medium.

Price Elasticity of Demand Low x Cross Price Elasticity High

These are the high risk markets. Lower prices do not lead to higher overall demand, but price differentials can drive a lot of switching behavior. Price wars are to be feared here. This kind of market dynamic becomes more common in a recession. Many markets never recover.

Price Elasticity of Demand High x Cross Price Elasticity High

These are the most dynamic and exciting markets and the hardest to price for. They exhibit many chaotic behaviours with strange attractors at work and lots of niches. Pricing is a lot of fun under this set of market dynamics, high risk and high reward .

Pricing and Market Dynamics in a Recession

Market dynamics generally change in a recession.

In a recession price elasticity of demand goes down

In general, price elasticity of demand is lower in a recession, the curve flattens and shifts to the left (overall demand goes down).

If this is the only thing happening you want to keep prices steady and double down on value based pricing, reinforcing the value you are creating (remembering that how you create value may have changed in different segments, see Value Driver Priority and Pricing Under Growth and Interest Rate Scenarios).

But what about cross price elasticity?

In a recession cross price elasticity behaves differently in different segments

In many markets cross price elasticity goes up in a recession as buyers start to look for less expensive alternatives. When this happens you may need to take some pricing actions.

Provide some sort of price concession, preferably tied to value, and not locked in; the price concession should not provide a new anchor price

Introduce a low cost alternative

Invest in value based pricing to help defend your current price levels

There are some markets, not as common, where cross price elasticity goes down in a recession, especially if vendors are willing to make compromises and invest in long term relationships.

In this case, one wants to invest in building long term commitments. One may want to make temporary price concessions to do this, but this is generally a bad idea. Rather than make price concessions, find new ways to provide value and to improve the customer experience.

In a recession cross price elasticity behaves differently in different segments

Your pricing strategy needs to combine that two possibilities. For most companies, there will be some segments where customers increase cross price elasticity during a recession, they become more willing to consider lower cost alternatives.

And there will be other segments where cross price elasticity goes down, they will not be willing to take on the cost and effort of changing suppliers or solutions for modest cost gains.

The job of pricing strategists is to determine which customers are in which segment, and then to come up with the appropriate pricing actions.

If cross price elasticity is going up you will need to take advantage of this and find ways to switch your competitor’s customers to your lower priced alternatives (using short term price concessions or a low priced alternative).

If you want to stay a high priced vendor, then prepare some defensive actions. Invest in long term relationships. This can be a good time to increase service levels, provide additional value added services or functions or otherwise improve CX (the customer experience).

Pricing and Market Dynamics After a Recession

Pricing is a strategic game and the winners will have thought out their strategy several moves in advance and prepared for more than one scenario.

People often assume that after a recession things return to normal. That is almost never the case. The changes forced by the recession will have established new expectations among buyers, changing pricing anchors, developed new capabilities at each vendor and its competitors, and setting new market relations (new partnerships, pathways, buying patterns will get established).

Choices made in responding to the recession will set up the choices possible after the recession.

All recessions come to an end, so as you prepare your pricing choices for 2023 ask what pricing choices you want to be able to make in 2024. You may want to be able to …

Raise prices - so any price changes in 2023 should be

Reversible

Not set a new anchor price

Change a pricing metric - to better connect value and price as the economy starts to grow again

Change the channels you use to go to market

Layer in a new growth model (add product led growth to a sales led growth strategy; add community led growth to product led growth)

As with all things pricing, it will be important to segment or resegment your market. In some segments, both price elasticity of demand will go up as will cross price elasticity. Markets will get chaotic. Pricing will need to be agile and adaptive.

In other segments, cross price elasticity will decline even as demand grows. This can happen as buyers begin to make long term commitments again or as capacity and supply chain limitations come in. In these segments the pricing response will depend on the overall business strategy. In both cases one wants to be able leverage value differentiation (value that your solution provides that the others do not).

Skim in established markets where one wants to own the part of the market with high WTP (willingness to pay)

Penetrate in rapidly growing markets where market share today predicts more sustainable profits in the future

The time to plan your 2023 pricing strategy is now. The plans should prepare you for more than one scenario. They should also set you up for what you what you want to achieve once the recession lifts.