Pricing and Planning: The SaaS Business Environment in 2024

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

What will drive B2B SaaS pricing in 2024?

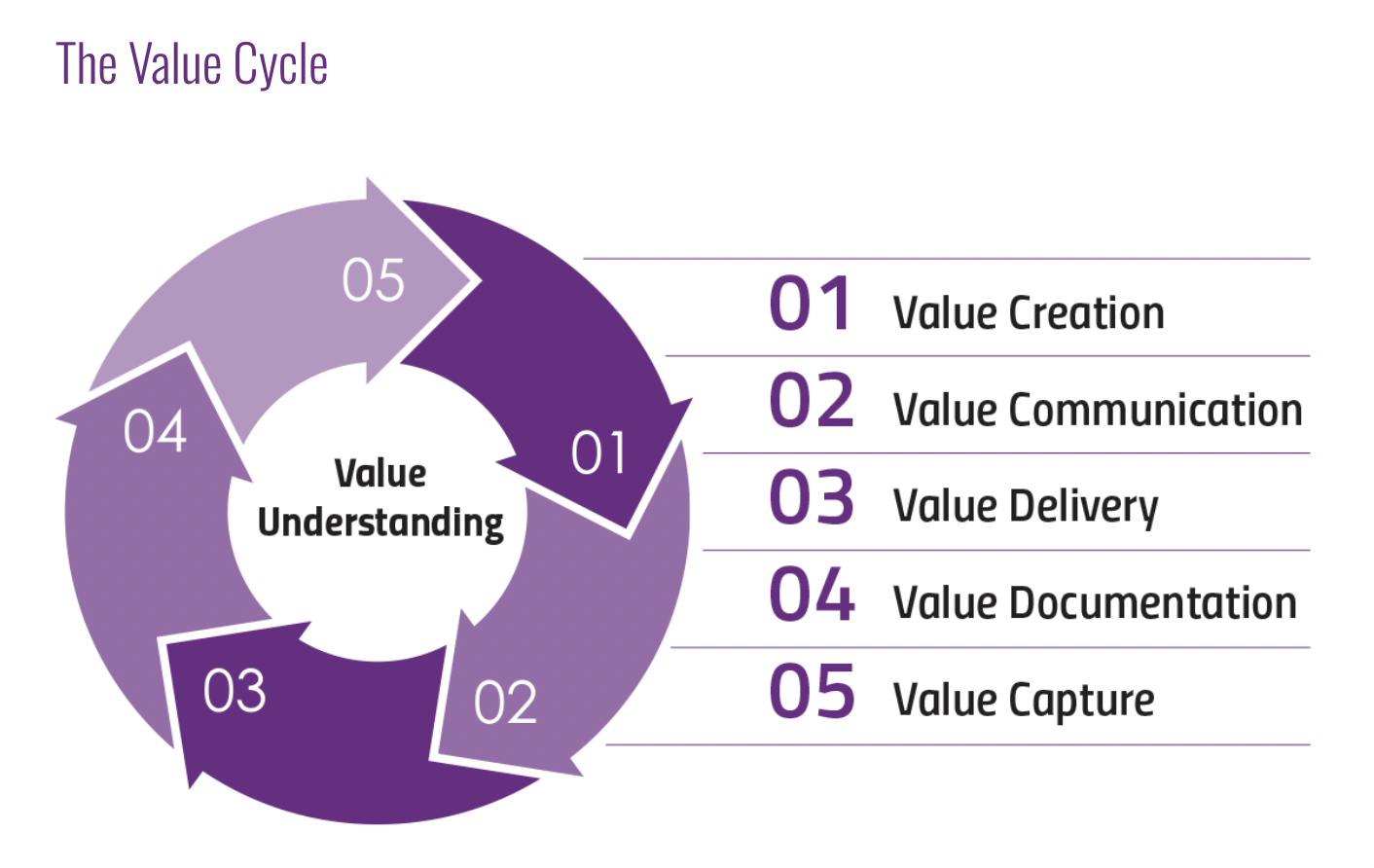

For SaaS companies pricing is not a once and done thing. Continuous innovation is part of the SaaS promise and with innovation comes a need to communicate the value of that innovation and then to document value delivered. This means that SaaS companies need to regularly adapt packaging and pricing to capture the value of their innovations. Failure to do so will break the value cycle and make it difficult to continue to innovate.

At the same time, competitors are also innovating, and what was a strong differentiator one year rapidly becomes a commodity and pricing power for existing functionality erodes.

The business environment also impacts customer willingness to pay (WTP) and even ability to pay. Overall trends like economic growth, inflation and interest rates all impact SaaS pricing, as do industry specific trends.

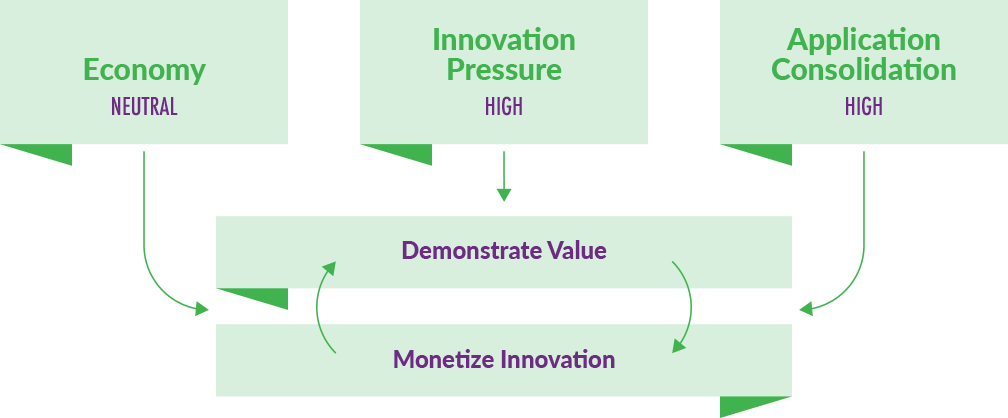

The key factors shaping the SaaS economy ins 2024 are

A neutral economy

High innovation pressure

High application consolidation

SaaS companies will have two imperatives

Demonstrate value

Monetize innovation

A neutral economy for most SaaS vendors

The inflationary and interest rate increase pressures of 2022 and 2023 are moderating and fear of a recession has eased. That does not mean we are entering sunny days. Interest rates will settle at a rate higher than what we enjoyed after the Global Financial Crisis (2008), economic growth in most regions will be moderate to low. In other words, the situation is normalizing.

We need to get used to operating in this environment as it will likely continue for the rest of the decade, baring major events like wars and climate disasters. This is the new normal.

We will not be able to use inflation as an excuse for necessary price increases. That play is played out.

Buyers will expect prices and price increases to be moderate and reflect changes in the relative value being delivered.

This is good news really, as a more predictable business environment makes it easier for buyers to buy and for vendors to execute on scalable, predictable pricing that is part of a cycle of continuous improvement.

High innovation pressure driven by AI adoption

In 2023 media coverage of AI and announcements by many SaaS companies on AI have raised expectations among SaaS buyers. AI is now seen as table stakes. It will not be enough to talk about AI or provide a magic wand here and there. Buyers will be looking for real functionality delivering economic value.

At the same time, many users will be used to using some form of generative AI in their personal life and in their own work. People are using AI’s to write e-mail, organize spreadsheets, summarize ideas and they have an idea of what to expect. Coders especially now see an AI assist as a normal part of doing work.

Microsoft will play a big role in framing AI pricing for B2B SaaS. It is expected to come out with new or improved bundles that include various forms of AI. Microsoft’s choices will provide the context for other vendors who will follow along or intentionally provide alternatives. Microsoft’s decision on price levels will anchor pricing for many other applications.

See AI Pricing: Microsoft will frame AI pricing in 2024

Open source models will be the foundation for a lot of the innovation. Over the past few weeks French company Mistral AI has attracted a lot of attention for its 7B model. It is time to go back to the open source playbook and see how to monetize open source and applications and services built on open source platforms. Remember that Red Hat was able to build a substantial business on top of the open source Linux platform before being acquired by IBM in 2019 for $34 billion. The Red Hat playbook will be applied to AI.

Others are also noting this open source AI moment. See AI’s Linux Moment (Chapter 2): Recent highlights of the open-source vs. closed-source model debate and Open Source Models : What Can We Determine from Download Patterns?

The key to sustained innovation is successful value capture. Innovators need to create, communicate, deliver and then capture value to reinvest in innovation. There are different ways to do this, both in terms of packaging and in how value gets measured.

In November of 2023 Ibbaka surveyed just over 300 B2B SaaS on how they plan to monetize their investments in AI. One thing we asked is how they would measure the value AI is creating for customers and what method they would use to set prices.

From Ibbaka AI Monetization in 2024.

Companies using cost plus and competitive pricing tended to be using soft measures of value like C-Sat (Customer Satisfaction) or NPS (Net Promoter Score).

Companies using value based pricing are taking a more formal approach to measuring value, using Economic Value Delivered (an external, customer centric approach) or Net Revenue Retention (a more internal approach).

The winning companies will be those that are able to communicate the economic value of their innovation and price based on the value delivered.

High application consolidation as companies search for value and simplicity

Some buyers are moving towards reducing the number of SaaS applications they use and leaning on large vendors to supply their needs. SaaS procurement companies like Vendr offer to help with this and the large platforms like SAP, Oracle, Salesforce, EPIc and so on are claiming that they can handle all a customer’s needs.

Best of breed and point solutions are going to be under tremendous pressure in 2024 to justify their place in the corporate SaaS stack. CFO and CIOs, who are often close to these large vendors, will be pushing business units to consolidate services and reduce spend.

How can smaller companies fight back?

The only real answer is to be able to create, communicate and above all demonstrate differentiated value.

Differentiated value is the value that you provide that the next based competitive alternative does not. You have to ask and be able to answer the following questions.

What specific value do you create that the large vendor does not?

How are you communicating that value to the buyer and to users?

How are you documenting that value?

The best practice is to feed usage and outcome data from your own application into a value modelDoes the documented value you are delivering justify the price you are chargin?

The value ratio or value capture ratio (the percentage of value you deliver that is captured back in price) is generally between 20% and 30%. In the 2024 operating environment there will be pressure to lower this. Make sure you know the value capture ratio for each of your customers, and know what value drivers are contributing the value.

SaaS companies need to communicate and demonstrate value

The economy, innovation pressure, and application consolidation are all pushing SaaS vendors to focus on differentiated value.

Assume that the large vendors will be doing everything they can to commoditize functionality and push your vertical towards commoditization. Large vendors win when functionality is commoditized.

Innovations will need to be priced based on the new value they create for customers. This can be the creation of new value drivers or improvements to existing value drivers.

All steps in the value cycle are in play here.

Of course one has to begin by creating value and then communicating that value to the market. But creation and communication are not enough. You have to be able to deliver the value you promise and then document that it has actually been delivered.

Documentation is where many SaaS companies are falling short. Customer satisfaction (C-SAT) or Net Promoter Scores (NPS) do not document value. If these are the key metrics for your customer success team you are setting yourself up to fail and to lose to the large consolidating vendors.

SaaS Investments in AI must be monetized

As is well documented, there was massive investment in AI in 2023, and to quote the OpenView research (agan), more than 70% of SaaS companies have made or plan to make investments in product AI but only 15% know how they will monetize these investments. This is not sustainable.

There will be huge pressure from customers and investors to get clarity on the value of AI-based innovations and to monetize this value. Buyers are willing to pay for differentiated value, bit not for ‘me too’ copycat solutions that do little to improve their business.

Key questions that packaging and pricing experts will need to answer in 2024 is

Is AI an extension to existing products, a new product or a new platform?

Is AI for current customers or for new customers?

Does AI improve existing value drivers or enable new value drivers?

Having clear and consistent answers to these questions lays the foundation for AI pricing and monetization.