AI Pricing: Microsoft will frame AI pricing in 2024

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

One of the defining things for pricing in 2024 will be how Microsoft decides to monetize its large investments in AI.

Download the AI Monetization Research Report

Of the big tech companies, Microsoft has made the largest bet on AI. Most prominent is its $13 billion bet on Open.ai but this is just the tip of the iceberg. There are many other investments in the underlying technology, at Microsoft Research and through the in-house venture firm M12.

These investments set the stage, but what is more important is how Microsoft is bringing this functionality to its users and creating new value for them. This is happening in many ways across the product portfolio, with Microsoft Copilot being the most visible.

How Microsoft decides to price and package Copilot and other AI investments will frame the market for AI business applications. Other companies may copy Microsoft, or strike out in new directions, but in B2B what we do will get compared to the decisions that Microsoft makes.

Last week The Information had an important article giving some insights into how Microsoft may approach this. The Architect of Microsoft’s Vaunted Cloud Bundle Turns His Gaze to AI: Takeshi Numoto has been one of Microsoft’s most influential behind-the-scenes executives in the past 20 years, helping turn its cloud business into a huge success. Now he faces the challenge of persuading customers to pay for AI tools.. This is behind a paywall, but a subscription to The Information is worth paying for.

What are the key decisions that Numoto needs to frame for Microsoft?

When should Microsoft charge for AI directly and when should it be part of other applications?

Which bundles should Copilot and other AI solutions be included in?

What pricing metrics should be used?

What should the pricing level be?

Before we dive into this, let’s look at the approach that Numoto has taken to bundling and pricing in the past.

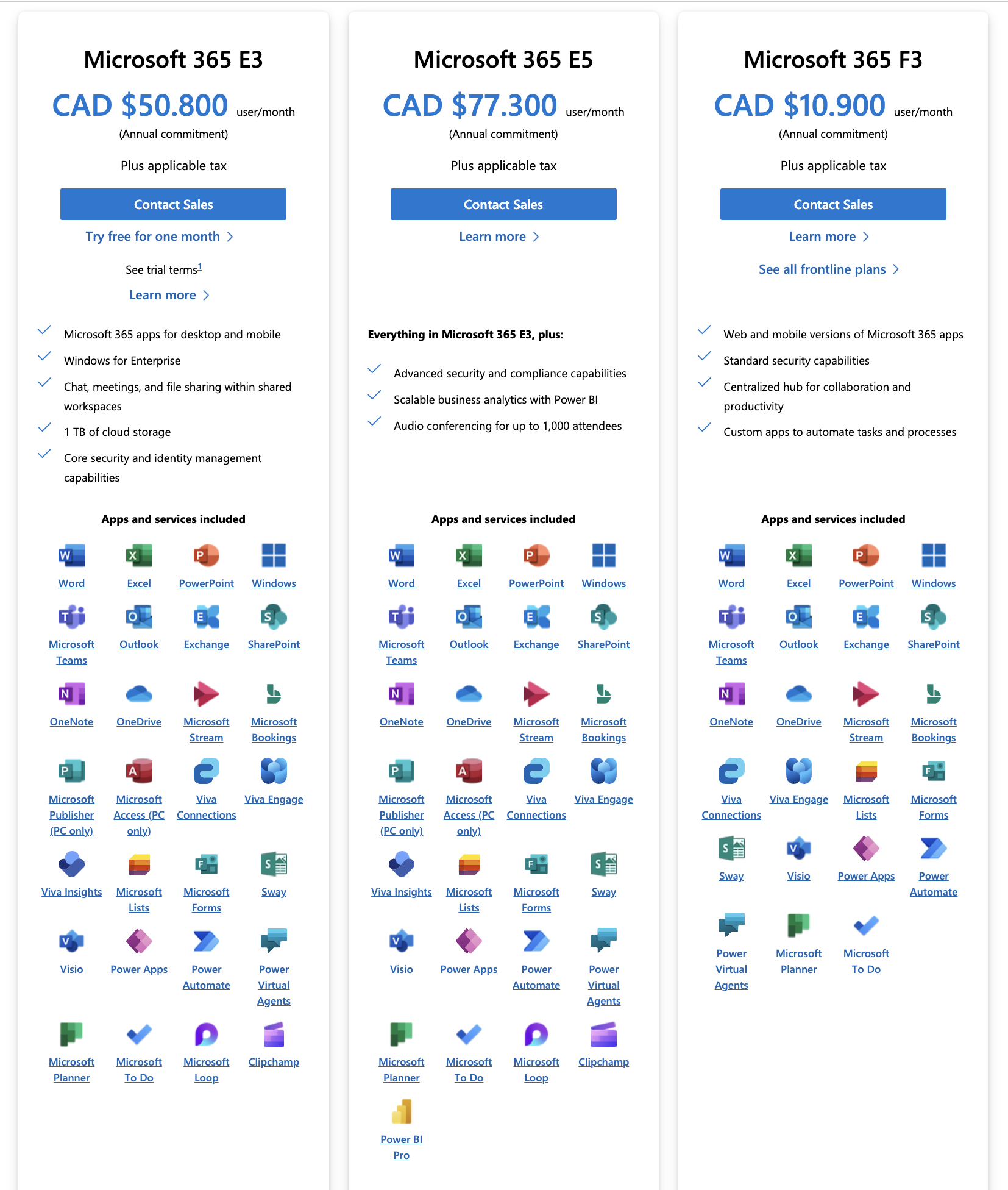

He has been one of the key people involved in crafting the E3 and E5 bundles and in defending the pricing of these bundles. These bundles are a pillar of Microsoft’s revenues.

Right now Copilot seems to be available primarily as an add-on priced at $30 per month. Pricing research that Ibbaka carried out back in July 2023 this seems to be a sensible price point, at the upper end of what Microsoft could charge.

From Pricing AI assistants for productivity suites: survey results

This was Microsoft’s first pricing move, but pricing is a game of many moves played out over time. The next moves will come throughout 2024.

When should Microsoft charge for AI directly and when should it be part of other applications?

This is the foundational question. There are some use cases where AI is best seen as a complement to other applications. Copilot seems to be an example of this. One uses Copilot when one is using some other application such as Excel Word or even BI. Other applications are built on AI and are AI native so to speak. Microsoft is not a leader here, but arguably Microsoft Designer is an AI-first solution for creating images and presentations. Companies that are AI native, are building on top of AI platforms, with an AI-first user experience need to differentiate themselves from companies that are using AI as a complement to existing applications.

Which bundles should Copilot and other AI solutions be included in?

Microsoft can take 3 different approaches to bundling (and as a very large company it will likely take all 3 approaches in different parts of its business).

Add to existing bundles? Copilot could simply become part of one or more existing bundles and not be called out separately.

Add-on to existing bundles? Copilot could be available as an add-on to an existing bundle for an additional cost (the current approach).

The foundation of a new set of bundles? As more and more different AI functionality becomes available specialized AI bundles could be offered.

These are the key questions that Numoto and his colleagues are working on. The decisions they make will be critical to all of us.

What pricing metrics should be used for Copilot and other AI solutions?

When the AI is added to an existing bundle, or when it is an add-on to a bundle, the default pricing metric will be to use some combination of pricing metrics already used in the bundle. This will be the easiest approach to pricing and the easiest for buyers to understand.

The challenge that some companies will have, though perhaps not Microsoft, is that this will not always align with the cost of operating AI platforms. Companies building on Open.ai, Anthropic, or similar patterns will be paying for token input and token output. These solutions are not cheap and costs do not necessarily scale in the same way as pricing. When pricing a solution that will be bought at different levels of scale the following relationship must be maintained.

Value > Price > Cost

What should the pricing level be for Copilot and other AI solutions?

The initial pricing of US$30 per user per month looks like a good starting point (see the above Van Westendorp study). But what is this price meant to optimize? It is a measure of Willingness to Pay (WTP) and does not by itself reflect

The value created by Copilot for different applications or use cases

The revenue-optimizing price

The profit-optimizing price

The volume-optimizing price

$30 is close to the price based on willingness to pay, but it is likely not the right price.

To find the right price Microsoft will need to answer some key questions.

Is the purpose of AI to enhance existing revenue streams or to create new revenue streams?

(A company as large as Microsoft with a diverse product portfolio can pursue both of these goals in different parts of its portfolio but most companies do not have the scale or scope to do this)Is the goal to optimize volume, revenue, or profit?

(These are different goals and you can only pick one)How does AI create value and who does it create value for?

(This is the foundational question, and where most companies should begin their pricing research; if the answers to the ‘who’ and ‘how’ questions are the same as for conventional products, then use existing pricing metrics and package this as a product enhancer or product extension, if the answer to either of these questions is different than you have a new product)Does the AI enhance current packages and bundles or should it be used to create new bundles?

(This is where Microsoft will spend most of its time)

How Microsoft answers these questions, and the decisions it makes on bundling, pricing metrics, and pricing levels will frame AI pricing in 2024.

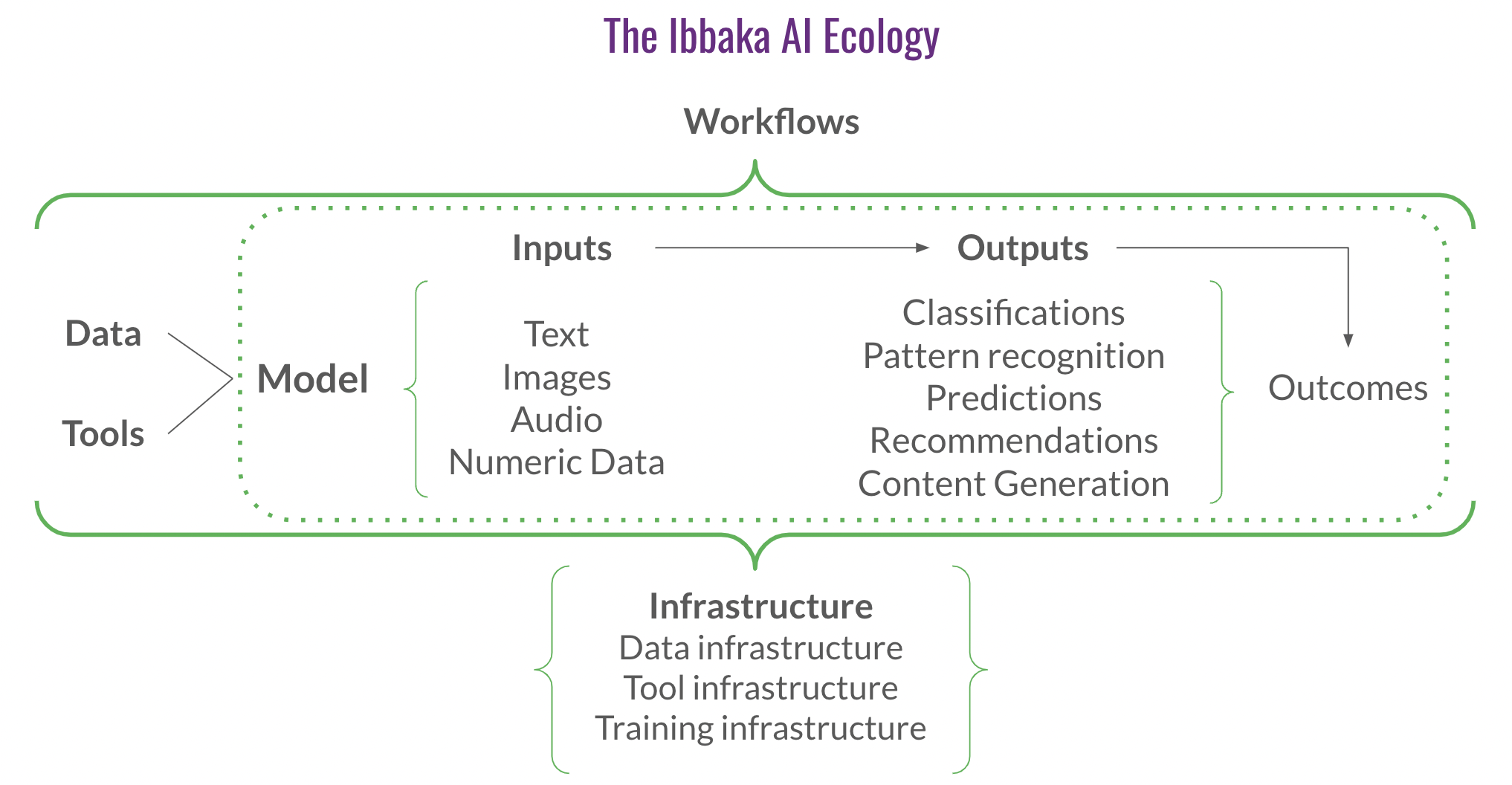

The Ibbaka AI Ecology

Microsoft plays across all the different parts of the Ibbaka AI ecology. This framework is used to help make packaging and pricing decisions as value creation and pricing differ in each part of the framework.

Microsoft plays across the full AI ecology. Azure provides many infrastructure services and tools. The Microsoft graph is a powerful data source to train models and to use in RAG (Reiterival Augmented Generation) architectures. Microsoft has privileged access to Open.ai GPT models, and other models, and develops its models. It even helps you develop your own models. Any data input into a 365 app can be used as input to an AI (this is the secret to Copilot’s power, and the only other company that can compete with this is Google with Google Workspace. Microsoft is also working hard to cover all of the different types of outputs, from classifications and pattern recognition to predictions and recommendations. And of course, one typical use of generative AI is to generate content of all kinds.

Where there is less clarity is the outcome that all of this enables. What is the purpose of AI? This is where Microsoft and all other companies investing in AI need to focus. It is the outcomes that create value. This takes us back to the key business question …

How does AI create value? Who does it create value for?