Wallet Allocation - Net Promoter Score - Pricing

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talent.

Net Promoter Score (NPS) is a popular measure of customer loyalty and enthusiasm. It is used extensively in measuring customer experience (CX) and in some companies people are being compensated based on the NPS achieved.

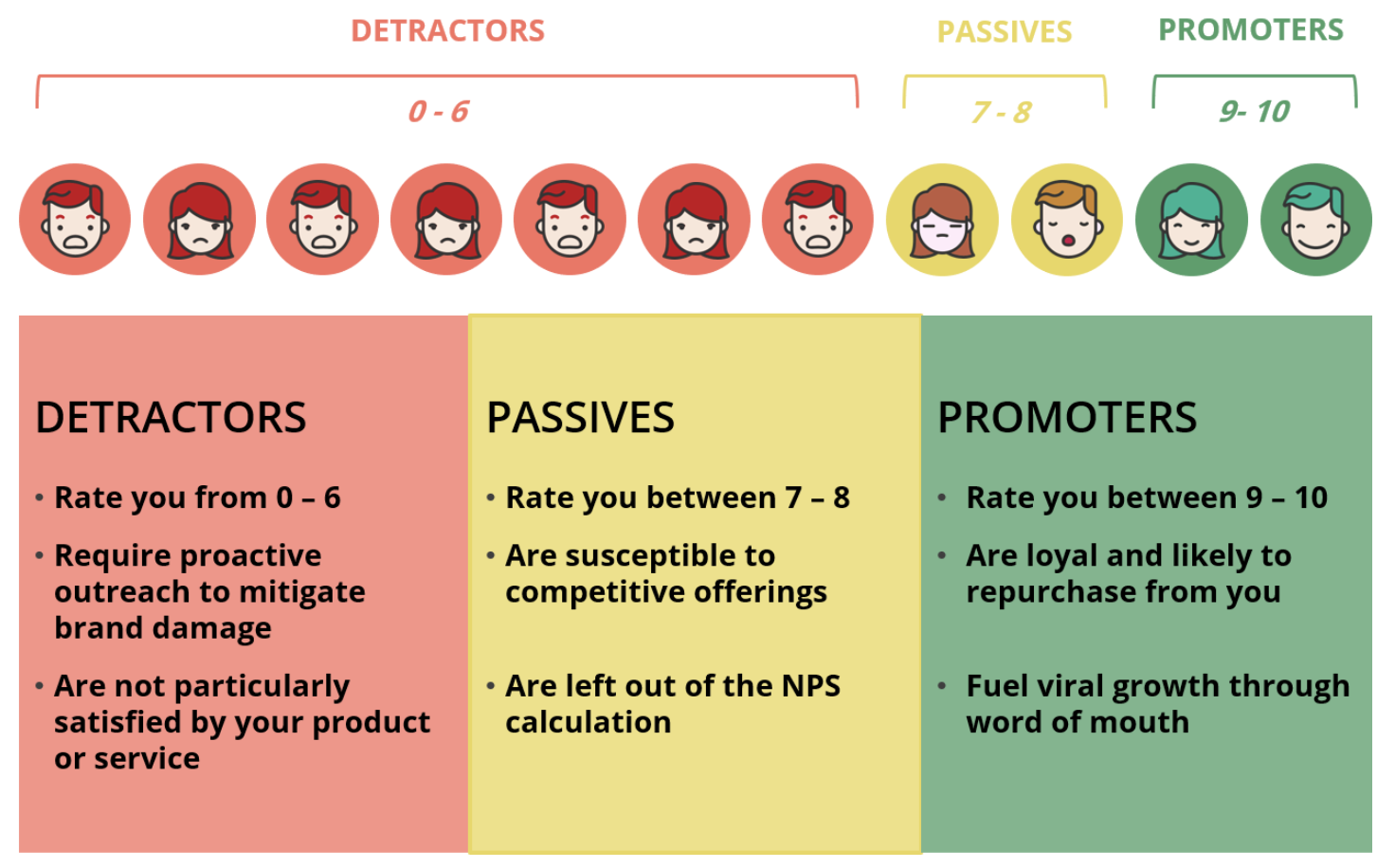

Simply put, NPS asks customers how likely they are to recommend a product or service and then classifies them into three groups: Detractors, Passives and Promoters. Subtract your Detractors from your Promoters to get your Net Promoter Score.

Net Promoter Score

From Netigate “NPS: The Ultimate Guide to the Net Promoter Score”

There are questions emerging as to just how effective NPS and related measures of customer engagement are in driving business goals. Another approach, The Wallet Allocation Rule, is discussed below.

One of the things that pricing work is concerned with is Willingness to Pay (WTP) which some take as a measure of value. Let’s look at NPS and WTP together and see if there are any insights for pricing. This boils down to two key questions.

Do customers with a high net promoter score have a higher willingness to pay?

How do prices impact the net promoter score?

Unfortunately, there is emerging evidence that the answer to the first question is ‘no, higher NPS does not correlate with higher WTP.’

Even worse, research into the factors that drive higher NPS scores find that price is an important component. One reason people give for recommending a product is a low price, or in the best case, good value for price. In other words, people who think they have gotten a deal (good value for money) tend to have a higher net promoter score. In extreme cases, high NPS can correlate with low WTP.

If you are interested in going deeper into the research, one good place to start is with the work of Timothy Keiningham at St. John’s University who has done a lot of research into how well NPS predicts different aspects of performance, such as growth and market share. Here is a link to his work.

Share of Wallet

All is not lost. Keiningham and his collaborators have come up with a more powerful metric than NPS which they call the Wallet Allocation Rule. Basically, this rule states that it is not absolute NPS scores that matter but rather buyers’ relative preference for each brand. The equation that predicts share of wallet is as follows:

Note that the Rank is the customers preference, with 1 being highest and Number of Brands being the total number of brands that the customer buys (and not the total number of brands in the category).

Clearly this is most relevant in relatively mature markets where customers buy from more than one brand and increasing the amount that customers buy from you (share of wallet) is critical to business performance. The more brands your customer buys the lower your share of wallet and the higher your ranking the higher your share of wallet. The results are shown below for a customer who buys three brands and a customer who buys five brands. To go deeper into the intricacies of the Wallet Allocation Rule go to the Wallet Allocation Rule website. Note that this is the forecast ot share of wallet for one customer. Other customers may buy a different number of brands, or rank your brand differently, so the total share of wallet will be the average across all of your customers, and this will not include customers who do not buy your brand.

From a value-based pricing perspective, what is interesting here is the focus on rank. Rank is the relative preference for one brand over another. In other words, rank is relative to the alternatives considered. This is quite similar to how value-based pricing analysts think about pricing. Pricing power comes from differentiation. This is the value of the things that you do for your customer that your competitor does not. The things that you and your competitor do equally well are the commoditized parts of your offer. They do not contribute to your pricing power and have little impact on Willingness to Pay (WTP).

How do pricing and share of wallet interact?

A number of factors will determine why customers prefer your brand to the alternatives. One cannot generalize here, instead one has to go deep into the data in order to decide what levers you can pull.

In most B2B markets, price is secondary to differentiated value in determining brand preference. Reducing price will only improve your rating if this is what will tip you over to be the number one preferred brand. . Additionally, even when a price cut wins more volume, the increase in volume will generally not be enough to offset the lower unit revenue. This is even more true of gross profit. Be very careful when offering price concessions to make sure that the lower unit price will not push down revenue and profit even when it does push up volume.

To really understand the how customer preferences impact share of wallet you need granular data. Consider the below, simplified, data set for a marketing automation system. The numbers indicate the buyer’s preference for each of the three options for each of the value drivers. This is not an example of the wallet allocation rule as most companies will buy inly one marketing automation system. But there are still lessons to be learned.

One lesson is that the number one ranking is what matters. It is better to win on one factor (as long as it is a factor that a buyer cares about) and lose on the others than to be average across the board. If you win on one value dimension, and it is the one driving buying, you are likely to win the sale.

Looking at the above data, the first thing to know is whether the buying decision will be based on revenue enhancement or on cost reduction. If the goal is revenue expansion, Option A or Option B will have the advantage. If the goal is cost reduction, Option B will win when the Chief Marketing Officer is driving the buying decision, and Option C will win when IT is the buyer.

We can go deeper into the revenue based value drivers. When the goal is to expand the top of the pipeline and increase the number of MQLs (Marketing Qualified Leads) then Option B will likely prevail; when SQLs (Sales Qualified Leads) and bottom of the pipeline have priority Option A will have the upper hand.

Net Promoter Score does not play a role in any of this. Despite its popularity in the CX world, NPS is a bit of a vanity metric, one that does not help drive informed investments that increase differentiated value . The key to share of wallet is to be your customer’s preferred brand. The key to pricing power is to increase your differentiated value. In both cases, it is the comparison to the alternative that matters. They key to pricing and to product management is to know what criteria you need to win on and then making sure that you are scored number on on that criteria.

In both cases, it is difficult to do this for every possible customer. It is more useful to segment the market into groups of customers that get value in the same way and that buy in the same way, and then to target investments at the customers where you can become the preferred brand and deliver the most differentiated value. This focus will be rewarded with higher pricing power and greater willingness to pay.