Costs come back into SaaS pricing

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

Interested in pricing and customer value management platforms? Help shape the category by contributing to this survey.

During the golden years from 2010 to 2021 many SaaS companies did not worry about costs when designing their pricing models. There were good reasons for this.

The most effective approach to pricing is value based pricing and your costs are not what is providing value to your customer

Margins were high, for most companies more than 70% and in some case more than 95%, costs were not a major concern

The focus was revenue growth and not profits

This has changed over the past year. There has been a paradigm shift in how SaaS companies are thinking about costs and this has led them to include costs in the design of pricing models.

As SaaStr noted in a recent post, 8 Things That Are Just Harder in SaaS Now, “Gross margins matter again. In the peak of 2021, no one cared if your gross margins were 20% or 80%. Now, they care again. So pseudo-SaaS products and other products with lower gross margins are commanding much lower valuations.”

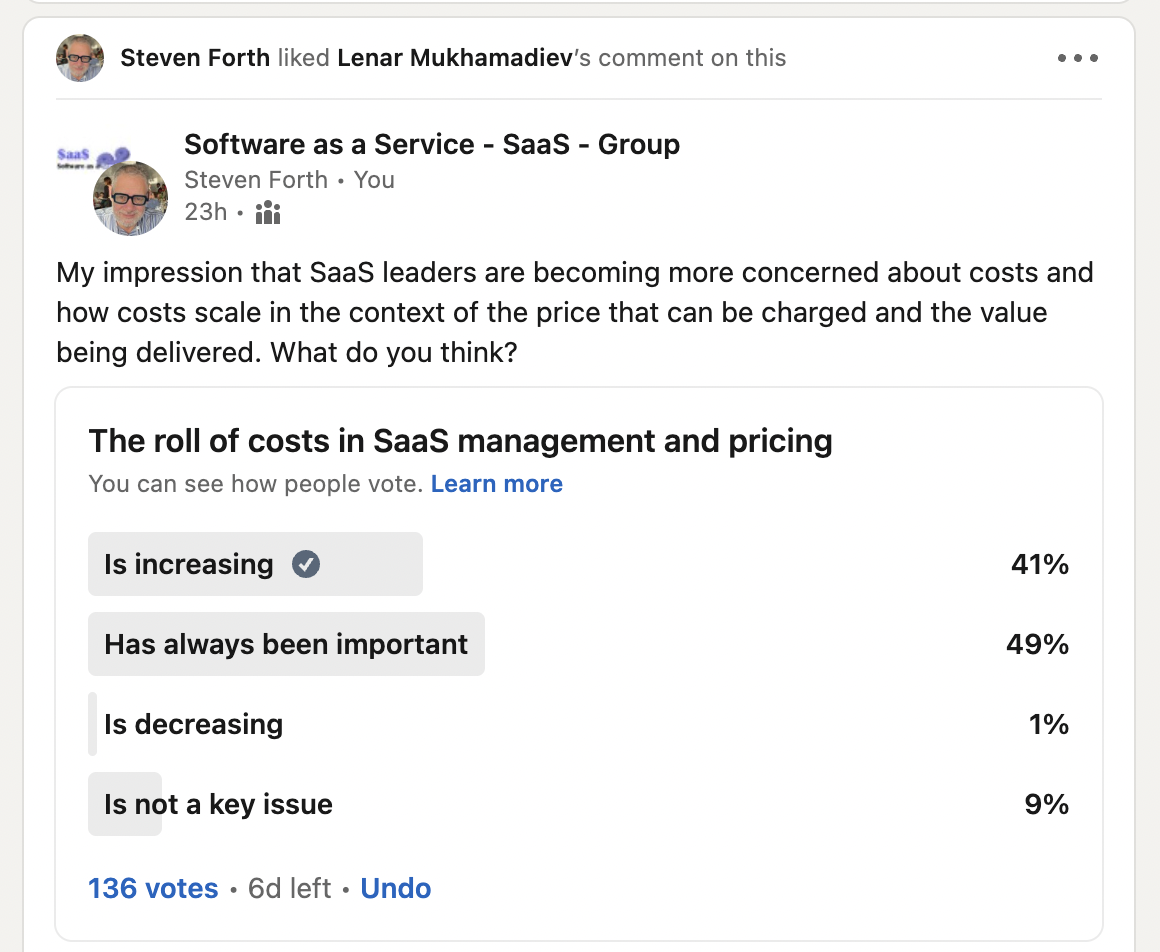

Two pieces of evidence. A quick poll on the LinkedIn Software as a Service - SaaS - Group (>150,000 members) found the following.

Some comments in the poll …

“It’s a complicated topic. Cost of pretty much everything went up and some SaaS companies I work with eliminating “Free” tier from offerings. It doesn’t make a financial sense to them to store data and support free users anymore. Current economic climate requires you to make adjustments for pricing policies.”

“Costs have always been important, but they’re more heavily scrutinized now that capital markets are dry and cost of capital has increased.”

“I recently met with a large customer, and their single most significant expense outside employees was their cloud costs. This customer has suggested they will be bringing applications and data back on-prem in a controlled manner. Rationalizing every application and whether is has exceeded its useful life. It is a cycle. Remember the days of centralized computing, then decentralized, and back again? Round and round we go. It is about balance.”

There is a good reason for this.

There has been a paradigm shift in how SaaS companies are valued, with a greater focus on profit and free cash flow

Costs are rising and expected to rise further

Some SaaS companies used generic inflation as an excuse to increase prices, which drew attention to their own costs

The change in the SaaS investment climate has been widely discussed. Basically the combination of higher interest rates and a business slowdown has made it more difficult and expensive for companies to raise money. The collapse of Silicon Valley Bank has made this situation even more dire as SVB was the leading lender to the tech sector in the US.

SaaS costs are rising. Part of this is general inflation, which is pushing up rents and salaries. By far the largest cost for most SaaS companies is the people who build, manage, support and sell the solution and people need to be paid more in an inflationary time. And even with the slowdown, the job market is tight and with demographic change will get tighter.

The inputs into SaaS solutions are changing. AI is eating software and almost all B2B SaaS will rely on AI to create value and optimize operations over the next three years. AI services are computationally expensive. They use a lot of data and run complicated algorithms that are processor intensive. Most data centers do not have the specialized hardware needed to run a large AI model or the skills needed to optimize processing. Eventually AI will be commoditized and costs will come down, but for the next few years they will drive up the cost of operating and scaling a SaaS solution. The key word here being scale.

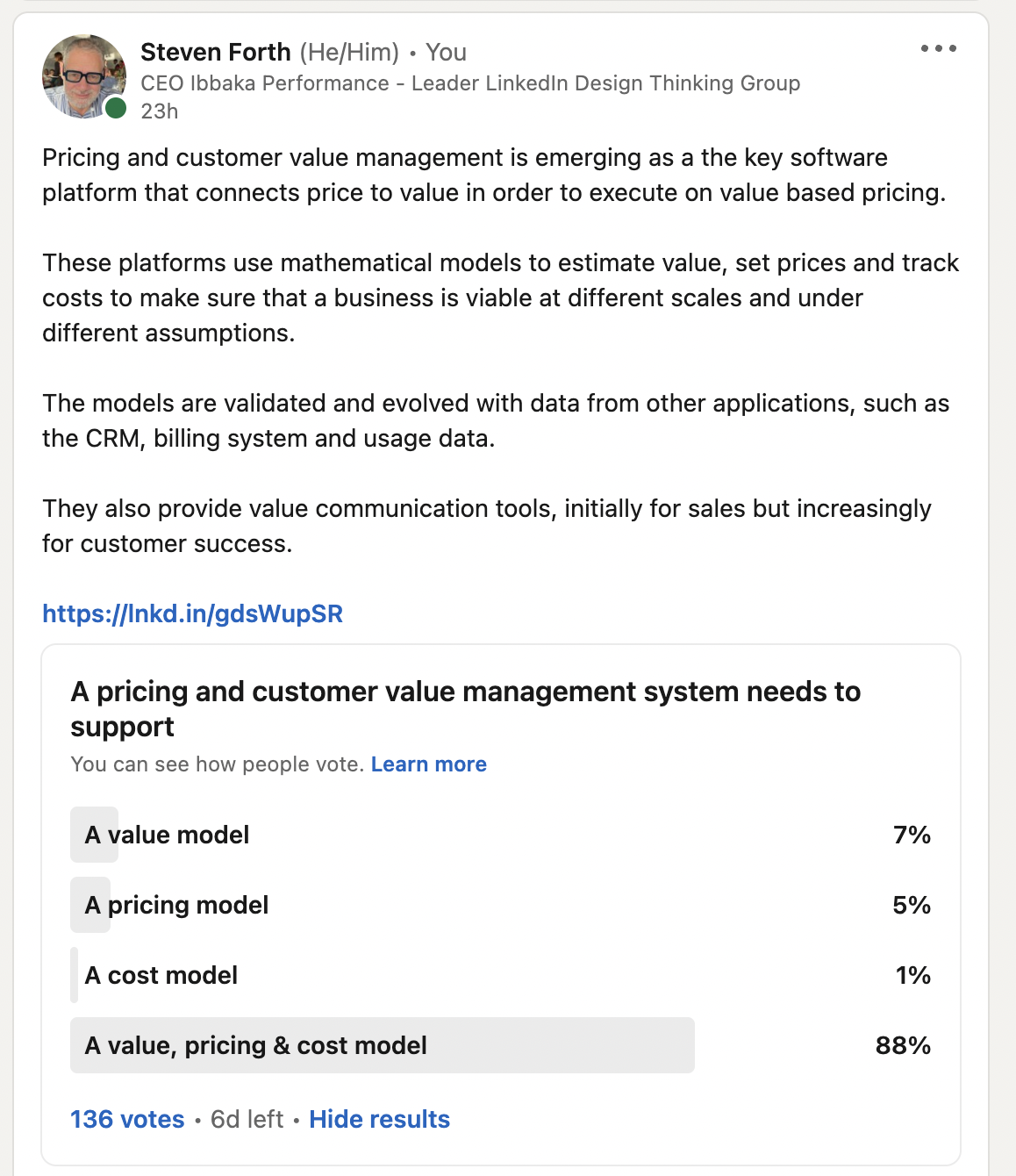

I asked the community on the Professional Pricing Society on LinkedIn about the models that pricing and customer value management need to support. Almost everyone agreed that all three models need to be supported: value, price and cost.

(It is pure coincidence that both polls had 136 responses, I checked and there were only two people who took both polls.)

At Ibbaka, we have always looked at costs when designing pricing, but we did not generally integrate costs into the value and pricing model. We checked to make sure that the price would generate a robust margin but did not go the next step and make costs a formal part of the integrated model. That has changed.

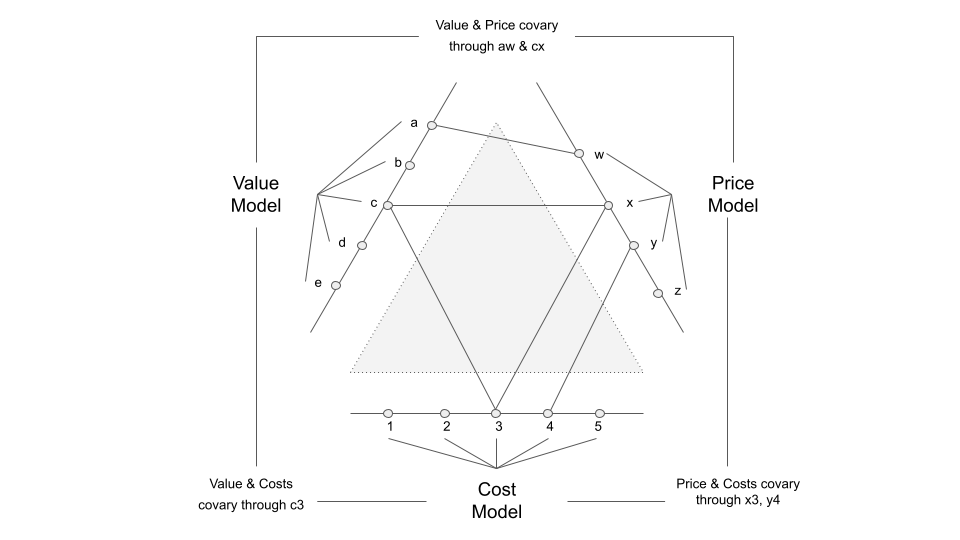

In several recent engagements, we have integrated a cost model with the value and pricing models and then tested to see how the relationship between value, price and costs changes as a business scales up and down. We do this to make sure the packaging and pricing satisfies the following fundamental constraint at all scales at which the company will operate.

Value > Price > Cost

Once upon a time, it was thought to be OK if the relationship was inverted early in the company’s evolution, and that at scale everything would fall nicely into place. This has changed.

Companies are now expected to show that the economics make sense right from the beginning

There have been too many examples of companies that did not scale properly and where the the value > price > cost equations did not resolve at scale (see Thomas Lah Why Are SaaS Companies Unprofitable)

So Ibbaka is adding a Cost Model tab to Valio and making sure that it tests its pricing designs to make sure that the value > price > cost requirement is met across different scales.