SaaS pricing is model driven

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

Interested in pricing and customer value management platforms?

Help shape the category by

contributing to our survey.

It has become a truism that pricing is data driven and this is especially true of B2B SaaS, where the application itself can collect data relevant to estimating value and setting price. Like most truisms, the data driven approach tells only half the story. Data is meaningless without models to interpret it. Model driven pricing is at the heart of digital pricing strategies.

Best of breed SaaS pricing is model driven.

The recent explosion of interest in Large Language Models like GPT-4 or PaLM has underlined the importance of models in making data meaningful and actionable. A good model is able to integrate all the relevant data, find patterns and trends, make predictions and generate designs.

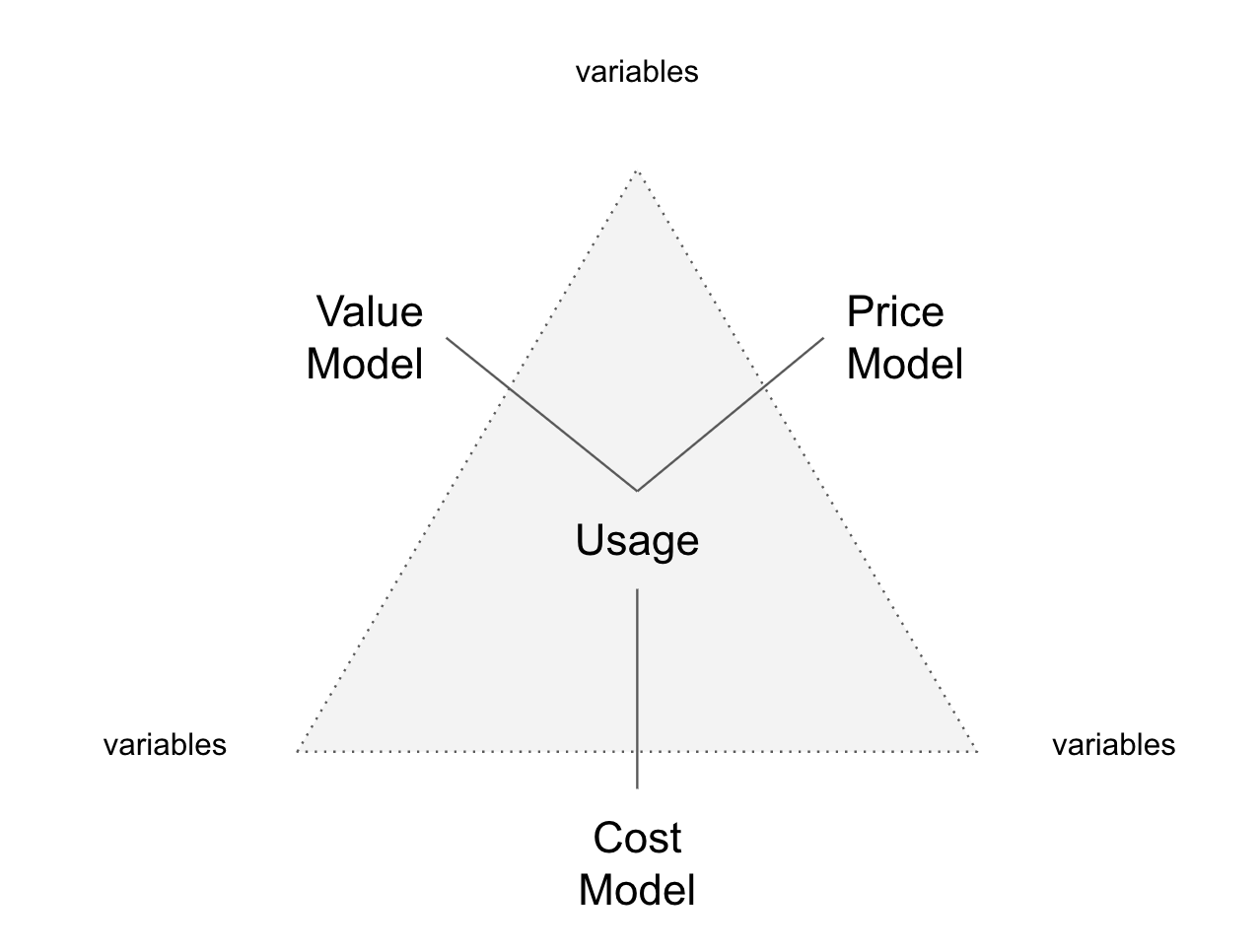

What models are we concerned with in SaaS pricing?

SaaS pricing integrates three models …

The value model

The pricing model

The cost model

This is quite different from mature and commoditized industries where the focus is often on the demand. model (I expect people from conventional pricing backgrounds to push back on this, but for differentiated and innovative solutions and in category creation demand does not depend primarily on price but on an understanding of value).

To be clear …

A set of written value propositions is not a value model, nor is an estimate of willingness to pay.

A list of prices on a website or embedded in a spreadsheet is not a pricing model.

A static number for variable costs is not a cost model.

A model is a system of equations and the algorithms describing how the equations are applied. A value model estimates the economic impact of a solution on a customer or customer segment. A pricing model takes inputs about a customer and provides a price. A cost model estimates and allocates costs, ideally at the customer level.

There are several ways to generate and maintain these models, but their essence is that they are mathematical expressions with shared variables.

The value model is the foundation. The pricing model is derived from the value model and the cost model imposes constraints on the price model.

Value Model

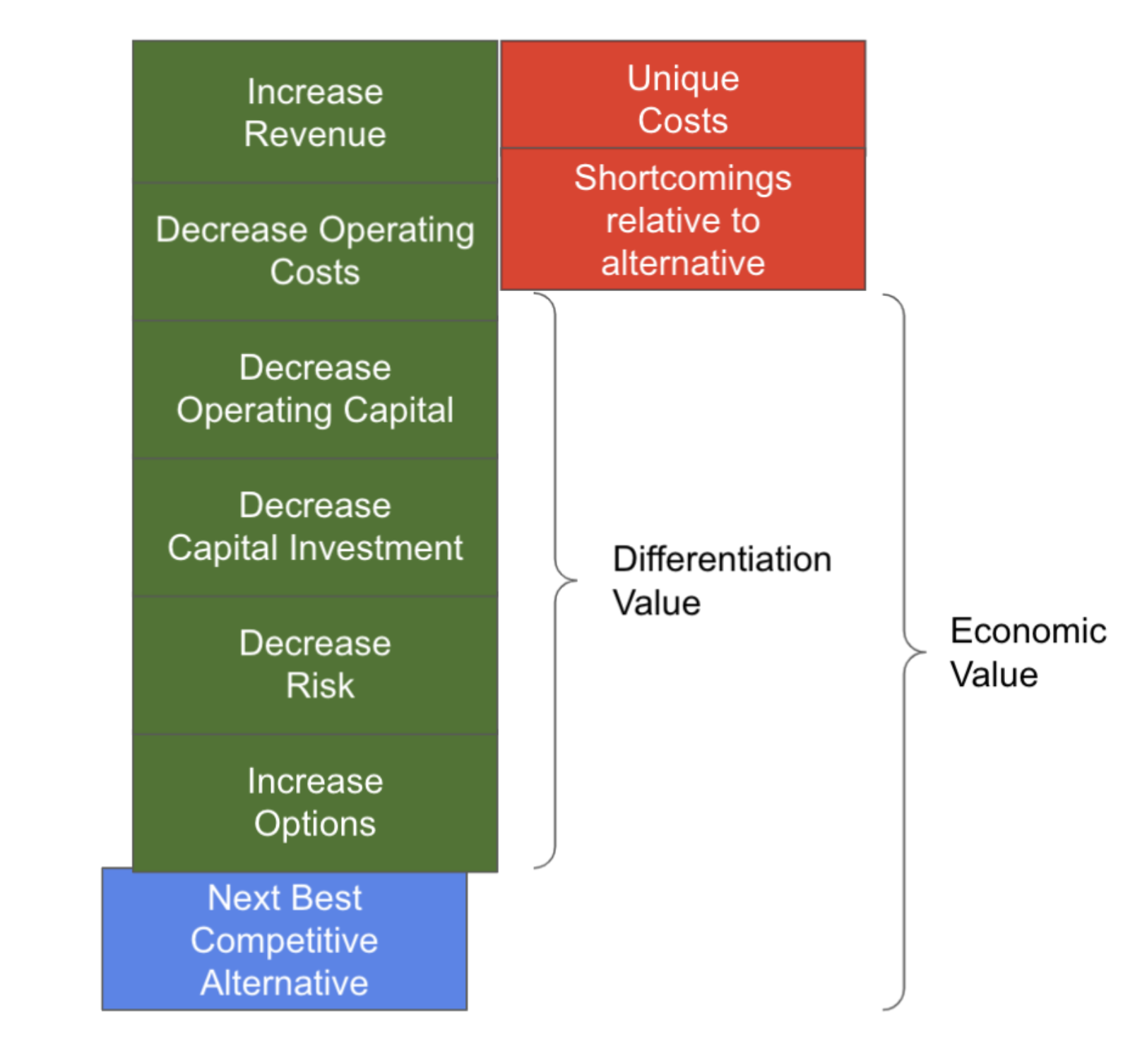

The foundational model, the place to start, is the value model. At Ibabka, we use Tom Nagle’s Economic Value Estimation or EVE((tm) by Deloitte) framework to organize value models. See Why value based pricing means something. If you do not have a formal value model, expressed as a system of equations, you are only pretending to do value based pricing.

Pricing Model

Digital pricing needs to be adaptive. It has to be easy to connect your pricing model to data to generate prices. If the model is locked in spreadsheets and hard coded into your webpage it becomes more difficult to evolve the model. Ibbaka codes pricing models into Valio, our pricing and customer value management platform.

We design algorithms that take inputs about the customer and use these to guide package selection and pricing. We even take an algorithmic approach to volume pricing and have developed a family of algorithms that be used to adjust price based on volume.

See our work on pricing and volume.

Cost Model

The cost model is focussed on variable costs and their allocation. Historically, SaaS companies have not been focussed on costs and how they change with scale. The assumption was that variable costs were near zero. This assumption is proving to be wrong. Costs have come back into SaaS pricing. Best of breed SaaS companies are making sure they know how their variable costs change across scale - customer scale and their own operating scale.

Validating and evolving the models

Models are always an approximation of the real world. You start with a model and then you validate it. One you have validated the model you need to investigate how the model performs at different scales and how the models interact.

There are two ways to validate a value model.

Interview customers and prospects (ideally using a Value Story created from the Value Model)

Apply the model to existing customer data and then compare the predictions from the model to the data

Both approaches are necessary and this validation process needs to be repeated at regular intervals as part of model management. Validation takes place across sales, implementation and customer success work.

Test each model across different scales: the value, pricing and cost models need to be tested across all scales across at which the business will operate. The scale test has to be conducted for all of the variables in each model.

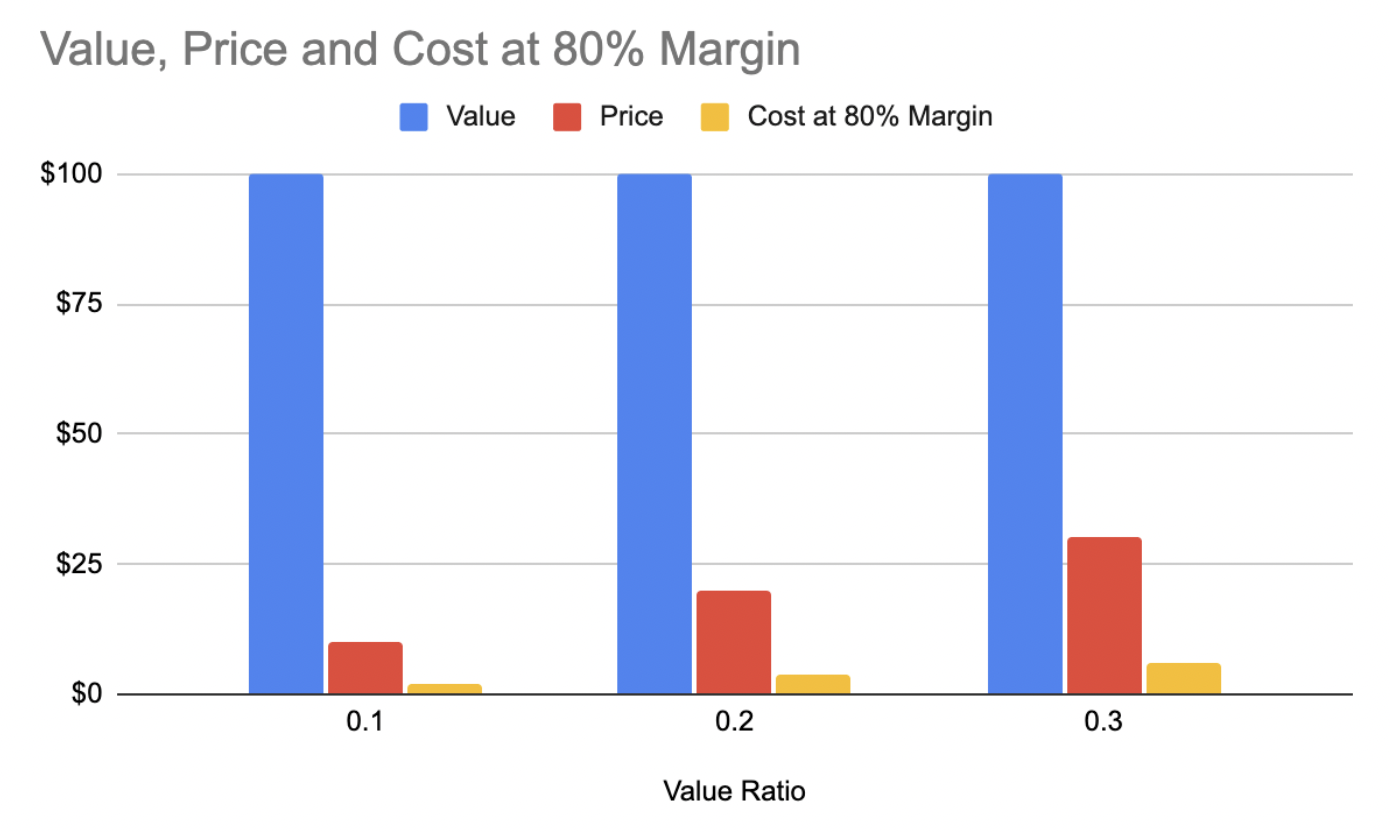

Basically, the value, price and cost models need to satisfy the following constraint:

Value > Price > Cost

The standard assumptions for SaaS make this a very high set of targets to reach. The value ratio is generally expected to be 10% for early stage companies (for every dollar a customer invests they get ten dollars back). Gross margins (revenue less variable costs) are expected to be higher than 80%. So if you create $100 of value you should try to capture back $10 of that in price and you can allocate $2 to variable costs.

If you are in a position to target a value ratio of 30% (for every three dollars invested the customer gets ten dollars back) then for $100 in value you should capture back $30 in price and can allocate $6 to costs.

Many SaaS companies will struggle to meet the 10:80 hurdle (ten percent value capture; 80% margins).

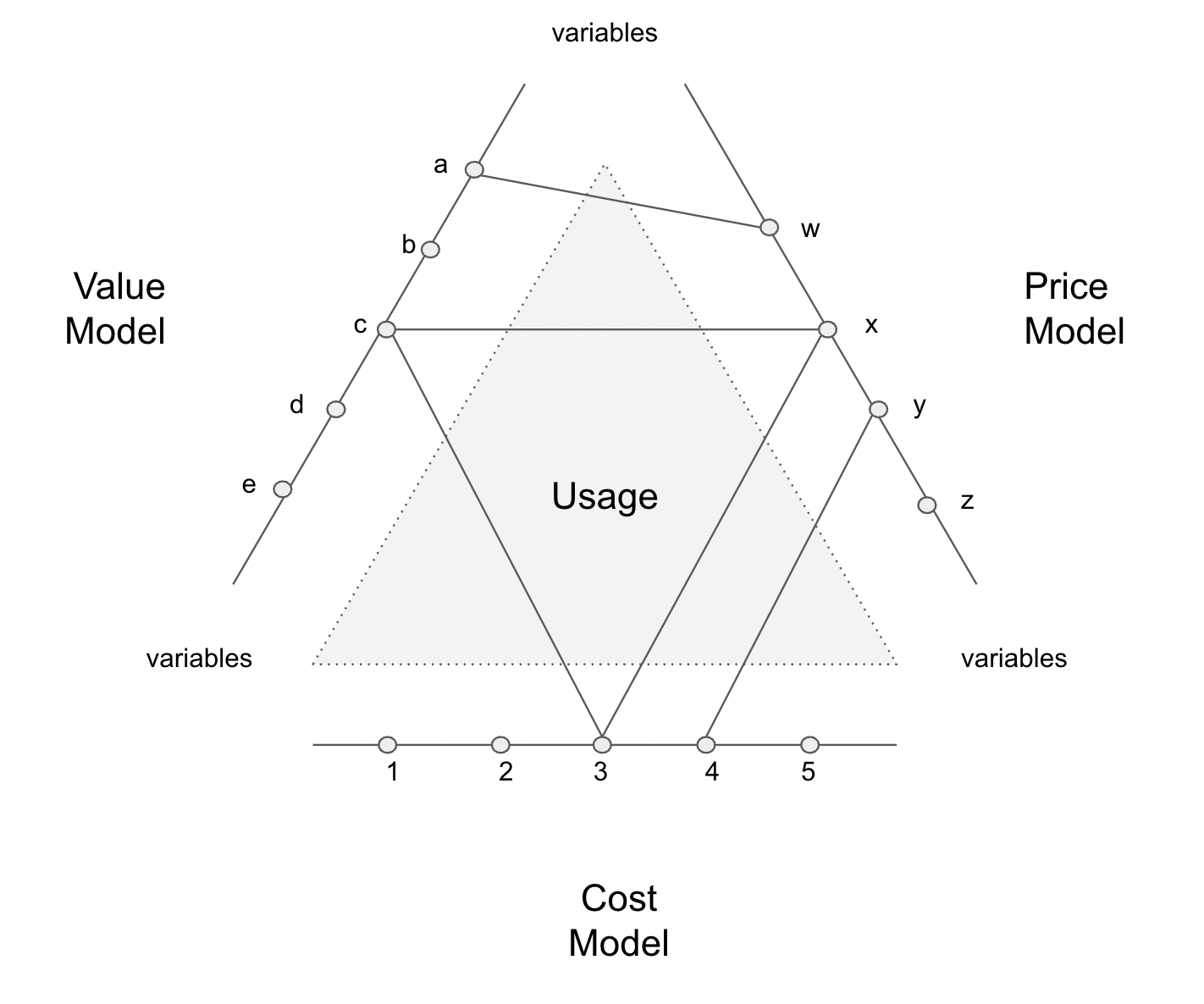

Ask how the value, pricing and cost models interact

It is not enough to look at how the value, price and cost models scale independently of each other. These models will have shared variables and they can interact in important ways that differ at scale.

Look at each of the shared variables (variables that are used in more than one model).

Analyse how these variables interact and how the models covary. Look for places where the costs grow faster than prices, or price goes up faster than value. These are the danger points. One can also find opportunities. If value is rising much faster than price you may want to adjust the pricing model to capture this. If costs grow slower than value and price (the operating assumption of most SaaS companies but one that needs to be tested) there is a lot of room to maneuver.

One cannot cover every edge case, but you want to be aware of them.

Pricing Will Become Algorithmic

Companies such as Ibbaka are working on ways to generate and validate value models using artificial intelligence. This is the beginning of the era of algorithmic pricing, where intelligent systems are used to compose the configuration that delivers the most value for a customer and the price is based on that value. The sweet spot in the market where the Value > Price > Cost relationship is satisfied then optimized will be found by using parametric algorithms to explore the configuration and pricing options.

Everyone will benefit from this. Buyers will get solutions that actually deliver the value they need, users will have well defined and supported value paths and a better user experience, and vendors will know where and how to deliver value and how to price to capture their fair share of the value created.