The 4Cs of Pricing and How they Interact

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talent.

Gerald Smith is one of a small number of people who has shaped how we understand pricing and pricing strategy. His new book Getting Price Right is one of the best syntheses of behavioral economics and pricing available. He also worked with Tom Nagle on a series of important articles that put value maps (a standard tool used in pricing strategy) in context (more on that below).

At the Professional Pricing Society’s Spring 2022 conference in Chicago, Smith gave a compelling keynote. One of the themes was the Four Cs of Pricing and the importance of understanding how each of these four Cs impacts pricing. The four Cs of pricing are:

Customer Value

Customer Willingness to Pay

Competition

Costs

Note that Customer Value and Customer Willingness to Pay (WTP) are not the same thing. Confounding these two very different concepts, as some unfortunately do, is the source of much confusion and poor pricing decisions.

Pricing and Customer Value

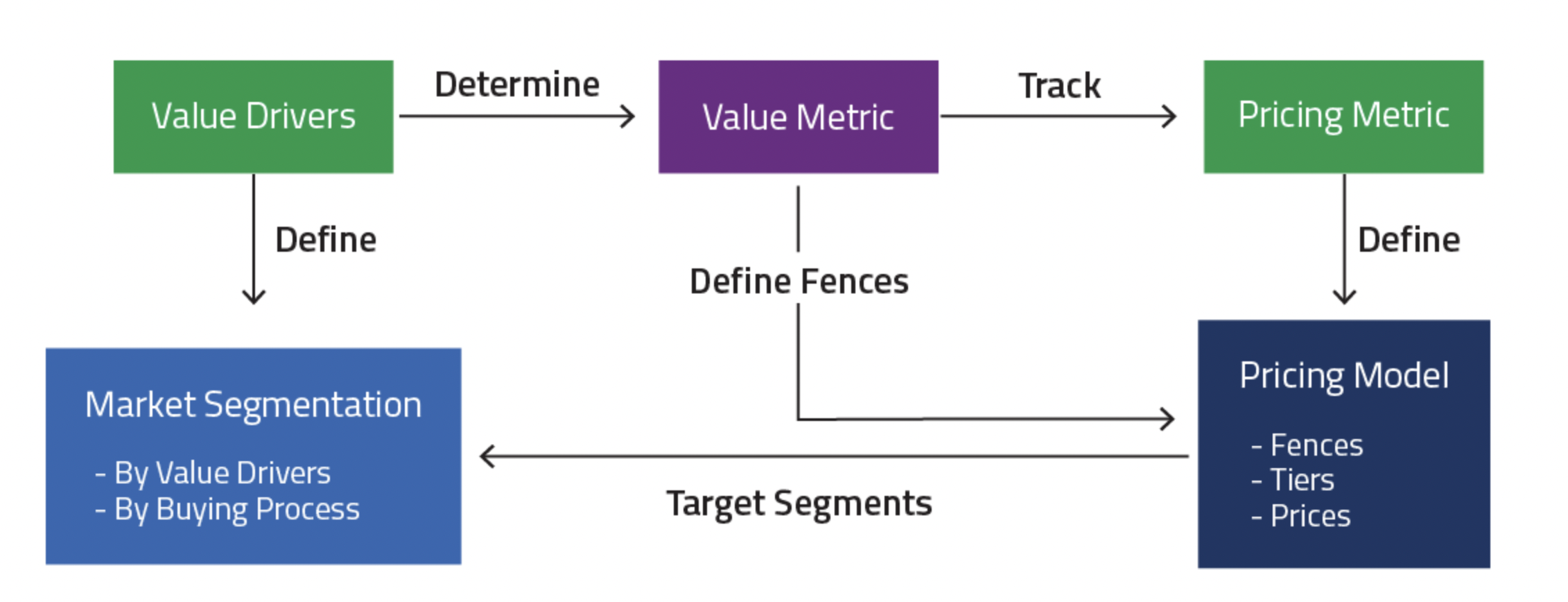

This is the foundation for pricing innovative and differentiated offers. It is based on developing a deep understanding of how your solution provides value to a customer relative to the alternative. A quantified value model is needed for value-based pricing. The variables in the value model become the candidate pricing metrics (there are generally more variables than one would want to use as pricing metrics, complexity is NOT a virtue for pricing models).

Pricing and Customer Willingness to Pay

Willingness to Pay (WTP) is not the same as value. Vendors and consultants that take this approach are confused and will not be able to design an effective pricing model.

Willingness to Pay is important though, as it determines pricing levels and the final price paid.

This is not a static metric. It is highly contextual and depends on a number of factors:

The value to the customer

Ability to pay

Competitive alternatives

Emotional value

Willingness to pay is something that can and should be shaped.

See Five characteristics of a superior pricing model

Pricing and the Competition

Value is always relative to the alternative. Buyers will consider alternatives. These are sometimes as simple as doing nothing, always an option if not a good one, or solving the problem internally.

One important decision in design a price model is how easy it should be to compare price with the alternatives. In mature markets direct price comparison is unavoidable. Part of the definition of a mature market is that there is a common understanding of value and shared pricing mechanisms.

This is not the case with innovation, especially disruptive innovation or category creation. Here one may well want to use pricing metrics that precisely align with one’s own value and the way the target segment(s) see value.

Even in mature markets there can be opportunities for pricing innovation. A company that comes up with a new pricing metric, one that does a better job of tracking value and moving risk to the vendor and away from the seller, can often come to dominate an established market. This is what is happening with the move to subscription models and usage based pricing.

Pricing and Costs

Cost plus pricing is generally regarded as the least effective way to price (with certain exceptions where the customer is in control of the deliverables or it is very difficult to forecast effort). That does not mean that costs are irrelevant to pricing.

A fundamental concern is whether value to customer (V2C) is higher than cost to serve. If the answer is no, then there is no business to be had. More accurately, is V2C higher than the vendor’s opportunity cost. If the answer is ‘no,’ then there is no business opportunity.

This is not the only consideration though. In some cases one can design pricing to guide users into usage patterns that lower the cost to serve. This can be a very effective pricing tactic and can have a big impact on gross profit.

In some businesses, growing capacity and capacity utilization is a critical issue. In this type of business (many manufacturing and infrastructure companies are like this) growing overall volume and maintaining capacity can be a critical business consideration. Amazon AWS, Microsoft Azure, even the some of the generic AI vendors can be thought of as infrastructure companies and growing capacity (to drive down unit costs) and maintaining utilization are key pricing considerations.

Interactions between the Four Cs

The four Cs are not independent of each other. Looking at two of the Cs together can provide new insights.

Customer Value and Competition

Value is relative to the alternatives, and in competitive situations this means the competition. What functionality is commoditized, where do you have the advantage, what does your competitor do better than you?

Customer Value and Customer WTP

Value is the foundation of willingness to pay. One should not pay more than the value received. When trying to determine willingness to pay, unpack how the different value drivers shape the customer’s response and ask how to communicate value more effectively.

Customer Value and Cost

One has to generate more value for customers, a lot more value, than it costs to create and deliver that value. In early stage markets the ratio of vendor cost to customer value is often very high. Assuming that one wants the ratio of 10X V2C to LTV (typical in growth markets) and a gross margin of 70% (also typical) then the costs to value ratio is 3%, in other words, one must deliver more than 33X more value to the customer than one incurs in variable costs!

Competition and Customer WTP

The lower the cost of the alternative the lower the willingness to pay. This is another way of saying that value is always relative to the alternatives, or in classic Economic Value Estimation (EVE) language, value is relative to the next best competitive alternative.

Competition and Cost

Understanding competitor cost to serve can inform pricing strategy and tactics. One will have more freedom to operate in segments where competitive alternatives have a relatively higher cost to serve, and one will generally want to avoid segments where competitors have a cost advantage. This is especially true where a young company is trying to enter a well established space. Pick a segment where you have a cost advantage.

Customer WTP and Cost

Sustainable companies need to be able to create and deliver value at a cost lower, much lower, than the customer’s willingness to pay. Before creating an offer this is both the fixed and variable costs. But once the offer is created it is the variable costs that are most important. Many bad pricing decisions are driven by finance’s desire to recover sunk costs. Sunk costs are just that, sunk. The time to worry about the implication of sank costs for pricing is before they are committed. Variable costs are the costs that matter when making pricing decisions.

Tom Nagle and Gerald Smith on Value Maps

One tool often used in pricing strategy is value maps. Value maps can be deceptive though. As Nagle and Smith have pointed out in two important articles, value maps tend to overstate the impact of value on WTP at the lower end of the market and to understate value and pricing power at the higher end of the market.

At the lower end of the market most of the value comes from commoditized functionality where price is set by the market. As one moves to the right, up the value curve, more and more of the value comes from differentiated functionality. Pricing power comes from differentiated value and not from commodity value.

See “A question of Value” and "Pricing the Differential" by Gerald Smith and Tom Nagle, published in Marketing Management in the May/June 2005.