From Greenhouse to TeamFit to Degreed – a host of startups are unbundling the Talent Management Sector

A post by Amar Dhaliwal

Recently, CB Insights has published a series of blog posts about companies and industries being fundamentally disrupted (they use the term “unbundled”) by a brace of start-ups. These startups not only threaten large incumbents, they are unlocking enormous value for customers and investors.

As I was reflecting on their analysis of the unbundling of Honeywell it hit me like a ton of bricks that today’s talent management industry is under similar siege from an emerging group of specialist start-ups.

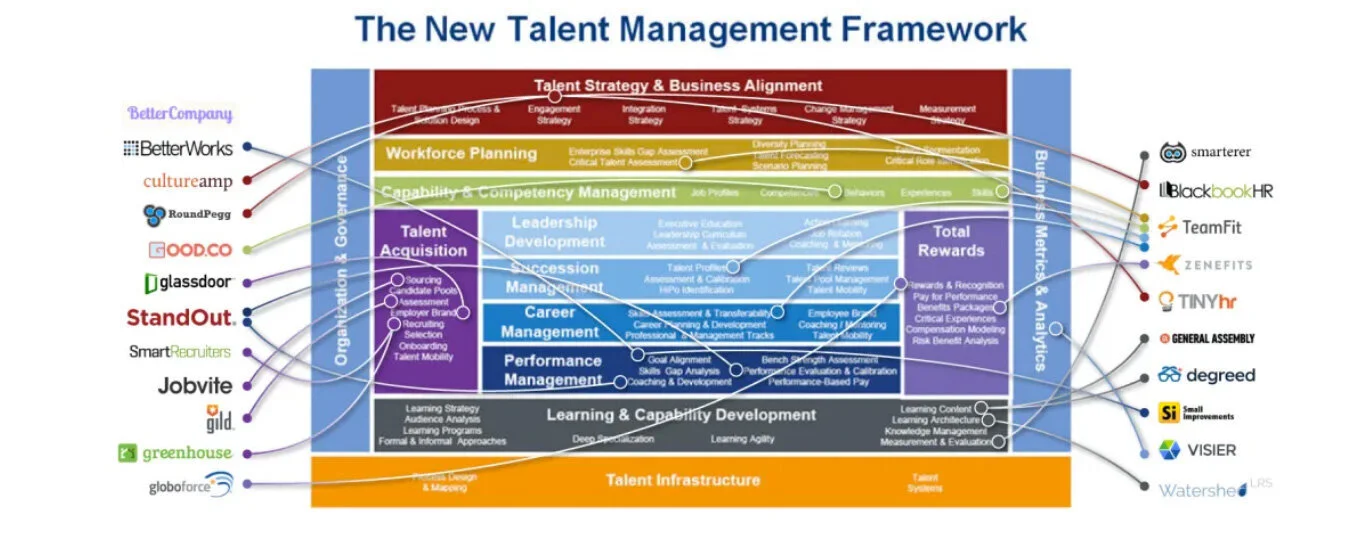

The graphic below is based on Josh Bersin’s talent management framework, onto which has been added some of the companies attacking talent management platforms. These range from payroll and benefits services like Zenefits and ZenPayroll; to talent acquisition companies like Greenhouse and Gild; to learning innovators such as Degreed and General Assembly; my own company TeamFit which is delivering a social skills management platform and man many others.

In their blog discussing companies disrupting FedEX, CB Insights explain that start-ups do not attack head on across multiple products. Instead, they find the specific opportunities were the monolithic solutions fail to create value (hence the term “unbundling”). The analogy with the talent management industry seems clear and the question obvious – are today’s talent management vendors going to be out-innovated and lose their edge not to incumbent, large competitors, but instead to emerging startups who will inflict a death by a thousand cuts?

Gartner’s Magic Quadrant Talent Management MQ for 2014 listed 18 companies including the usual suspects – SAP (Success Factors), Oracle, Saba, IBM (Kenexa), SumTotal, CornerstoneOnDemand, etc.

Each of these companies offer a talent management suite with a broad range of functionality covering the entire talent lifecycle and are sold as a “one stop shop” typically to the talent or HR leader. Make no mistake that these are ERP solutions – in terms of cost and complexity. Also, make no mistake that much of the functionality sold or delivered is never used; it is in fact often unusable; and often slapped together from a bunch of disjointed acquisitions.

The argument has been that despite the issues of cost, complexity, and under utilisation the suite buy is still more effective than a best of breed strategy because of the elimination of costly integrations; unified work processes, and the reduced headache of multiple vendor management.

The new breed of specialist talent management vendors may be changing this dynamic. Not only are they taking a fresh view to a wide variety of point processes but with a “no sacred cow” approach they are starting to innovate and disrupt the core talent management processes themselves. In doing so, these innovators are unlocking value for customers, themselves, and the entire industry (via open data and open API approaches).

While the suite vendors have been on a long-term dive to the bottom in terms of pricing these new start-ups are introducing innovative business models that drive adoption and value (to themselves and their customers).

Investors are taking notice and betting that these startups can successfully take on the incumbents. Some recent deals include Zenefits $583.6 Mn; Glassdoor $161.5 Mn; Inkling $70.1 Mn; Visier $49.5 Mn; Guidespark $42.2 Mn ; Greenhouse $24.8 Mn; Gild $21.5 Mn and Betterworks $15 Mn.

We are clearly still early in the cycle, and who knows how this will play out. The early evidence points to these startups making major inroads in the talent management industry and over time capturing the most valuable parts of the value chain. It’s going to be fun to watch. And even more fun to be part of.