AI Pricing: 2024 will be a year of AI Monetization

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

If 2023 was the year AI went mainstream, then 2024 will see the focus shift to monetization. In October and November of 2023, Ibbaka surveyed more than 300 B2B SaaS and Industrial Internet of Things (IIoT) companies to better understand different approaches to AI monetization.

The research was motivated by the finding by OpenView that while 46% of SaaS companies had launched AI features in 2023 and another 31% were actively building or testing AI features, only 15% had a clear view of how to monetize this new functionality.

[Update] Please click here to take this year’s AI Monetization 2025 survey.

As a first step in the analysis, we ran the survey data through our clustering software and used K-Means to identify four clusters.

Despite the hype, the dominant cluster was Cautious Incrementalists (43% of the total). These companies are making small investments into AI, responding to pressure from competitors, and their focus is on customer satisfaction rather than generating new revenues directly.

A second group, Optimistic Incrementalists (19% of the total), were more positive about AI and saw it as a way to improve functionality and increase prices.

There are 2 clusters that are more optimistic and ambitious.

Disruptors (25% of the total) see ways to disrupt existing categories using new AI-based solutions that dramatically increase the performance of existing value drivers, and are launching new AI-based products.

A fourth group is the companies working to create New Paradigms or Market Categories (13%). These companies are working to solve problems that previously had no solution, or at least no scalable, affordable solution. The General AI companies (13 of these companies replied to the survey) are an example of this but companies are taking this approach in many other verticals. Just two years ago, it would have been difficult for most companies to imagine developing a language model customized to their content. Today this is straightforward using tools gathered in collaboration hubs like Hugging Face. where more than 450,000 models are available. Open.ai’s annualized revenue (12-month forward revenues) is now estimated at US$1.6 billion (see The Information OpenAI’s Annualized Revenue Tops $1.6 Billion as Customers Shrug Off CEO Drama).

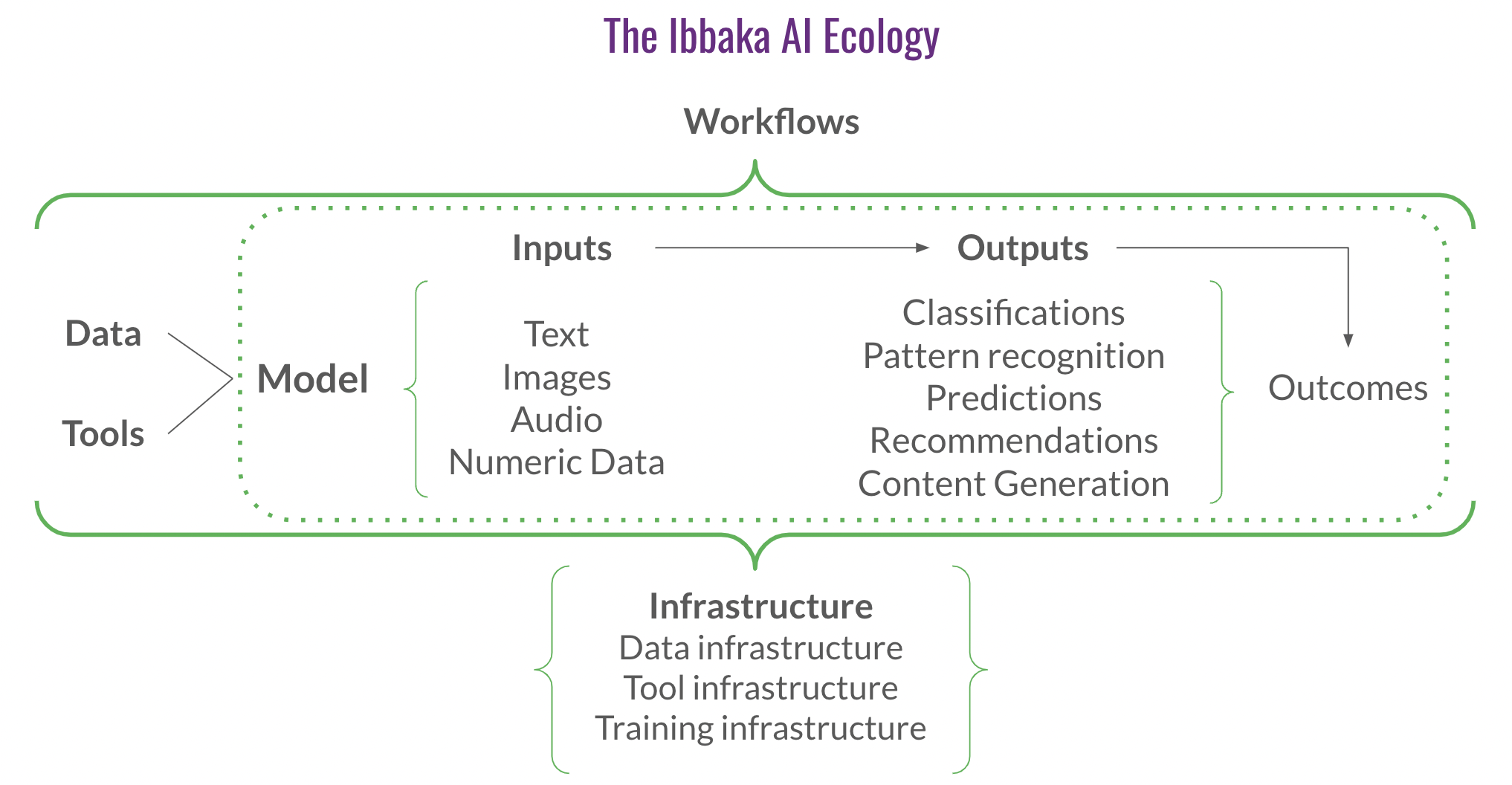

Ibbaka is frequently engaged in helping companies package and price AI-based innovations. We developed a framework for the AI ecology to help organize the value drivers and pricing models for different parts of the ecology.

How one prices AI will depend on where one plays in this framework. Most B2B SaaS companies deliver outputs, that is to say, some form of

Classification

Pattern Recognition

Prediction

Recommendation

Content generation

Pricing metrics will differ for each of these outputs and will depend on the value of the output.

Large language models built on transformer architectures (the most hyped flavor of AI in 2023) can be applied to all of these, but are most commonly used for recommendations and content generation. Deep learning more generally is behind most of the other applications.

In 2024 we are likely to see more application-specific models and to see some B2B SaaS companies offer specialized models to the market. These companies may price more like the general AI companies, who tend to price per model or input and output.

There is much speculation that AI and causal modeling will lead to the pricing of outcomes. We are seeing some small signs of this, mostly as performance riders on more conventional contracts, but this survey found little use of outcomes or performance-based pricing.

In the research, we did ask two related questions.

How will you measure the value AI is providing your customers?

What method will you use to set prices for AI functionality?

It is interesting to map these to the four clusters found in survey respondents.

The Incrementalist cluster gravitated towards Customer Satisfaction (C-Sat) and Net Promoter Score (NPS) metrics. They priced using cost-plus or by comparing with competitors.

The innovation-driven clusters (Disruptors and Nare Paradigm) were much more likely to use economic measures of value. These could be customer-facing, economic value delivered (V2C), or internal, net revenue retention (NRR). Appropriately, they use a value-based approach to pricing.

Which verticals will earn the most money from AI?

One of the most interesting results of the survey is to see which SaaS verticals will earn the most revenue from AI-enabled solutions. There are no real surprises on the leaderboard. What is interesting is the verticals where companies are diverging.

Developer Tools, Data Analytics, Supply Chain & Logistics, FinTech, and MarTech all have a significant number of companies expecting to earn less than 10% of revenue from AI-enabled products or services, and other companies that expect to earn more than 50% of their revenues from AI.

There are many other insights in the report, which runs to more than 70 pages and has data summarized in more than 100 figures.

AI monetization will be one of the main trends for 2024. Companies will rely on AI-enabled products for more and more revenue and will find new ways to price.