Generative AI Monetization: An Interview with Michael Mansard

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

Ibbaka is working with a number of companies and thought leaders to understand generative pricing, the approach to pricing needed for generative AI applications. Michael Mansard from Zuora is one of the thought leaders in this rapidly evolving field.

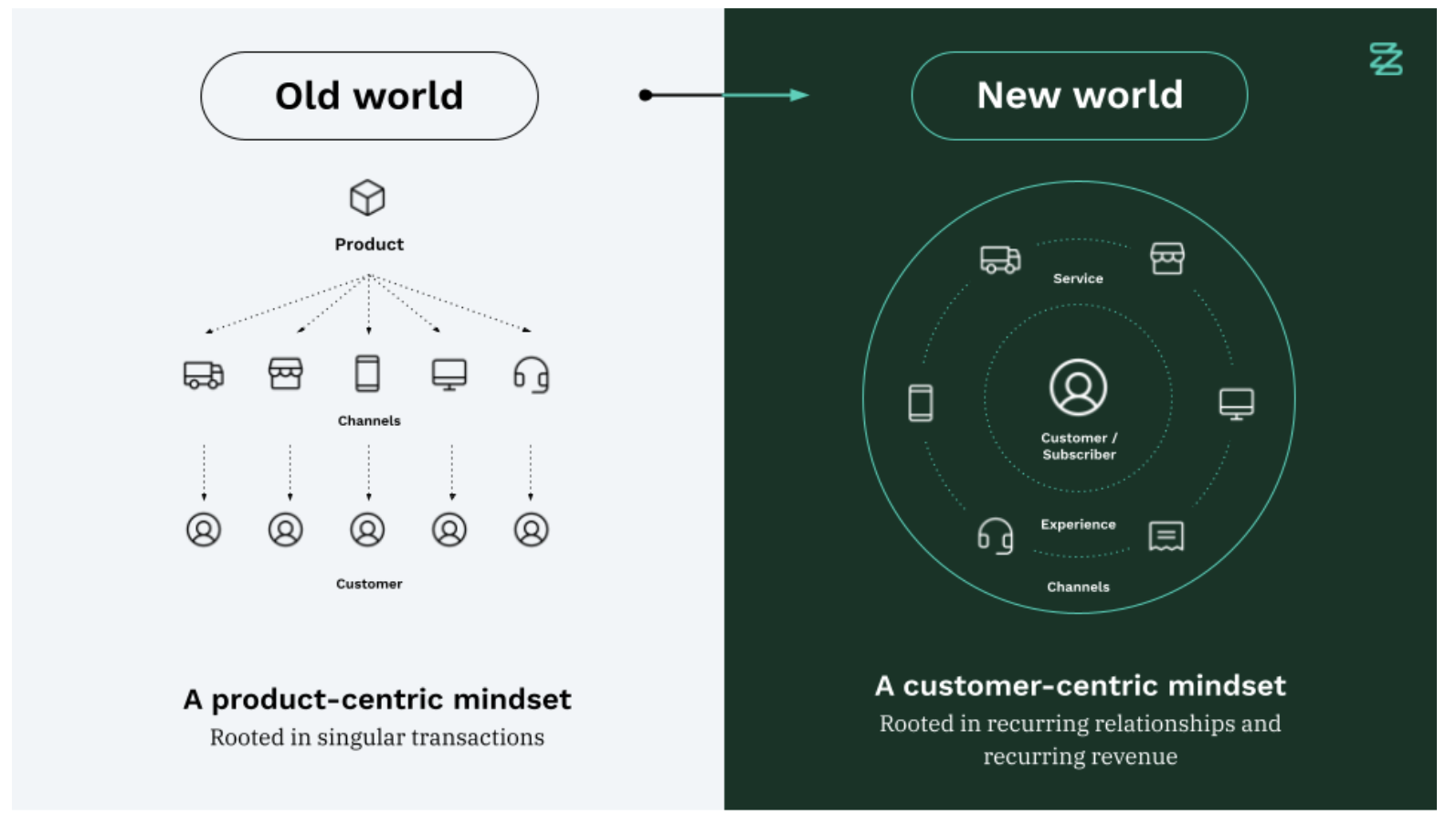

Zuora is one of the central companies of the subscription economy. Indeed, it coined the term and the book Subscribed, by CEO Tien Tzuo, helped define what it means to be a customer-centric business and how culture and organization need to change. The below image, from his book Subscribed, helped many of us rethink our businesses.

TL;DR: The attached document is an interview with Michael Mansard from Zuora, discussing the challenges of monetizing Generative AI (GenAI) and the strategies companies can use to overcome these challenges. Key points include:

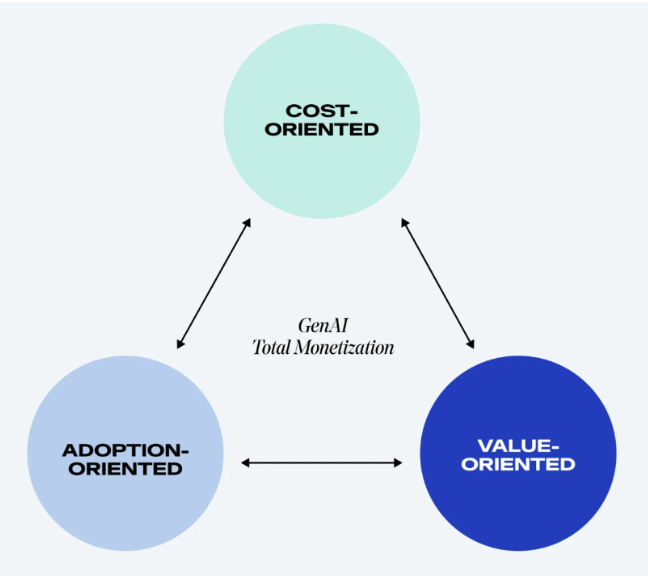

The Impossible Triangle: Balancing adoption, costs, and value in GenAI monetization.

Characteristics of GenAI Applications: Actionable insights, adaptability, and process efficiency.

Predictors of Value: Uniqueness of underlying data, specialization, attributability of value creation, time to value, scalability, and regulatory compliance.

Trends: Hyper-segmentation, value-based pricing, and the need for AI in monetization.

Examples: Companies like Box, Intercom, and Microsoft are already experimenting with GenAI monetization strategies.

Future: The role of AI in evaluating RFP responses and the need for stringent value demonstration.

Here are two drawings that have helped many of us rethink our businesses.

We are now in the early stages of an even more profound transformation, generative AI. This will force us to rethink our businesses profoundly. (See Will generative AI require new approaches to pricing?) One of the people leading this question is Michael Mansard from Zuora’s Subscribed Institute. He is publishing a series of research on the question Monetizing GenAI: Why most SaaS companies are missing out, and how to fix it. We reached out to him to get further insights and context on this important work.

Ibbaka: I thought we'd start just by getting an idea of where you're coming from and what sort of experience you bring to your work at Zuora and the Subscribed Institute that shapes how you think about subscriptions, subscription management, and pricing.

Michael Mansard: I'm the Principal Director of Subscription Strategy at Zuora and I also happen to be the EMEA Chair of our Think Tank, called The Subscribed Institute, which is roughly 1,500 members strong. Zuora is a monetization suite that powers dynamic business models, anything from usage-based models, subscription bundles and all things in between.

I was lucky to join Zuora about nine years ago. My background was in finance advisory at Deloitte and pre-sales specifically for the office of the CFO at SAP. I was contacted by a headhunter and from the get-go I was really impressed with Zuora and especially Tien Tzuo, our CEO and founder, and his vision. This was also my very first opportunity to join what was then a super fast-growing startup and I took the leap of faith. What was great is that I had the opportunity to grow within pre-sales and progressively adding more and more emphasis on strategic engagements, complex value articulation, and industry point of view and that means interacting a lot with leadership teams, our clients, and our prospects.

That's why I joined forces with Amy Konray who created The Subscribed Institute. We have made The Subscribed Institute into a team that helps companies navigate this new world of customer-centric business models.

I have worked with around 400 companies, moving them towards new business models. This includes companies like Schneider Electric, NetApp, and Phillips.

Outside of Zuora, I’m super lucky to be a guest lecturer at INSEAD. I co-created and co-run a program called The Subscription Business Bootcamp, which is an elective program for Executive MBAs, but also an executive education program and we did that with Professor Wolfgang Ulaga.

Finally, I invest in and advise start-ups. I would say a good dozen start-ups and scale-ups have in common complex B2B Solutions where value is really important. What they all have in common is they are recurring businesses or consumption-based businesses. I advise them mostly on pricing, packaging, monetization, value selling, and pre-sales. Anything on value. After all of that, I’d say I’m a monetization geek.

Ibbaka: How would you describe the key skills that you have that you bring to your work?

Michael Mansard: I would say the ability to articulate value is a big one. Customer centricity and customer empathy are key in order to uncover value. Know-how with subscription, recurring, usage-based models because that's what people want to talk to us about. Internal customer support. My customers are the field, the leadership team, the sales team, the pre-sales team, and the delivery teams. I’d say the last point would be intersecting with most people in the company. So cross-functional knowledge and communication is key.

Ibbaka: You recently published a wonderful research e-book on Monetizing Generative AI. What motivated you to write this at this time?

Michael Mansard: First I observed and I'm sure you did, that there's an abundance of content on Generative AI capabilities, innovation, ethics, and potential impact. There's a real gap when it comes to practical advice on how to monetize this new thing. I'm a monetization geek so it really stood out to me. When you know that monetization is vital to sustaining a business and growing a business, the real hot truth is, according to Kyle Poyar, that only 15% of companies are actively monetizing GenAI, which I find extremely risky. I decided to take a scientific approach back in March 2024, and zoomed in to examine around 70 companies to understand their approach, their success and their challenges. I wanted to answer simple questions like

How is GenAI priced?

What is the price premium for GenAI?

What are the typical metrics, especially for solutions, that eventually need fewer users, if not no users at all.

I included in the research companies what I would call native GenAI companies like HeyGen or Perplexity. I also wanted to add established SaaS companies who are starting to infuse GenAI capabilities, such as Box, Notion, or Intercom. The key criteria for me was ‘Can I get enough public information?’ That was the key thing because otherwise it's really hard to talk about something.

I also had several conversations in the background with practitioners, investors, and even journalists. There was a lot of interest, with people saying this was the first time they had heard the problem phrased in this way.

The first version of this research was ready around mid-April 2024. I showed it to our colleagues in the marketing team. They really loved it and the idea, but they got slightly overwhelmed because it was more than 50 pages long. We decided to break it down to what you see now, which will be a series of six articles.

The first one sets the stage and frames the impossible triangle or triptych between adoption, costs, and value. The second one is around offer positioning. The third one is on packaging. The fourth one is on pricing metrics. The last one will be on trials. Then there will be a summary of all these findings for the decision maker. What are the new capabilities that need to be put in place to solve this very complex and rapidly evolving opportunity.

My motivation was to address something very critical in the market that seems like a white space. Some experts like you and Kyle are talking about it, but there is a big white space and an opportunity for collective learning. We need deep quantitative research and this collaborative effort will be valuable to practitioners.

Ibbaka: Did you use a generative AI to help you do the research?

Michael Mansard: No, but that is a good question. I actually tried to do so, but most of the content is so complex and structured in a way that made it difficult to use GenAI. What I did was build a humongous Excel sheet. Then I would slice and dice the data to find trends and create charts.

Ibbaka: I want to come back to the triptych you mentioned earlier. Can you say a little bit more about the emerging ways people are managing that tension?

The Subscribed Institute at Zuora, Monetizing GenAI: Why most SaaS companies are missing out, and how to fix it

Michael Mansard: There's nothing new about this triangle, but each vertex is very different in the word of GenAI. I want to call it the impossible triangle because you cannot satisfy all sides of the triangle at the same time.

It's a very dynamic relationship, we don't know where it's going to lead and we cannot predict the future. You’re going to have to play with this triangle. In GenAI I start with costs, which is weird for pricing because you hate starting with cost. But in GenAI managing costs is because the costs are a lot more complex, especially compared to conventional SaaS.

We've been thinking about incremental costs as relatively low in SaaS, right? Adding more users, and more clients didn't create a linear increase in cost. There were economies of scale. In GenAI, and especially if you're thinking in terms of inference costs, which is, the cost of generating outputs or querying the model, it translates into real additional costs that pile up. Each time you ask a question to a GenAI model you have more costs.

Around 10 months ago it was said that ChatGPT cost $700,000 to run every single day. So you have a cost dynamic which is very different to traditional SaaS where platform costs could be overlooked. This doesn't mean you should price based on cost plus. That is never a good idea. But cost becomes a key input in monetization for GenAI and that's new. GenAI businesses tend to be 10 to 30 percentage points lower in terms of gross profit margins and that is significant.

The second vertice of the triangle is adoption. You want to lower the barriers to adoption. It's the case for any solution, but GenAI is so new and transformative that the ability for customers to explore is vital. This means the free trials and the freemium models that we know.

These trials also help you to explore value. 70% of companies (maybe a bit more) have free trials. Customers can get hooked on the value that GenAI can provide and that can ultimately lead to higher revenues. But you have to balance this with the higher cost of operating a generative AI.

Of the companies analyzed for this research, 45% of GenAI companies today offer a usage-based model. That also helps once you've done the trial to take the leap of faith and tiptoe into buying GenAI that you can then progressively scale. That is going to help on the adoption side. Such a model also aligns nicely with costs. You don't want to price based on cost, but the fact that your pricing is going to at least follow cost can be a good thing, especially If you don't know value. We know that value is the most important thing.

If you're unable to clearly communicate, quantify, and demonstrate the value of a feature it's going to be a problem. It's not about showcasing a cool, new tech, it's about being able to directly translate it into business outcomes. Productivity, customer satisfaction, cost savings, you name it. But the thing is, it's so new that many providers are in the process of uncovering value, or the absence of value, alongside their clients.

If I were to summarize it, you have a more complex cost dynamic. You have an adoption that needs to be fostered because it's so new and you need to know value. That's why I call it the impossible triangle. If you push too hard on adoption, then you can have exploding costs. But if you do not enable adoption, you're not going to have enough data or insights to actually assess the value of your innovative use cases. Balancing these three things requires a dynamic approach. We are seeing this exercise unfold before our very eyes, which is rare. It's almost like seeing a scientific experiment unfold in real time.

I think companies should be prepared to iterate on their pricing and packaging based on customer feedback in data. A flexible model and being able to adjust as you discover things is going to be critical and one example on this is GitHub. They introduced a new tier to GitHub Copilot. Microsoft, as I was doing this study, did a free trial for Copilot for security. Salesforce changed one of the price points of Einstein add-on as I was doing the study. It kind of shows these open-heart surgeries with these companies and that was only 3 out of 17. The best way to approach this tradeoff is to stay customer-centric. You need to understand the pain point and you need to make sure that your pricing reflects the value to encourage adoption. It’s super easy to say but a lot harder to do.

Ibbaka: Can you say a little bit about the characteristics of generative AI applications that underlie these challenges? You mention the costs, but are there other attributes of GenAI that are driving how we think about monetization and how we manage the tradeoffs between the three parts of the triangle?

Michael Mansard: I can answer this in two parts. These are the characteristics of generative AI value creation compared to traditional SaaS. Then I’d like to go into characteristics that are good predictors of future value.

I would say the first one that comes to mind is that generative AI applications are actionable. We all experience it, you go into a GenAI application and it provides you with direct actionable insights and outputs.

Linked to this is adaptability, that is where GenAI shines in my view. It customizes and adapts what we just said in a user-friendly way, in a way that you did not expect. Here you can tweak the outputs to meet your needs.

The third one is process efficiency because you can produce at extreme speed, actionable and adaptable outputs with limited and sometimes no human effort. These three things that help you have more efficient processes and workflows as compared to SaaS. These three things speak to me as a value person.

What I find interesting now is what could be good predictors of value if you are a GenAI company.

One is the uniqueness of the underlying data. We all know that the quality of training of an AI model and the quality of the output highly depends on the data. If you have a narrow, very specific, or very deep datasets that provides a unique Insight, that is a complete advantage. We saw that OpenAI recently signed with data providers. IP and high-quality data are important.

The second one is specialization. We see a lot of general purpose engines right now, but hyperspecialization on a domain or use cases, which is a clear problem, is a big value predictor as well.

The third one is attributability of value creation. If it's really hard for you and the buyer to make sure that there's a direct correlation so that you can say “I do this, therefore, this value has been created” it's going to be really hard to capture a value premium. So how do you manage to have an application for which you can have a direct attribution of value creation?

The fourth predictor, and it has been the case for years, is time to value. In a rapidly changing world, you have to be able to deliver value quickly.

Then there is the ability to scale. Is this a generic solution able to scale elastically in every direction? Regulatory and local compliance issues are popping up across the globe. So how do you minimize legal risk for your clients?

Lastly, your position in the value chain. There are always links in the value chain that are able to capture more value than others. There is usually not much one can do about that, but GenAI may change the ground rules.

I purposely didn’t focus on the drawbacks, such as data privacy, inaccuracies and energy consumption. I would say that these can negatively impact or modulate value. But if you manage them well they can become your unique value selling points.

Ibbaka: Can you give some concrete examples of companies where these are at play?

Michael Mansard: Box is one. I think it is quite interesting how they do it. Box created Box AI, which integrates AI in the Box cloud. They enable companies to unlock value out of a large amount of unstructured data and documents. You can summarize documents, get extra insights, and generate new content because you have got so much content that is yours. You can create new content from your content. When it comes to monetization, each subscriber to the Enterprise Plus plan gets 20 AI queries per month, and on top of that you have a corporate-wide allotment that you can pay to top up.

The second one I find very interesting is Intercom. You mentioned this in your recent webinar with Mark Stiving (the webinar is available here). They use generative AI to power a customer service called Fin AI. This service handles customer support interactions and Intercom only gets paid if the customer issue is resolved. This improves customer satisfaction and of course, reduces support costs.

The last one I want to talk about is Microsoft. They launched a standalone security copilot, which is offered at four dollars worth of security compute unit hours. I find it very interesting that they have created a new metric and that this metric conveys value.

Ibbaka: Where is all this going? Generative AI is moving incredibly quickly, so what are the trends that you're going to be watching over the next two to three years?

Michael Mansard: Things have changed that are very different. Right now, I would say companies are struggling to find what is the exact premium you can extract from AI. In the study, I assessed the premium, whether you're an add-on or whether you're a new super tier as in the top tier.

You can see how companies are pricing, if you take it as a ratio of the add-on as compared to the core product it, or if you compare it to the super tier as compared to the previous non-AI tier. For add ons, you see between a 13 to 500 percent premium. On the other hand, you see something like 50 to let's say 150 for the top tier. What this tells me is it's really hard right now for companies to really understand and articulate the value premium.

For years, price metrics in software have been seats or users for applications, regardless if you're a vertical application or a horizontal application. Seats or users have been a widely accepted pricing model. There are exceptions of course and I think there's going to be massive changes in this. You'll see in the study that more than 50% of companies analyzed right now in GenAI do not price based on users. For those who price on users, some of them are already integrating new metrics. I'm not sure if pricing is yet customer-centric, but at least they're experimenting with new pricing models that go beyond users. This is only going to accelerate and user-based pricing is going to disappear in most cases. I'd say the first thing, the iteration that we're seeing right now, is only going to accelerate at a faster pace.

The second thing I would mention is there's going to be an acceleration in the need for real-time consumption or usage data analysis as a basis for value measurements.

That is, in order to support more systematic and scientific value exploration more proof points and more scientific ways to measure value will be needed.

A value-based approach, value-based discovery, value selling, and value engineering are important in any software company and it’s going to become vital. I think there's going to have to be a massive sales transformation so that every single sales and pre-sales rep is going to have to be a value expert.

That's my deep belief. Why? Because we're going to go into hyper or micro-segmentation. I think that the dream of a segment of one that I think was famous in the 90s is going to happen and it's going to be a segmentation in both journeys, individual journeys, and individual packaging, which will lead to individualized pricing.

So if I try to use an image, it's almost à la carte pricing meets good/better/best, right? You have a la carte pricing in the background, but you're going to show dynamic good, better, best, because we all know the positive impact in terms of pricing psychology of using good, better, best mechanisms.

So long story short, hyper segmentation in terms of journeys, offers and pricing.

Going forward, in my view you will need two things. The first is AI for monetization. You cannot monetize AI without using AI. The effort to run pricing is not at the scale of a human team. The real-time nature of it also means hyper modularity, and not only for packaging, but also for the provisioning. You need to be able to reconfigure everything on the fly. That means you also need a very robust and agile monetization platform to be able to do this at scale, because this has massive implications in terms of invoicing payments, revenue recognition, and so on.

My second conclusion is more customer centricity. I think it's going to create massive polarization in terms of pricing and packaging. You're not going to be able to get away with just pricing per user. You're going to have to be value experts. That means that it’s going to make your job a lot harder as monetization is critical. The buyer job is going to become a lot more complex. They will need to dive deep in order to really understand the implications and the intricacies of the pricing model.

Maybe right now the value-based approach is for the sellers, but in the future you're going to have to be able to do value-based buying. This will be a new skill for the buyer, mirroring the value based selling.

Ibbaka: I think this is going to have an enormous impact on CPQ systems because configuration will be based on “How do I configure this solution at this point in time?” The question will be how to create the most value for the buyer while optimizing the price. Over the past few months, Ibbaka has been developing some approaches to analyzing RFP responses using generative AI. I don't know how many RFP responses you've looked at recently, but they tend to be long - up to 100 slides. If you have six responses, that's 600 slides, and you're probably doing this as a team of 2 or 3 people. I don't think there is any group of two or three people that can absorb 600 slides and make sense of them. It's not a human task, but generative AIs are pretty good at this.

So increasingly, generative AIs are going to be used to evaluate RFP responses. Which brings us to the point you were making earlier, which is that in the very near future, your buyer is going to be an AI. So how does it impact how we think about value and pricing when increasingly the buyer is an AI and also many of the users are going to be AIs as well?

Michael Mansard: I haven't thought of it to be very transparent with you. It's hard to say. I would be convinced that the human-to-human will remain critical for any critical situation. I don't believe in full AI autopilot mode. That's true for any sector for anything strategic. To your point, the idea is augmenting. How do you do it and how does it impact pricing? I would say it requires stringent value demonstration. Vague claims won't work anymore because you're going to have to have substantiated proof of what you're saying.

That's why I think humans are going to be very important and that's why the ability to document value is going to be key. The profiles of the people in sales teams are going to be a lot more data-driven. Value documentation is going to be critical. The ability to automate your response as well, to be relevant to the buyer AI in front of you, of course, is going to be critical.

Ibbaka: That is all fascinating. I think we're going to need to do a follow-up, after the next part of your series drops. Before we end today tell me a little bit more about yourself. Who are you when you're not at work? What are your passions outside of your role at the company?

Michael Mansard: That is the first time someone has asked me that in a business interview!

Many things. I wish my days were longer. The main thing is spending time with my family. I have two young daughters, two and four. They have massive energy and curiosity and seeing them discover the world, that’s refreshing and inspiring and it keeps us quite busy. Travelling is a big passion as well, Japan being my favorite destination. I have been there ten times and I especially like going to Tohoku. And then music plays a central role for me for relaxation and renewal. I am a drummer and a pianist. I am a huge fan of Jazz music. You said that pricing is like architecture, and I cannot agree more, but for me pricing is a bit like music. It is part science and part craftsmanship. And pricing needs controlled improvisation. I listened to a lot of music while I was working on this.

Ibbaka: What are some of the music you listened to while working on this?

Michael Mansard: I have to confess that I would go to my Jazz playlist and go random. It is a massive list with more than 150 different pieces from classic to very modern Jazz, a bit of crazy Jazz. When I need to focus I would listen to what they call LoFi music, maybe you know the LoFi Girl on YouTube. I would do that when I needed my brain to focus on just one task.

Ibbaka: That reminds me of Brian Eno’s Music for Airports, music that is interesting as both foreground and background.

Michael Mansard: I don’t know this but it sounds very interesting. I will look it up.

And then, cooking and food. I love Belgian strong ales, Trappist beers, and of course sake. Anything with a strong malty or grainy flavor. So to summarize, family, travel, music, and cooking. Nothing unusual but I am fairly niche in each of them. These keep me energized.

Ibbaka: Thank you, Michael, we look forward to our next conversation and to seeing how GenAI and GenAI pricing, or even generative pricing, will unfold.