Interview with Dick Sobel on Pricing Acuity

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

Dick Sobel has been a respected voice in pricing circles for many years. Together with his late partner Ralph Zuponcic, his firm PricePoint Partners has helped many companies in the manufacturing and distribution sectors improve their pricing.

PricePoint Partners has a very useful tool - Acuity Analytics. Ibbaka has been working with users of Acuity Analytics and has experienced its value as a way to gather, organize, analyze, and present price and margin data. This is a great complement to Ibbaka Valio with its value and price management platform.

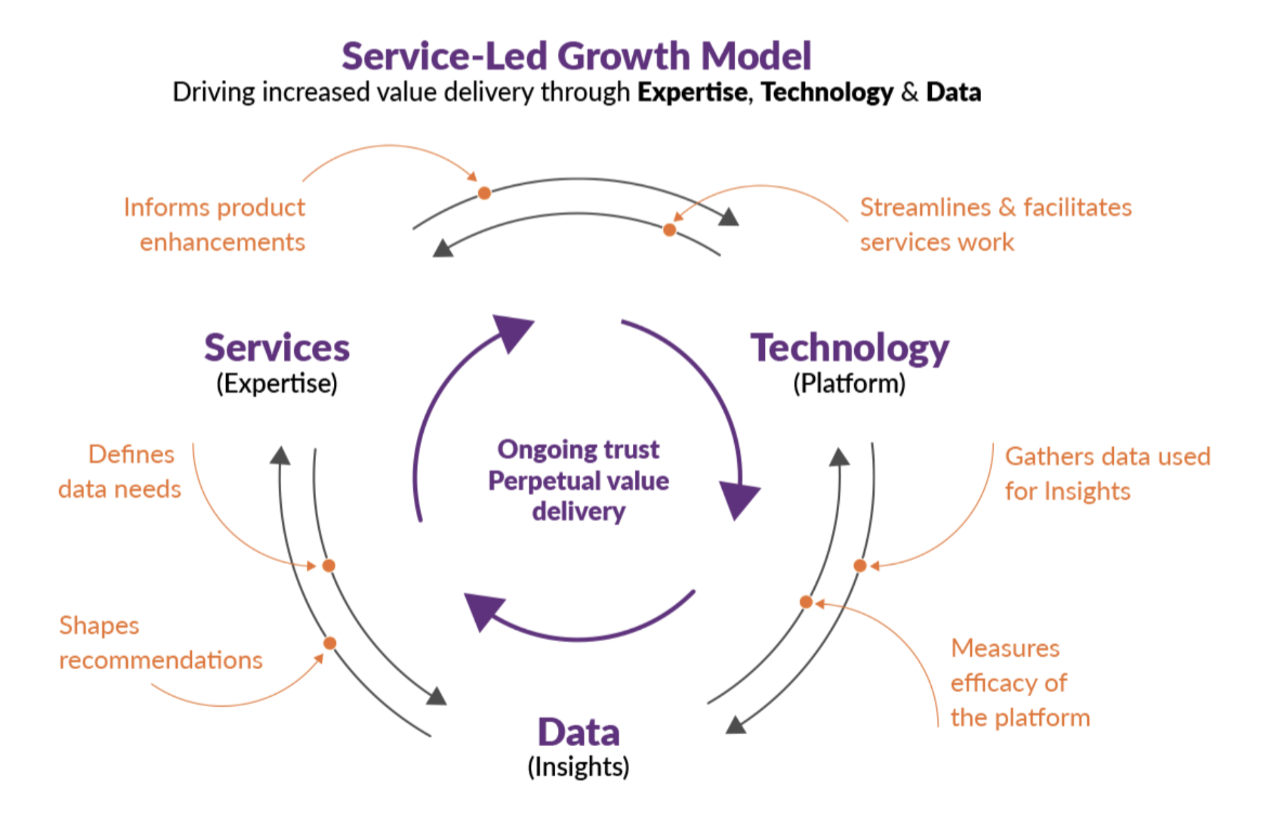

PricePoint Partners is a great example of a consulting company transitioning to service-led growth, where consulting is delivered through a software application that provides continuing value to customers and a subscription revenue stream to the consulting firm. This is likely to become the dominant model for many consulting firms going forward.

We spoke with Dick in late December about pricing Acuity and his career in pricing.

Steven: Share with us a little bit about your background, how you got into pricing, and how the experience you have with pricing shapes your approach to the design of pricing Acuity.

Dick: I got started with pricing at Emerson back in the mid-90s. I had various positions in marketing, sales, strategic planning, management, and so forth with a background in chemical engineering and mathematics.

So, I started with Excel spreadsheets and developed the necessary calculations and algorithms.

With Emerson, when you attend, a strategy meeting there are numerous spreadsheets, including price and margin that a division provides. If you understand the spreadsheets and how they interact, then you can understand the business.

When I left Emerson, I started The Pricing Analytic Group and was able to win a couple of projects through my Emerson contacts. I recognized that you cannot survive as a one-man band. You need somebody else that you can work with and I joined a team, partnering with Ralph Zuponcic, founder of PricePoint Partners.

As we did more and more projects we were getting bogged down in massive spreadsheets. I was addressing the issues of price cost mix, volume, elasticity, and so on. Doing all of this on spreadsheets was impossible.

I was looking for a software platform that would help and that would be repeatable and scalable. Ideally, one that could be offered as a SaaS model. Of all the alternatives I looked at, Tableau was the best because of its platform and its technical support.

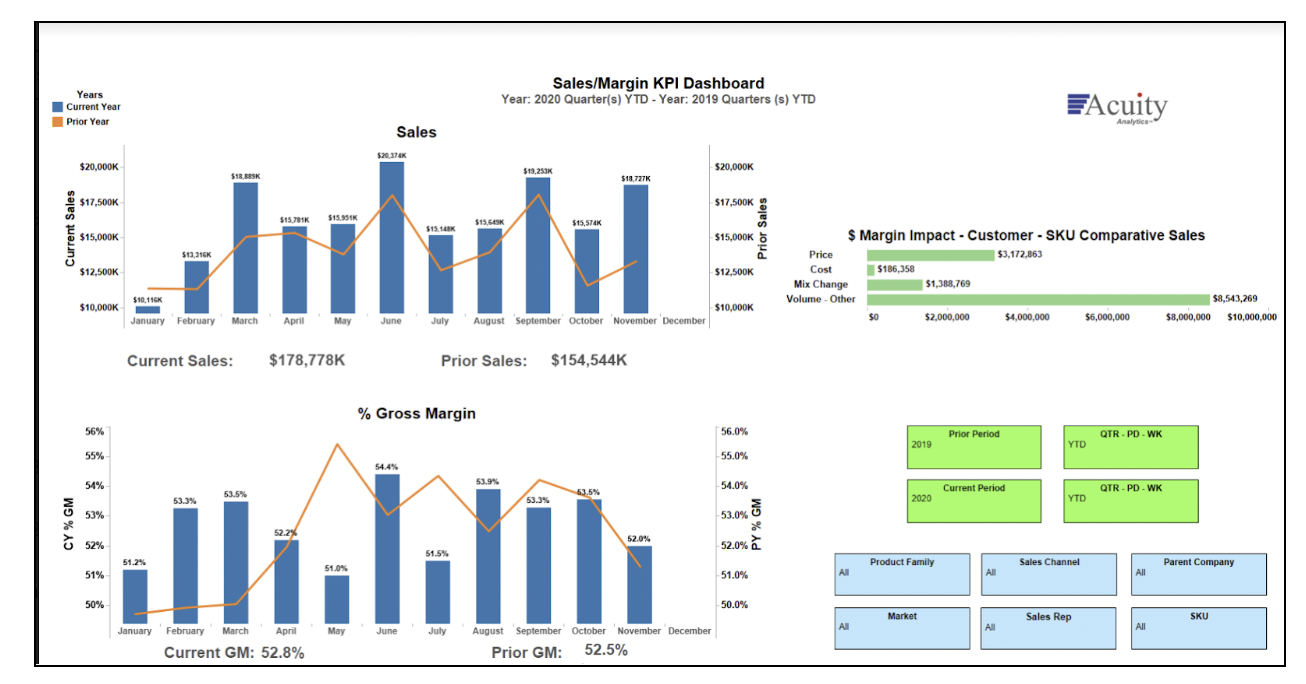

Acuity Analytics Screen Shot

Tableau tech support has been very helpful, and I would go with them with very specific questions on how to make certain things work right. We developed this back in late 2017 through early 2018, and it's matured over the years.

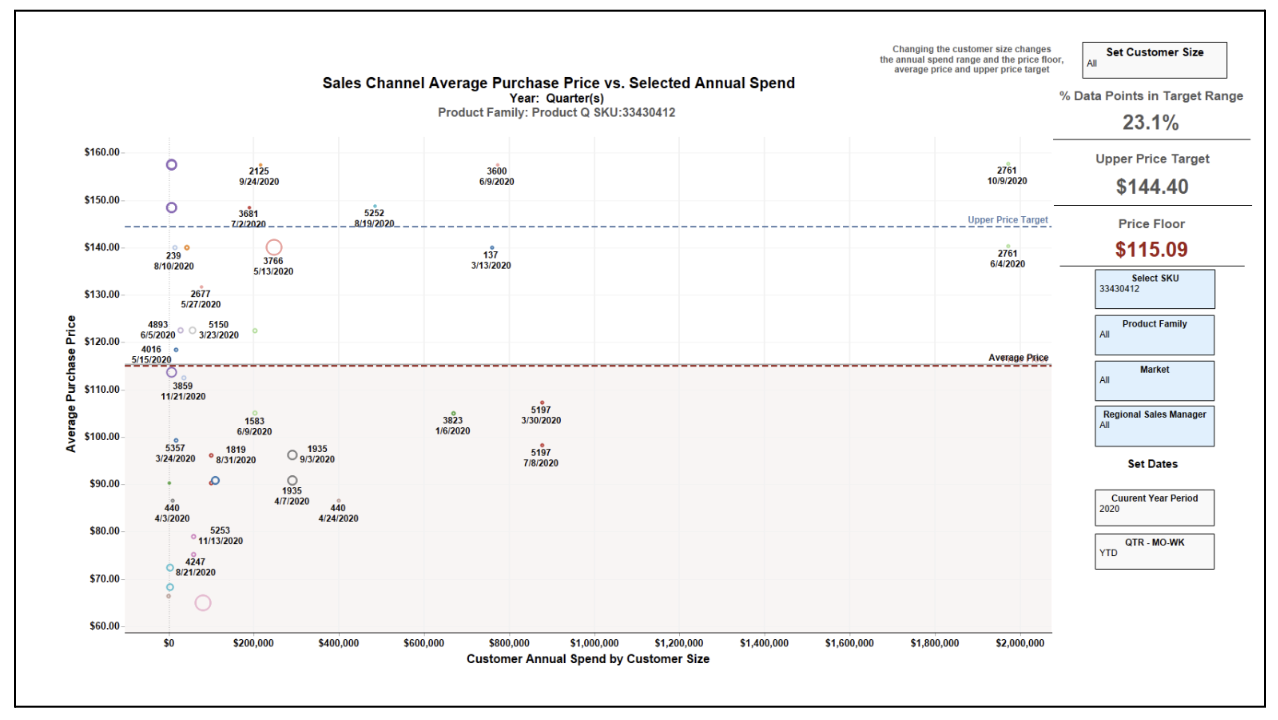

Acuity Analytics Screenshot

We have a close relationship with Zilliant. I don't suggest that Pricing Acuity comes close to the level of sophistication that solutions like Zilliant and Pricefx offer. But in the market that I serve, which is manufacturing and distribution companies with between about $10 to $250 million, we have a good solution. The sweet spot is companies with $100 to $150 million in revenue, whose pricing journey is just beginning.

These companies are sophisticated, but they don't have the resources to deal with these large pricing software applications, nor do they have the budgets for them. Conventional pricing analytics software will take an investment of $100,000 to $3.5 million. The companies I work with don’t have that kind of budget.

Steven: Before we go on to talk more about pricing Acuity, what is it about pricing that gets you excited? Why are you devoting your career to helping people price and understand their pricing better?

Dick: Pricing is very analytical and that suits me. I enjoyed it because there was problem-solving. We were helping people use the pricing lever to deliver massive improvements in profitability.

This is true for clients like convenience stores and distributors. They're lucky if they clear 1% or 2% profit, and their gross margins are usually 8 or 9%. Any improvement in pricing drops to the bottom line and has a big impact.

In the case of a billion-dollar distributor to convenience stores, we were able to increase their profit by millions and made it possible to sell their business to a much larger distributor. No matter who you talk to in a company, everybody is concerned about pricing, but they don't know what to do about it. Management is sometimes scared to death of their salesforce and their sales management because they're always wanting lower prices.

Acuity was a way to help management to encourage the salesforce to recognize the value and the importance of price to profitability.

Steven: Can you tell us more about who Pricing Acuity is meant for, who are the main people that use it, and how do they get value from it?

Dick: I had a look at a marketplace that was under-served. Companies below $10 million were not ready to engage with pricing, but once they reached $10 million to $250 million their readiness changed.

Pricing Acuity delivers value by helping users understand the impact of price, cost, mix, volume, elasticity, and market insights. In particular, they can evaluate customer by customer, product by product, market by market, salesperson by salesperson, and analyze all these different possibilities. The impact of margin and price management down to the SKU level and at any level of detail tells a different story than looking at aggregate numbers. Often the aggregate numbers don’t make sense until you get into the granular details. Once you start looking at the details, you often find groups of customers that are poorly priced and where the company is losing money.

In the past, clients often initiated a general price increase, peanut butter spreading. With Pricing Acuity, you can target price increases. When different customers in the same product group behave differently you need to be more precise with price changes. That's how they get value.

Steven: Who uses this? Who are the main users of pricing Acuity at one of your customers?

Dick: Typically, they're marketing managers or, in one case, a national sales manager. There are some senior product managers as well. Once you have the CEO on board, you're pretty much home-free. You have to bring in everybody to be part of the team.

Steven: How did you come up with the pricing for Pricing Acuity?

Dick: I pay attention to client sales, current EBIT, and the general level of profitability.

The size of the company and its profitability suggest what their willingness to pay might be. If they're not very profitable, even if a high ROI is presented, they may not have the budget to do it. So, we try to balance these factors and prices that maximize value to our clients.

We don’t use long-term contracts, customers are not locked in. You get professional services along the way, and I have strategic partners that I rely on, like Ibbaka, in different areas to help when I need help.

Steven: Given what you are seeing in the world, what sort of directions are you going to take Pricing Acuity in 2024?

Dick: Tableau has what they call ‘explain data’ and ‘ask data’. When you're online, you can select a data point or a section and they have a display bar, they'll analyze all the data and display recommendations and commentary. They're moving closer and closer to something more compelling such as Tableau GPT (based on generative AI) and Tableau Plus which is expected to be released in 2024.

I expect that it will allow us to add that additional value to Pricing Acuity and do things with a data set that is extremely complex to do now. I mentioned earlier the question of wallet share, where you're looking at customers within a specific industry cohort that are buying products, some are buying five or six others are only buying one or two. Identifying the products that determine the share of the wallet will be helpful. It will also help in price optimization.

But as I've argued in the past, you really shouldn't be handing salespeople an algorithm price and saying, “Well, we use our artificial intelligence to set prices.” That just invites pricing objections.

Steven: Do you think that, as a community, people in pricing are paying enough attention to AI and are paying attention to it in the right way? What could we be doing to have more important and more relevant conversations about AI and pricing at a community level?

Dick: Part of the issue I think is the big players. The 5 or 6 that are out there are debating about who has the better AI.

I don't think they're helping the community. We need a group or an organization that will focus on AI and the pricing function. It is something that is missing. We need to help each other ask better questions.

Steven: If a young person came to you and asked for your advice about a career in pricing, what sort of advice would you give them?

Dick: A business background would be helpful or have an interest in the pricing function. They need to have an analytical perspective. People who have an inquiring style of life and they're interested in solving problems. Some skills, like business intelligence software. I don't necessarily think you'd have to learn something like Python.

Steven: If they asked you the question, “Isn't a career in pricing at risk because of AI?” how would you answer that?

Dick: I think AI is universally an issue for everybody. It's how you apply it, and how you use it that matters.

You need to keep being aware of how AI is changing and the new uses that are emerging.

Find mentors who can help you figure out the business questions you need to ask. AI might help you get the answers but you need to be able to ask the right questions.