Navigating Price Adjustments: When to Raise Prices Amid Rising Costs

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

The typical response to rising costs often involves raising prices. A few years back, I found myself in the office of a Pricing VP at a major manufacturing firm during a period of escalating commodity costs. As input expenses, such as metals, rare metals, and energy, soared, he was summoned by the CEO to address the board regarding safeguarding margins through price hikes. However, his approach was rather unconventional. He proposed reducing equipment costs while elevating software service prices. This decision was rooted in the understanding that their software complemented their machinery, enhancing manufacturing efficiency.

A couple of years ago, a post on the Professional Pricing Society’s LinkedIn group strongly advocated for price hikes in response to increased costs, garnering significant approval. But is this strategy truly advantageous?

Get Ibbaka’s Pricing Planning Guide & Checklist for 2024

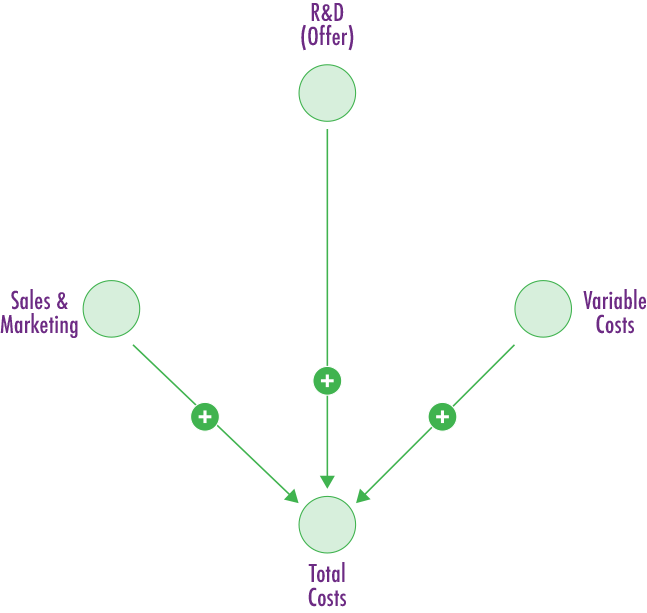

If you're reading this, chances are your company has substantial sunk costs in research and development, alongside hefty sales and marketing expenditures, with comparatively lower variable costs. Of course AI compute costs may be changing the variable costs component, but even then most SaaS companies have relatively low SaaS costs. This scenario is common among most SaaS companies. While this dynamic is evolving, particularly with the growing importance and costliness of data acquisition, variable costs per unit sold generally remain modest. Consequently, this raises our initial question.

Which component of your costs has gone up?

(Note: This diagram style draws inspiration from Judea Pearl, a Turing award recipient renowned for his causal diagrams. Expect to encounter these diagrams more frequently as they enhance model clarity and facilitate connections to causal and predictive models).

Your approach will vary based on which cost component has altered and how this influences the long-term sustainability of your enterprise. If R&D expenses have increased (potentially due to rising compensation for data scientists employed in R&D over recent years), you must assess your future investment needs and your attractiveness as an employer. Alternatively, if sales, marketing, or variable costs have risen, your initial consideration may be how to refine your offerings to better manage these expenses.

Those familiar with OpenView are acquainted with its product-led growth philosophy. (Refer to the compilation of Product-Led Growth Resources). One implication of this philosophy is the ability to leverage the product to address other cost concerns.

Furthermore, sales and marketing can be utilized to control variable costs by tailoring marketing strategies and directing sales efforts toward customers with lower service costs.

Another crucial question to address prior to reacting to a change in costs is, "What effect will this cost alteration have on Customer Lifetime Value (LTV) and Customer Acquisition Costs (CAC)?" Examine the underlying equations governing LTV closely to discern their changes and their subsequent impact on the LTV/CAC ratio. Investing in product development stands out as one of the most effective long-term management strategies in this regard. However, focusing solely on internal factors is insufficient. Decisions regarding price adjustments cannot be made in isolation; they must consider external factors.

Neglecting to consider the impact of cost increases on competitors is a recipe for failure. It's imperative to inquire, "How does the cost increase affect my competitors?" Without understanding this, it's impossible to anticipate how competitors might respond to any price adjustments you make.

Equally important is the question, "How does the cost increase affect my customers' businesses?" This perspective is essential for understanding the broader implications of cost changes beyond your own company's operations.

Does the alteration in your expenses also affect your customer's expenditures (and consequently, their revenues)? If the rise in input costs directly impacts your customer's expenses, then raising your own prices would doubly burden them, likely leading to a negative reception.

We commenced this discussion with the reaction of a manufacturing company to a price hike, which was commendable. Their approach began with understanding how cost increases affected their customers, not just their own financial standing. Recognizing that the cost hike posed a more significant challenge for most customers, they opted against increasing prices for their equipment, a move that would have exacerbated the situation. Instead, they concentrated on enhancing the value of their overall solution, particularly their materials optimization software, which was increasingly valuable in the evolving market conditions. Consequently, they reduced equipment prices and raised the price of their now more valuable software, much to the satisfaction of many customers.

Read More on Pricing and Planning: 3 Approaches to Discounting

Anticipating the consequences of a price increase is a multifaceted endeavor. I've discussed this elsewhere, illustrating how simple causal models can streamline communication and facilitate the development of analytical and predictive models (refer to "Predicting The Outcome of Price Changes").

When contemplating a price adjustment, it's essential to pose several critical inquiries:

For a Price Increase:

How much volume can be sacrificed while maintaining current revenue levels?

How much volume can be sacrificed while preserving existing profit margins?

For a Price Reduction:

What volume increase is necessary to sustain current revenue figures?

What volume increase is necessary to maintain current profit levels?

In the realm of SaaS, additional considerations must be made regarding the impact on Net Revenue Retention. It's crucial to assess whether the price alteration will:

Influence churn rates

Impact growth or contraction within the package, particularly significant when introducing usage-based metrics

Potentially drive higher rates of up-selling or down-selling.

Moreover, it's imperative to evaluate how the price change will affect the sales pipeline:

Will it attract more opportunities into the pipeline?

Are there expected shifts in conversion ratios across pipeline stages?

Will the velocity of the pipeline accelerate or decelerate?

Given the intricacies of SaaS pricing dynamics, any pricing adjustment decision should thoroughly incorporate its potential effects on critical SaaS metrics.

On Wednesday, March 27th, Ibbaka and PeakSpan Capital will delve into the power of strategic pricing and packaging to combat churn, also known as optimizing gross-dollar retention (GRR).

Churn, often likened to a "leaky bucket," poses a significant obstacle to the growth of SaaS businesses. It stands as a pivotal determinant of Net Recurring Revenue (NRR), offering insight into a subscription's value proposition for customers.

Every subscription-driven enterprise must possess the capability to foresee churn and possess effective strategies to retain at-risk customers. Our Master Class equips you with the necessary tools to:

Identify the root causes of churn

Forecast potential churn occurrences

Develop actionable plans tailored to address specific churn triggers

Determine the optimal timing for intervention, avoiding delayed responses

Acknowledge the inevitability that some customers may churn

Read other posts on Pricing Design

PeakSpan Master Class: Optimize Pricing & Packaging to Minimize Churn (Register Here)

Pricing and Planning: Will usage-based pricing continue to drive growth?

What to price? What to optimize? How to optimize? Three key pricing questions

Pricing under uncertainty and the need for usage-based pricing

Enabling Usage-Based Pricing - Interview with Adam Howatson of LogiSense