NDR Growth Tactics 1: Grow in Package

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

Net Dollar Retention (NDR), or Net Revenue Retention (NRR) to use the more generic term, has become a priority for most SaaS businesses. The reasons are simple.

Customer Acquisition Costs (CAC) have already been covered so this is a very cost efficient form of growth

Buyers and investors want to be sure a solution delivers value; NDR growth is strong evidence of value

Positive NDR shows that the company has the ability to overcome the natural account churn that is part of any SaaS business

Ibbaka has a compelling framework for delivering NDR growth, one that is well supported in the Ibbaka Valio platform. We are sharing this framework in this series of eight posts.

The six NDR factors are often shown using the NDR waterfall. This is a powerful tool to understand what levers are driving NDR and where actions should be focussed.

Why treat growth in packages and shrinkage in package separately?

It may seem odd to separate Grow in Package and Shrink in Package into two different threads. They are two sides of the same coin, right?

No.

One of the first steps in managing NDR is to segment your current customers into those that are growing in package and those that are shrinking and to treat them differently.

The reasons that some companies are growing in package may be quite different from why other companies are shrinking. They each need their own tactics.

The levers to grow in package

How can we encourage growth in package? There are just three ways,

Grow use

Add users

Increase price

Your ability to pull these levers depends in large part on your package and pricing design. The pricing metrics you use for the package, the way the package is fenced, connections between value paths and value over time all determine the tactics you can use. Let’s break these out.

Growing usage can improve NDR

Pricing metrics

Do your pricing metrics capture increased use? If you have a basic user-based pricing model, the answer will be ‘no.’

Do your pricing metrics capture a growing user base? This is a more nuanced question, as the value created by the growing user base can be captured directly, through user-based pricing, or indirectly, by growing use.

The implication of this is that you should always have some form of usage based pricing and that you may want to have some form of user based pricing as well.

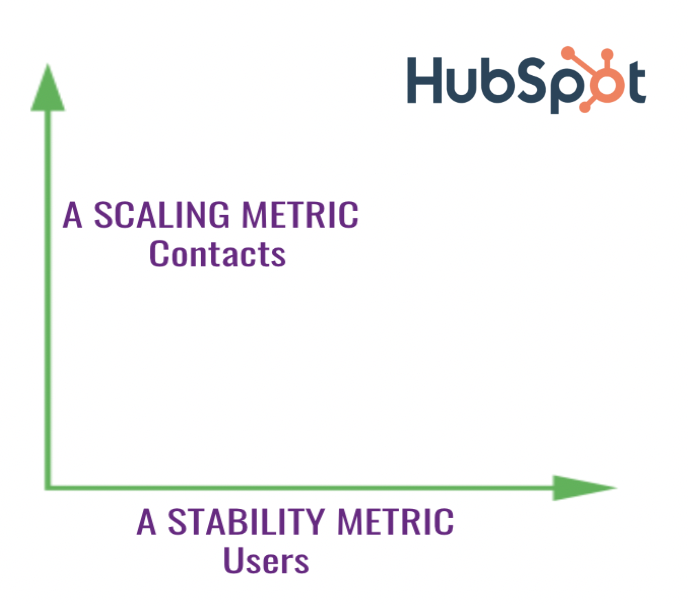

A pricing design that combines two or more pricing metrics is generally known as hybrid pricing or multifactor pricing. One of the most powerful SaaS trends over the past few years is the move to hybrid pricing. Hybrid pricing deserves its own post, so here are just a few of the high points.

Have no more than three metrics, preferably two (use other possible metrics as fences)

The metrics should be largely independent of each other, if they are closely correlated just use one metric or combine the two metrics into one with a simple equation

One metric should support stable revenue, provide a floor

One metric should be scalable and drive upside

Some examples …

Hubspot (Contacts and Users)

Open.ai for GPT-4 (Token Inputs and Token Outputs, see How Open.ai prices inputs and outputs for GPT-4)

Slack (Users and Features)

Fencing

Fences are limits on a package that are meant to guide buyers into the right package when they buy and then lead them to upgrade to a higher level (higher priced) as usage increases.

Fences are an important part of package design and one of the most powerful ways to drive upsell. But in certain cases, especially in the current economic environment, they can discourage users from expanding use.

Take a hard look at the fences in your packages and how they interact with the pricing metrics. Are users running up against a fence and then rather than moving to a higher package throttling back usage? If so, you may need to loosen the fences that are choking usage expansion and keep revenue growth down.

Value paths

(There is a concrete example of value paths in NDR growth tactics 2: Drive Upsell.)

A value path is the series of actions a user takes that results in something of value. Applications like Pendo can help you track how users are proceeding along value paths and value path completion. A well designed package has at least one complete value path. Most packages, especially at the professional and enterprise level, with have 3-5 value paths. If you have more than that, you are probably confusing your users and it is time to branch your product.

A focus on value path design and value path completion can drive NDR, but only if you have the right pricing design.

You can do this through good UX(user experience) design that makes sure that users are able to complete value paths, removing barriers, providing the data, and not just the tools, that people need to do their work.

This impacts NDR in two ways.

People getting value are more likely to renew, especially if that value is being documented.

A pricing metric linked to completion of value paths will connect NDR growth to growth in value delivered.

Adding users can increase NDR

The more users the higher the revenue, right? So adding users should be a priority for NDR growth. Maybe. But only if those users are getting value and creating value, for other users and for the organization paying the bill.

User-based pricing is so common in SaaS that some people see it as the default pricing mechanism. It should not be. Use user based pricing when each user gets unique value and needs their own view of the data. Otherwise avoid getting caught in the user based pricing trap. See When is user-based pricing a good pricing metric?

If you have a user based pricing metric then adding users obviously helps you to grow in package. But this is not the only way more users can help growth. Generally more users leads to more activity and will indirectly impact usage or activity based pricing metrics, leading to growth.

As with many things, usage follows a Pareto distribution, with a small number of users contributing most of the activity. Your growth strategy should focus on supporting these users as they are the ones creating value with your software.

Raising prices can increase NDR

One of the obvious ways to grow NDR is to increase prices. May SaaS applications are under priced, and there is the potential for price increases. Before jumping in and imposing a blanket price increase, segment your user base into four segments. Look at the value you are providing (value to customer or V2C) and the value you are capturing back (the best way to do this is by lifetime customer value or LTV). Are there customers where the value ratio is higher than your target? Are there other customers who are not getting enough value given what they are paying. Do not treat everyone equally.

We go into more detail in this in our post Customer segmentation for price increases.

Tension between upsell vs. in package growth

Note that there is a natural tension between two of the levers for NDR growth: Growth in Package and Upsell. One can often grow in package by increasing value or through price increases. But any actions you take here will also impact upsell (the theme of our next post). You need to calculate whether you will have a bigger impact on NDR by growing in package or by guiding your users up into a higher tier. Work out the different scenarios and if necessary rebalance your assumptions about the user and revenue distribution across packages.

Steps to improve NDR by growing in package

Move to two factor pricing (hybrid pricing)

Raise prices (for the segment that is getting high value to customer but providing only limited customer lifetime value)

Eliminate fences that prevent in package growth

Make sure that value paths are completed in package

Design for viral growth

Balance in package growth with upsell potential

Download the NDR Report here

Read other posts on Net Dollar Retention

Pricing Diagnostics and Rapid Response (Master Class with PeakSpan)

Using Pricing to Optimize NDR (Master Class with PeakSpan)

NDR Growth Tactics 1: Grow in Package (this post)

Net Revenue Retention (NDR) impacts the value of your company