Pricing and Planning: Should You Increase Prices?

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

One pricing action most companies consider is to simply raise prices. A lot of pricing consultants advocate this and there is a common assumption that solutions are underpriced.

Get Ibbaka’s Pricing Planning Guide & Checklist for 2024

On the other hand, there is a growing concern among buyers that they have too many SaaS solutions and that they are paying too much for them. This has given rise to the notion of ‘SaaS Inflation’ and the emergence of a category of SaaS spend management platforms that basically promise, and are sometimes priced, on the premise that SaaS spending can be reduced.

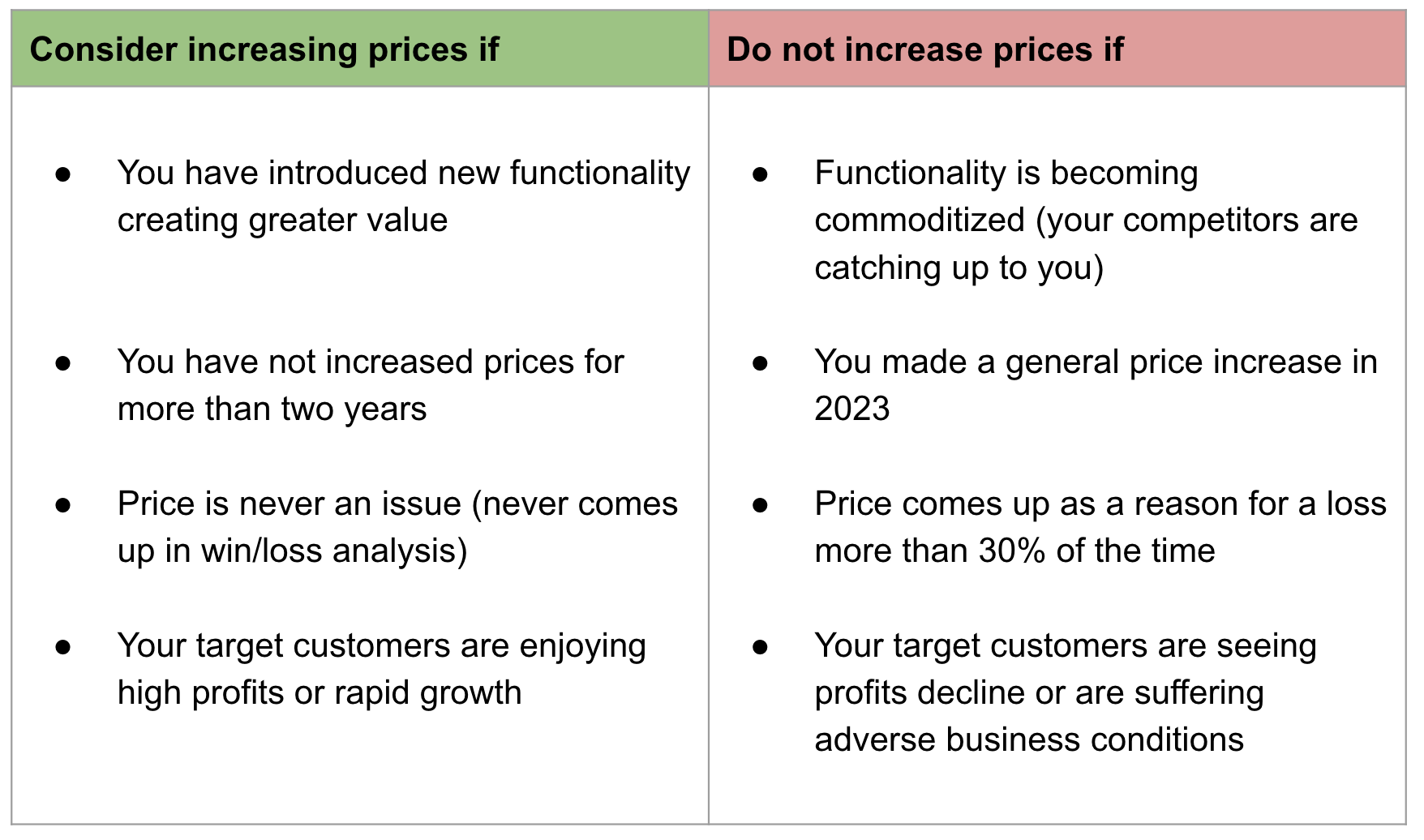

So what should a SaaS leader do? How can you know if you should increase prices?

Consider increasing prices if …

Price should be based on value, so if you are innovating and creating new value then you should consider raising prices. Having a value model will help you understand how you are providing value and who you are providing it for.

If you have not raised prices for two or more years you should be considering a price change. Markets move, customer needs evolve, and competitors change their positioning.

Many SaaS companies are underpriced. Sometimes this is random, pricing is a frozen accident, and a set-and-forget approach is taken. Other companies have intentionally underpriced as they wanted to win market share. This sometimes makes sense early in a category’s history, but as a category matures this strategy becomes less and less effective.

If price is never a reason for losing deals you are probably pricing too low and should consider increasing prices.

Finally, if you are selling to companies that are themselves growing quickly and enjoying high profits there is often a chance to catch a lift on this wind.

Do not increase prices if …

If your innovation has not kept up or you have been focused on matching a competitor you are likely falling into commoditization. In commodity markets, it is market forces that determine the price. Price changes should follow the trend in the market. It is dangerous to go alone.

While it makes sense to raise prices regularly, if you can, making big price increases for all customers is likely to attract scrutiny and lead buyers to look for alternatives. You need a reason to raise prices.

If you are losing a significant number of deals because of price, more than 30% is a good rule of thumb, be careful about raising prices.

Good pricing is about your customers. If your customers are struggling it is probably not the right time to hit them with a price increase.

There is more than one way to increase prices

One way to change prices is to simply change the unit price. The direct approach is not always the most effective. Consider some alternatives.

Reduce discretionary discounts - many SaaS companies offer discretionary discounts and these can sometimes be near random. Tightening up on discounting should be the first pricing action any company takes. Raising prices without getting discounting under control is like pouring water into a leaky bucket.

Add a pricing metric - this is often the single most effective way to increase pricing. One can often reduce the current pricing metric while adding a new metric and then, as usage grows, the effective price can go up.

Change price scaling - most companies have some form of price ratchet such that price decreases with volume. This is best done with a scaling algorithm, but can also be done through some form of tiered pricing table. Adjusting price scaling can be a simple and effective way to change pricing.

Add a new module or package - if you are changing the price to reflect new value being created consider putting that functionality into a new module or package or module or making it an optional product extension. This will give you a chance to test how the market sees the value of the new functionality.

Price increases should be surgical

It is rarely the right decision to apply a uniform price increase across all products and customers. Price increases should be surgical. The first step in targeting price increases is to segment your current customer base by how much value you are providing them (value to customer or V2C) and how much of this value you are capturing back in price.

In the top left quadrant, you are providing a lot of value relative to the value coming back to you. The value capture ratio is too low. This is where you need to work out how to increase prices.

In the bottom right quadrant, the opposite is the case. You are not providing much value compared to what you are extracting. The value capture ratio is too high already. Here you need to figure out how to deliver more value before you raise prices.

The top right quadrant is where you want your customers to be. You are providing a high value to customer (V2C) and are capturing back an appropriate amount of the value through price. This is where you and your customers want to be. But you can’t rest here. Value delivered tends to degrade over time so product and solution innovation needs to be pushing V2C up while the commercial part of the business (marketing, sales, customer success, and pricing) needs to be keeping prices in line with value and market conditions.

The lower left is the problem quadrant. Here you are not providing a lot of value and are not getting a lot back. This quadrant is divided into three sub-segments.

At the top of the red square are the customers where you can see a path to delivering higher value. When you can increase value do that first, but set the expectation that the price will be going up.

On the bottom are customers where you can not see a quick way to increase value and they are a drag on the overall business. Here you need to simply increase prices. This will push some over to the right where at least you are making decent money. Some of these companies will reject the price increase and churn out. That is OK. You want a business where you are focused on high V2C customers that pay well.

The key business questions to ask when raising prices

There are standard questions to ask about price changes.

For a price increase:

How much volume can I afford to lose and still make the same revenue?

How much volume can I afford to lose and still make the same profit?

For a price cut:

How much volume do I have to win to make the same revenue?

How much volume do I have to win to make the same profit?

In SaaS, one has to go a step further and ask about the impacts of a price change on Net Revenue Retention. Ask will the price change

Impact churn

Change growth/shrinkage in the package (especially important when adding a usage metric)

Lead to higher up-sell/down-sell?

One should also evaluate the price change against its impact on the pipeline.

Will more opportunities enter the funnel?

Will conversion ratios between pipeline stages change?

Will pipeline velocity pick up speed or slow down?

SaaS pricing has its complexities and demands and the potential impact on key SaaS metrics needs to be part of any price change decision making.