AI Pricing: Questions Boards Need to Ask

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

2023 was the year most of us became aware that we are using artificial intelligence every day. This had been true for some time of course, but it was underlined by the explosive growth of ChatGPT and a growing understanding of the power of the transformer architecture and Large Language Models (LLMs).

At the same time, more than 70% of B2B SaaS companies began to develop or plan the development of AI-powered solutions. Only 15% had begun to monetize these innovations (see the OpenView 2023 SaaS Benchmarks Report). Monetizing AI investment and innovation will be a major theme in 2024. Watch for Ibbaka’s research into this which will be released in December.

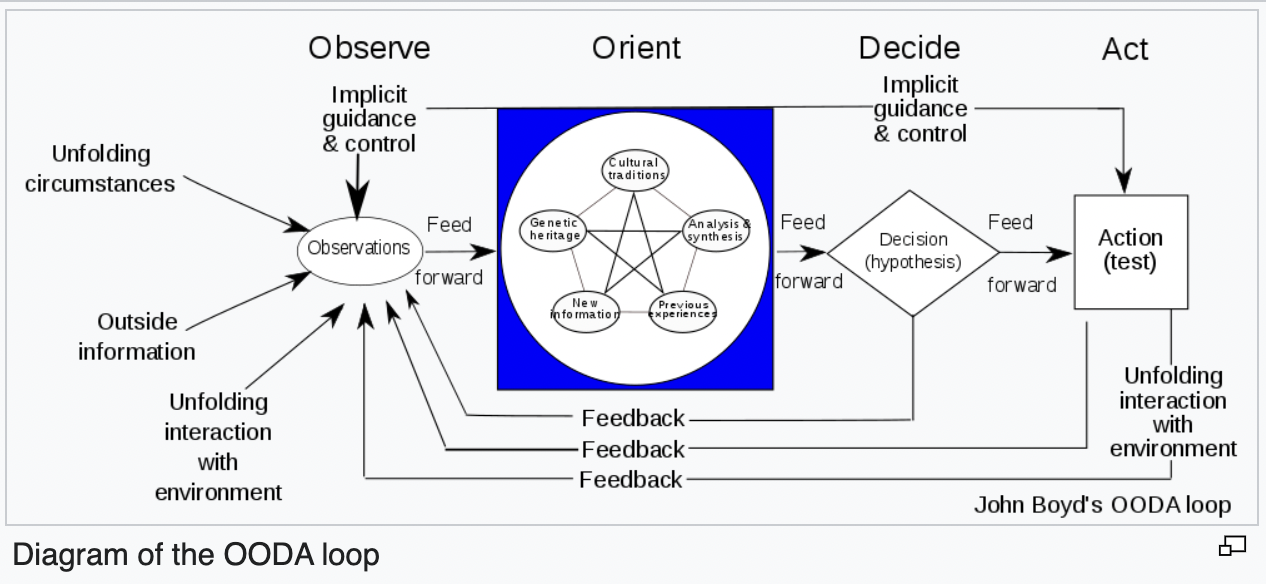

Generative AI is changing the operating environment for B2B SaaS companies. We all need to be aware of the change we are living through and be prepared to change ourselves. OODA Loops (Observe Orient Decide Act) gives us a frame for thinking through this and can help boards and other advisors help management teams with this generational transition.

OODA loops were first developed by US Air Force Colonel John Boyd to help fighter pilots win dogfights. The likely winner is the one with the fastest OODA loop. The goal is to get inside the competition loop so that you are making decisions faster but are making the decisions with good situational awareness.

By Patrick Edwin Moran - Own work, CC BY 3.0, https://commons.wikimedia.org/w/index.php?curid=3904554

Observe

Management is best positioned to observe customer and competitor actions around the adoption of generative AI.

How are customers using generative AI?

How are competitors introducing generative AI?

How are these innovations being priced?

The board and advisors may be better positioned to observe larger movements.

What investments are being made in generative AI?

How are they impacting valuations?

Who might leverage generative AI to enter the market?

Orient

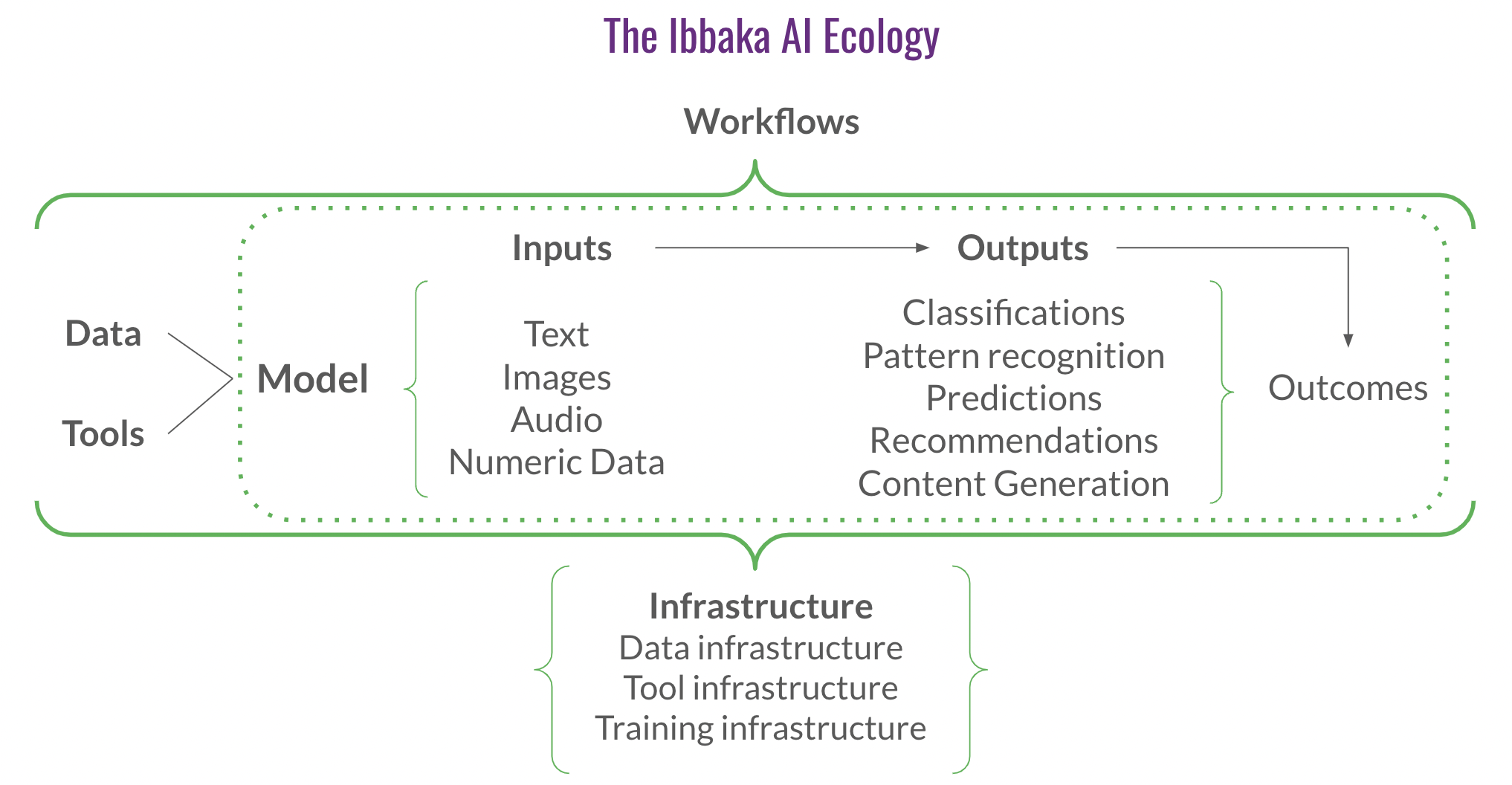

A framework is needed to make the observations meaningful. At Ibbaka we use two frameworks for this. The Ibbaka AI Ecology framework.

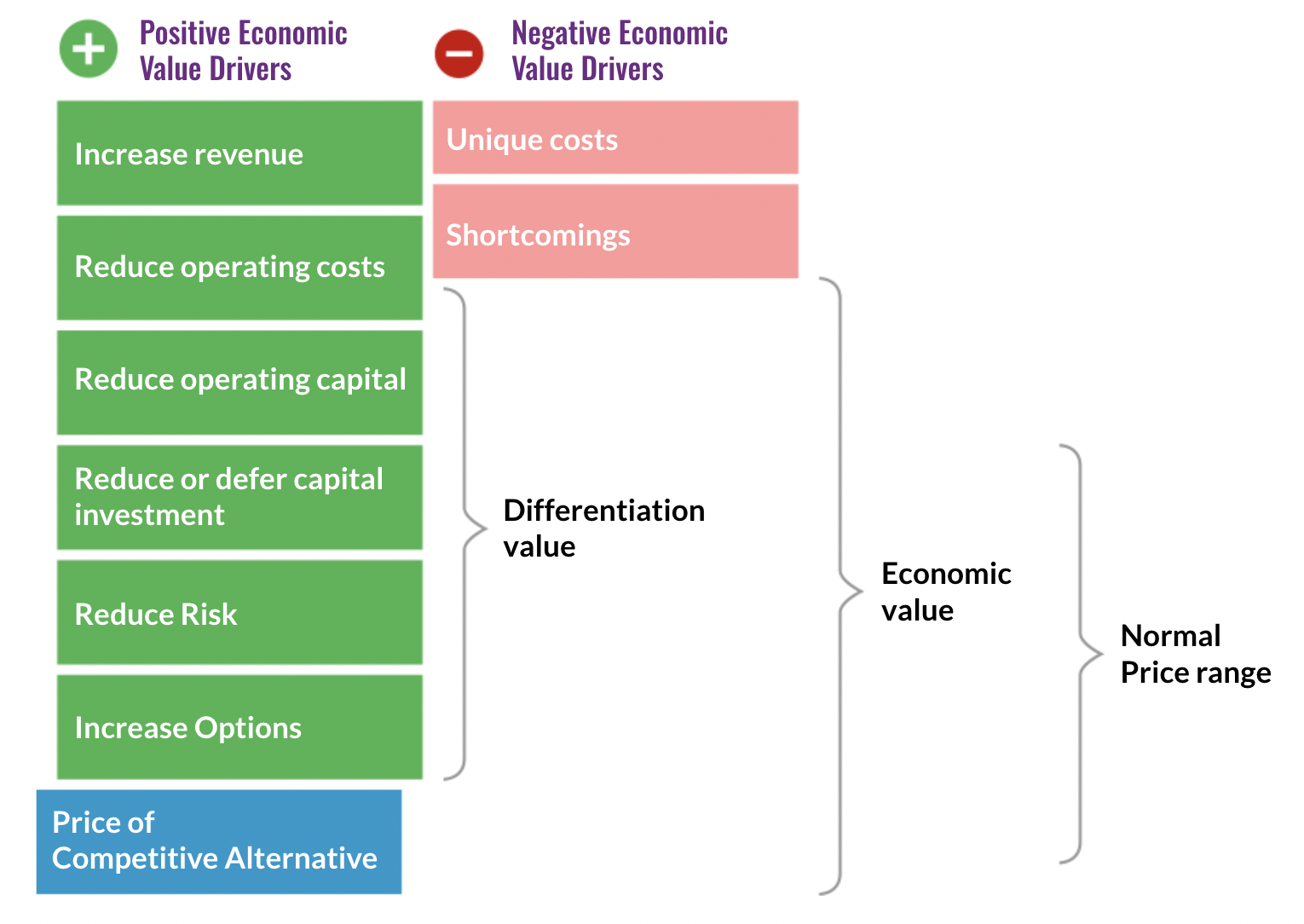

This helps focus the conversation on how the AI is being developed but then there is the question of how value is being created at each of these layers. The Economic Value Estimation or EVE model is the best way to answer this.

It can be a lot of work to build a value model, but it is worth it, especially when there is so much at stake.

How does the AI solution create value?

Who is the value being created for?

Are there new negative value drivers?

How is the competitive alternative changing?

Decide

Observing what is happening and putting it into context is not enough. Decisions have to be made.

How much to invest in generative AI?

What kind of innovation?

What value drivers should be targeted?

Different markets and different companies will take different approaches to innovation.

Initially, most established companies will attempt to sustain innovation. Some will try to disrupt an existing category with new value drivers for new types of customers using new pricing metrics.

The biggest wins will be in category creation. Boards and investors should be pushing to see if generative AI can be used to create new categories, and new ways of solving fundamental problems.

Act

OODA is not a loop without Action. Plans to act on generative AI need to be converted into action. That only 15% of SaaS companies have begun to monetize AI investments is a problem that needs to be fixed in 2024. Investment, development, productization, and monetization need to move forward at a rapid cadence, Failing to do so will let competitors get inside your OODA loop.

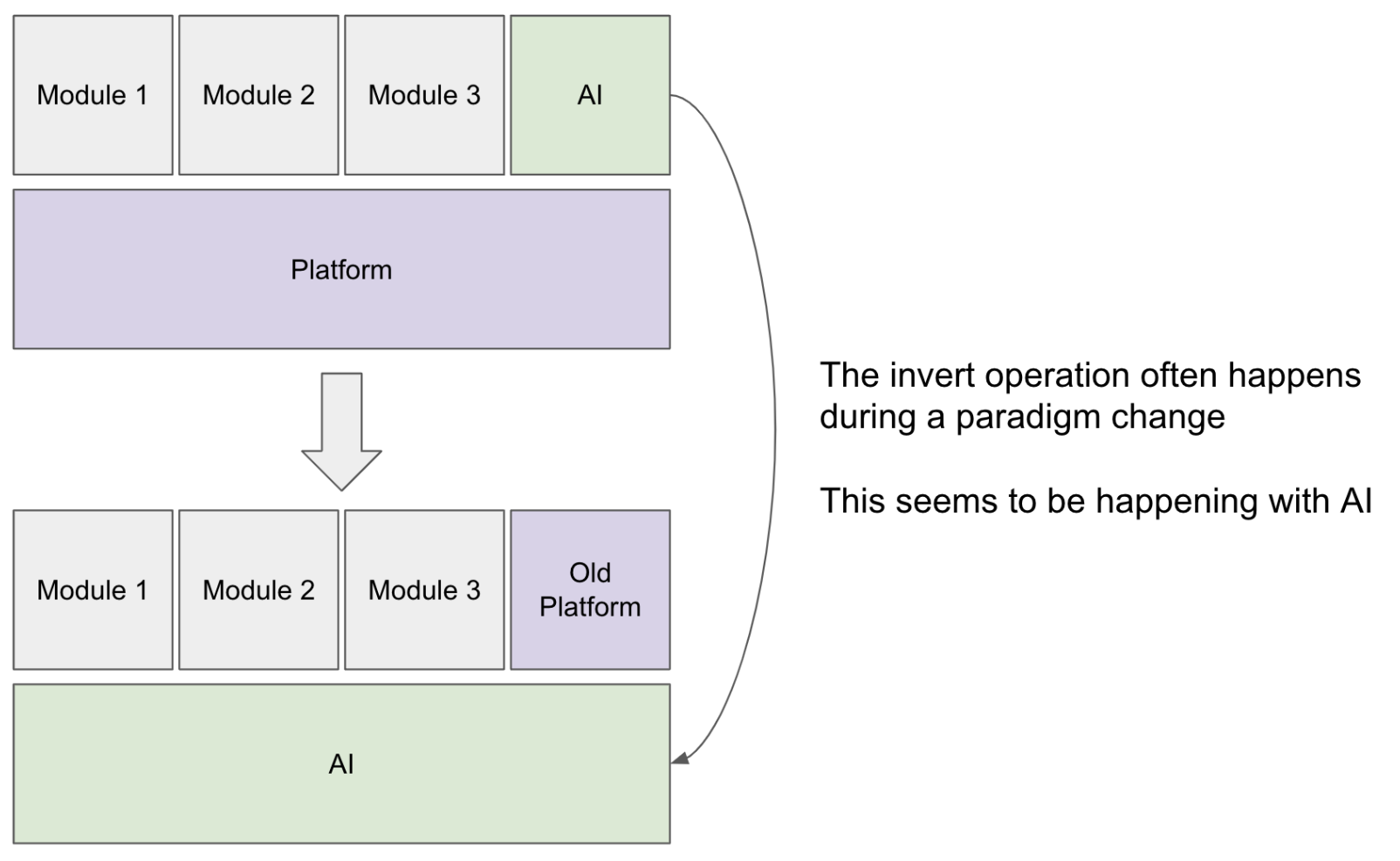

Generative AI, Packaging and Pricing

The generative AI revolution is leading many companies to rethink packaging. Rather than appending AI as an extra module, they are moving to re-platform on top of their AI models.

Re-platforming is a big decision, but it is the kind of commitment needed to win during a transformation as profound as the one we are living through.

Questions to ask the leadership team

Here is a quick checklist of questions boards should be asking leadership teams.

Is generative AI opening new ways to create value?

How are your customers adopting generative AI?

How are your competitors adopting generative AI?

What percentage of R&D will be invested in generative AI?

How will you monetize the investment in generative AI?

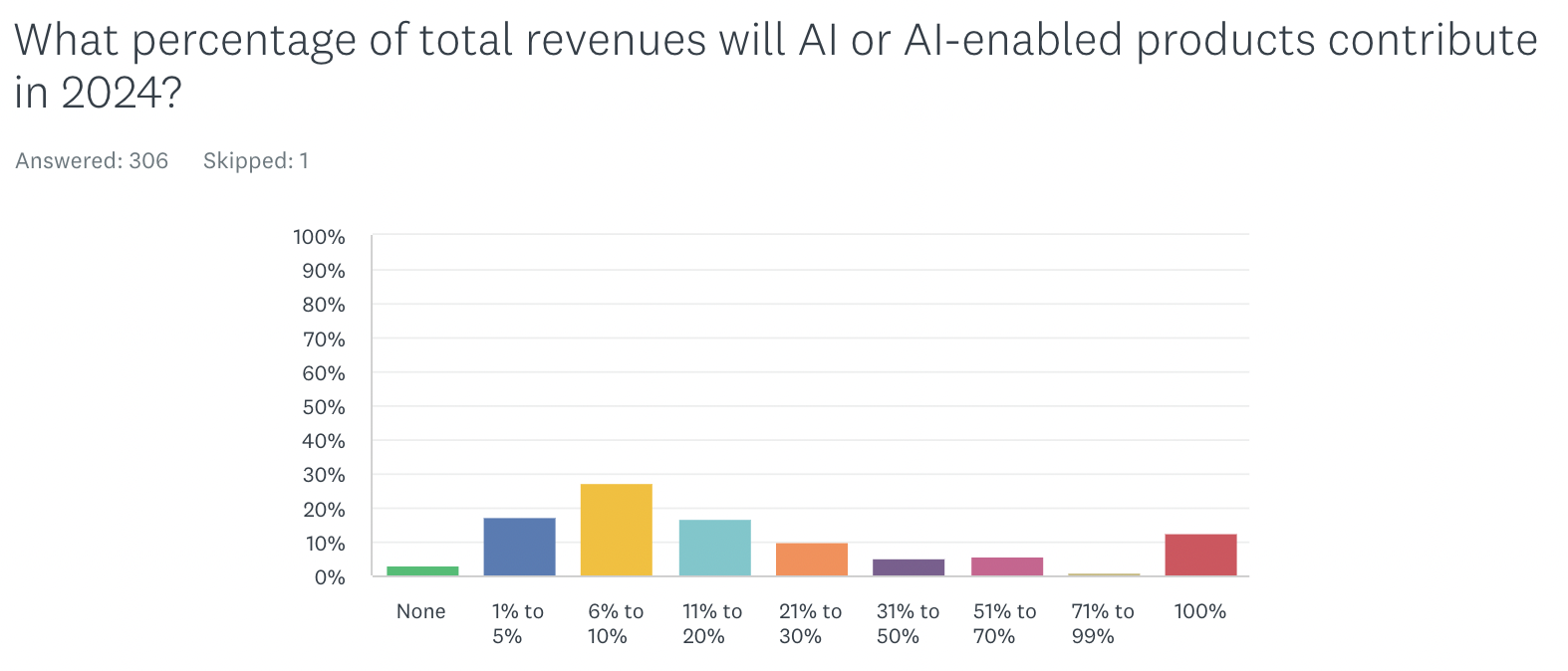

For some context, here is some data from the 307 SaaS companies in the Ibbaka research on AI Monetization in 2024.

What percentage of your product development budget will be used for AI in 2024?

What percentage of your revenues will come from AI enabled products in 2024?