What is driving your Net Revenue Retention (NRR)? Poll Results

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

Net Revenue Retention (NRR) measures the ability of a SaaS company to grow revenue from its current customer base. This is important as it shows that customers get value from the offering (they would not renew otherwise) and that they can grow even if opportunities to acquire new customers are limited.

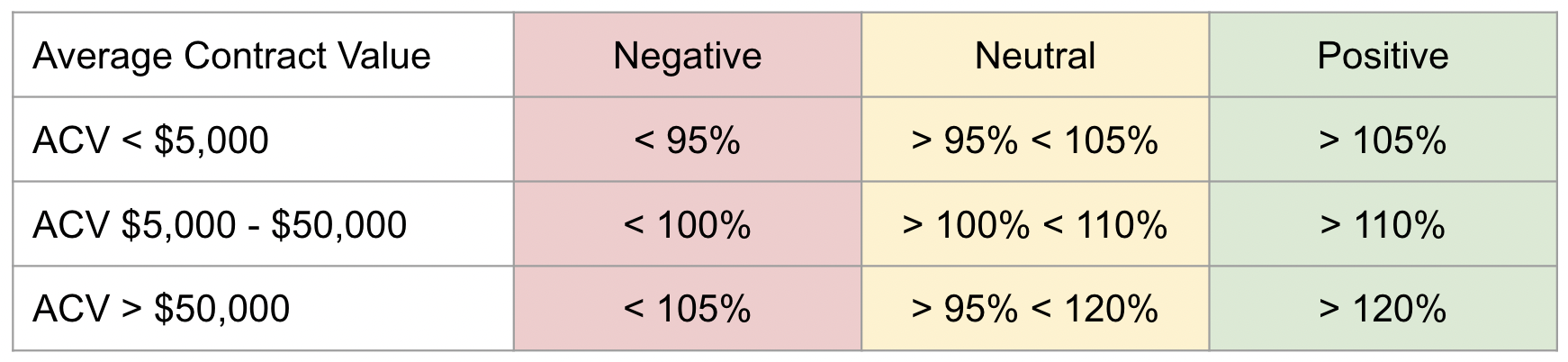

Based on our conversations with several Venture Capital and Private Equity firms, benchmarks for NRR are as follows.

Register for the PeakSpan Master Class: Optimize Pricing & Packaging to Minimize Churn on March 27

Net Revenue Retention is a composite metric. There are 3 factors that drive NRR up and 3 that drive it back down. The NRR waterfall looks like this.

Managing NRR means managing these 6 factors, but you can’t manage 6 things at once. You have to focus on what has the most impact. For most companies, this means that you begin by reducing churn (increasing retention). If you lose the customer the other factors are irrelevant.

Every business has a natural rate of churn though, based on the rate of attrition in the customer base (from business closings, transitions, and mergers and acquisitions) and the level of cross-price elasticity (when cross-price elasticity is high there is more switching).

Once churn has been reduced as low as possible it makes sense to switch one’s efforts to growing revenues from the customer base or in some cases preventing contraction.

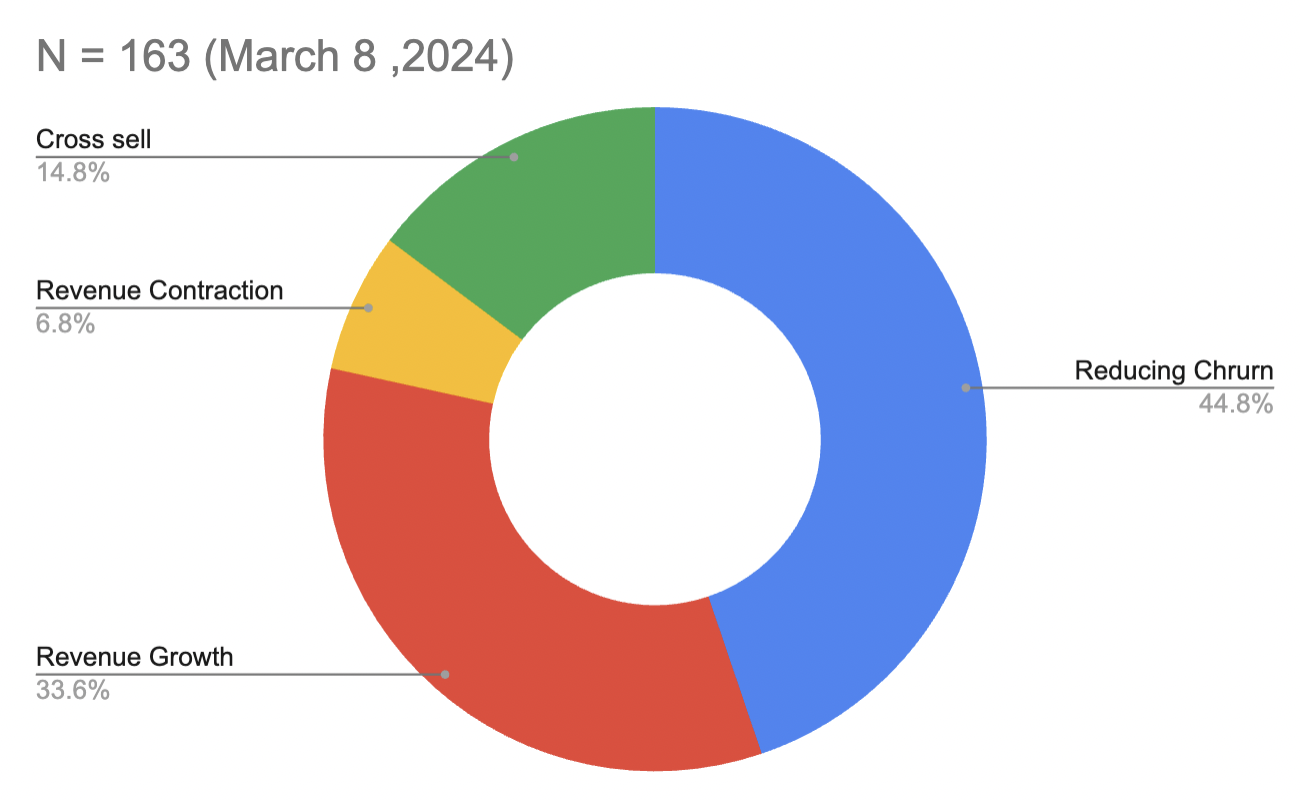

In the week of March 4th, we posted a simple poll on LinkedIn to see where SaaS companies are focusing their NRR efforts. We asked “What is the most important factor in managing Net Revenue Retention at your firm?” and allowed for the following four answers.

Reducing churn

Revenue growth

Revenue contraction

Cross sell

The poll was posted to the Product Development and Management Association (PDMA), the Professional Pricing Society (PPS), the Software as a Service - SaaS Group, and Steven Forth’s personal feed. Here are the results:

Given the current headwinds in the SaaS economy, this is an optimistic result. Reducing churn was the top priority, at just under 45%, but the positive factors of Revenue Growth and Cross Sell combined for 48.4! Of course, there were also some companies trying to prevent revenue contraction (these are companies with usage-based pricing and/or Good Better Best style tiered pricing) so companies focused on the negative outnumbered the positives by a small margin of 1.6%, but all in all this is better than we had expected based on the general tone of the industry.

Each approach requires its own playbook. Churn management, revenue expansion, and revenue contraction all depend on an understanding of root causes and then clear choices on which levers to pull. At the Peakspan Capital Master Class on March 27, we will share our playbook for churn management.

Register for the PeakSpan Master Class: Optimize Pricing & Packaging to Minimize Churn on March 27