Will pricing for profit lead to higher SaaS prices?

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

Interested in pricing and customer value management platforms?

Help shape the category by

contributing to our survey.

SaaS companies are under pressure to increase cash flow and improve profitability. After a decade in which subscription revenue growth was the overwhelming priority, and valuations ranged from 10X to 30X twelve month forward subscription revenues, we have moved into a period where most SaaS companies have to get to cashflow positive and profits are part of valuation. We are still a long way from the world of EBITDA multiples (which encourage excessive borrowing) but there has been a paradigm shift.

How will SaaS companies respond?

One of the expectations is that there will be price rises. it is well known in pricing that

the profit optimizing price is higher than the revenue optimizing price.

Even more important,

the revenue optimizing price goes up as variable costs go up.

And SaaS variable costs are going up.

SaaS has a cult of believing it has zero marginal costs and that there is such a thing as scale free growth. This is not proving out in the real world. Of course companies will try to hide this, and pump up gross margins, but the reality is different.

There are three reasons for this.

Growing customer success costs

Higher labor costs

AI operating costs

Growing customer success costs

In a difficult economic environment Net Dollar Retention (NDR or NRR for Net Revenue Retention) becomes a priority over winning new logos. This makes the role of customer success critical. Customer success costs increase with the number of customers. They also increase with the scale of customers, and even product led growth companies have meaningful and growing revenues from enterprise.

Take a close look at the above chart, from Kyle Poyar’s excellent Growth Unhinged Subtack. Your guide to PLG + enterprise demand. Iconic PLG companies like Snowflake, Asana and Slack already have 40% of their revenue from enterprise. As this ratio grows expect the percentage of customer success costs to go up. Perhaps customer success should be treated as a cost of goods sold and be taken out of the gross margin.

Higher labour costs

Shrinking labour forces and demand for STEM workers across all sectors of the economy are keeping compensation high in the tech sector even with massive layoffs. Expect compensation to go up, not down, and for this to put pressure on SaaS cashflows.

AI operating costs

Some believe that AI will take care of customer support and mitigate labour costs. Maybe. Though most major technology advances have led to expanded employment and new jobs not previously imagined. (There is already a growing demand for people who describe themselves as ‘prompt engineers.’)

Modern AI systems are computationally expensive. They run on specialized hardware, they consume a lot of processing (and energy) and they commonly use some form or usage based pricing.

Open.ai’s GPT-4, which many of us are using to support Generative AI applications, charges for both input tokens and output tokens (a token is a piece of a word with 1,000 tokens being about 750 words).

Virtually all SaaS companies will leverage AI one way or another over the next three years. This will push operating costs up.

SaaS companies will raise prices to improve cashflow and maintain margins

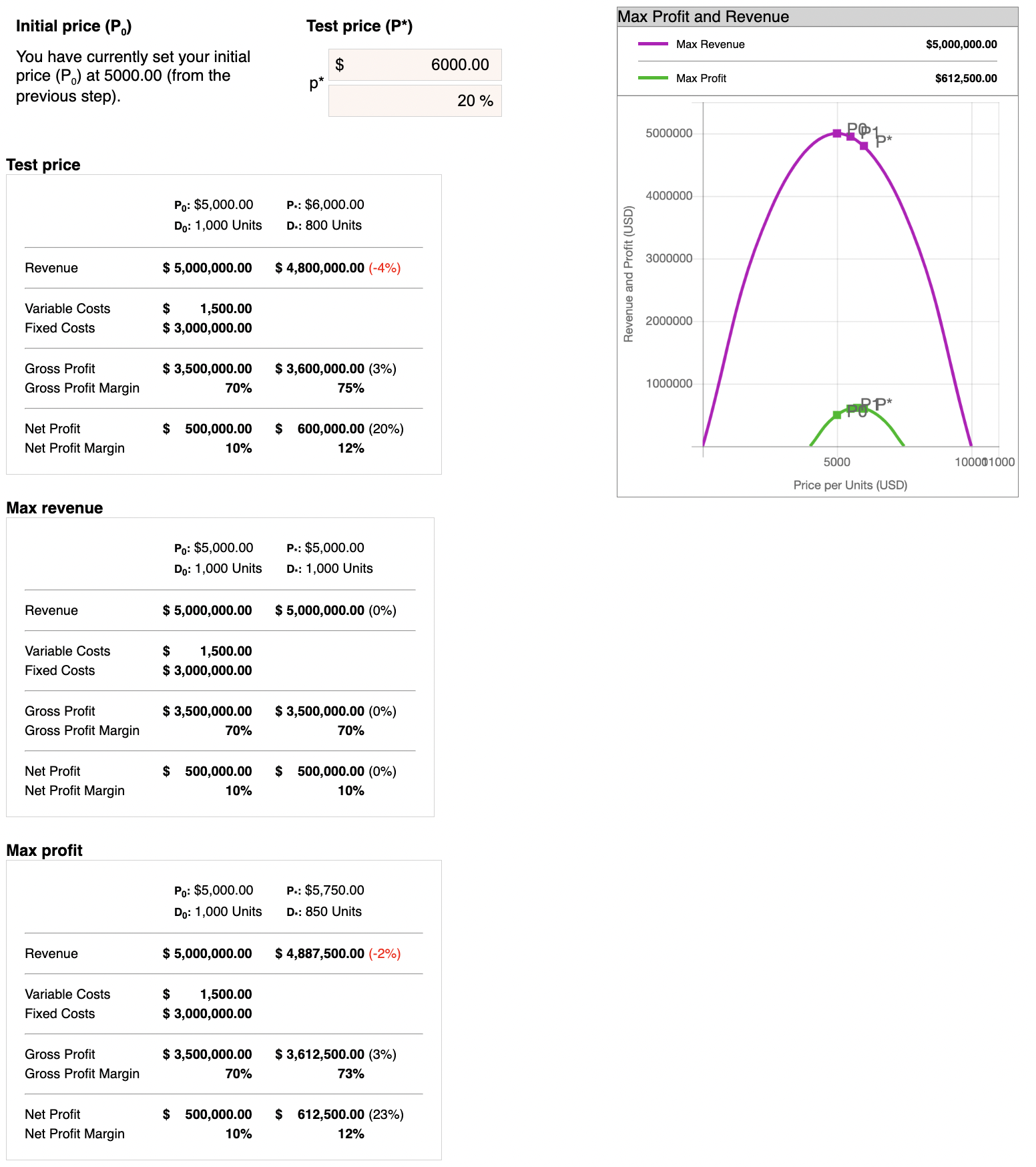

Let’s explore some options at a small SaaS company. The company has been doing pretty well. It has an average contract value of $5,000 and 1,000 customers for revenues of $5 million.

Variable costs are $750 per customer and fixed costs are $3 million (sales and marketing, research and development, general and administrative). It has tracked how demand changes with price and done some market research and knows the price elasticity of demand. It has evidence that a 20% price increase would lead to a 20% decline in volume.

It wants to know the revenue optimizing price and the profit optimizing price.

This is a well run company and it turns out that the current $5,000 price is the revenue optimizing price. But it is not the profit optimizing price.

If it is willing to take a 4% revenue hit it can raise the price to $5,375 and get an additional 1% in gross profit. Net profit would go up 2%. Probably not worth the risk and the cost of making the change.

But what happens if variable costs go up? This could happen for a couple of reasons. Maybe the company needs to spend more on customer success to keep customers in a tough economy. Or maybe it has layered in a content generation AI to build differentiation in a competitive market. Let’s assume that variable costs double to $1,500 (and I know a dozen or so SaaS companies that are seeing variable costs double, not the variable costs on the PnL, but the variable costs that show up in a deeper look into cost and revenue data).

In this case, the profit optimizing price is $5,750. The price increase will push revenue down 4% but lift operating profit 3% by $112,500 dollars. Net profit would go up 23%. In today’s environment many management teams would go for a 23% increase in net profit.

For most SaaS companies we have looked at there is a good argument to be made for targeted price increases. Packages can be designed for customer segments with low price elasticity and prices increased. These target segments are also the ones getting a lot of differentiated value and a high value ratio.

The argument for raising prices becomes much stronger when variable costs are increasing. And there are good reasons to think that variable costs will increase.

Ibbaka expects SaaS prices to increase in two cases.

High value differentiated packages can be designed for market segments with low price elasticity

Variable costs are increasing

AI innovation is likely to increase variable costs for SaaS companies (and fixed costs as more R&D will be required). The most innovative companies are likely to raise prices for the segments they serve with AI.