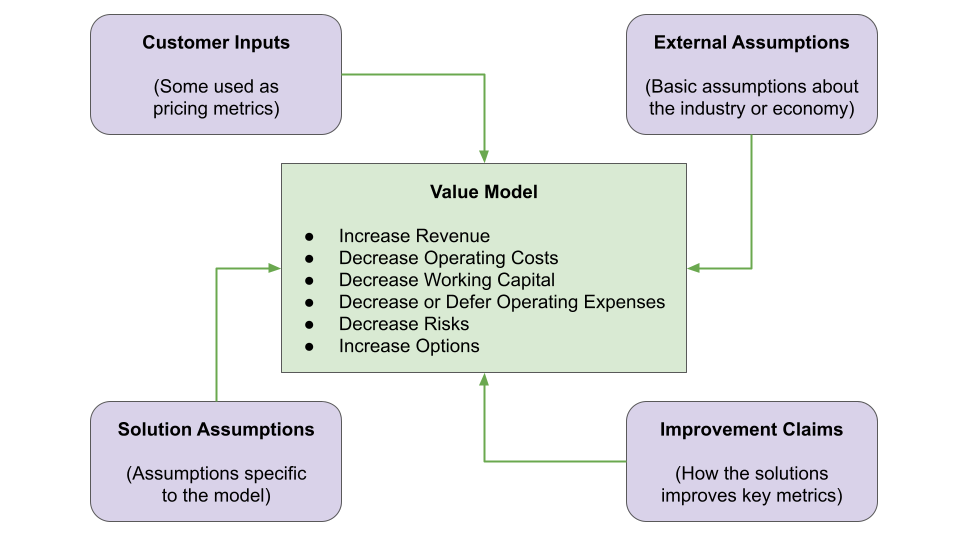

Four types of input into a value model

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

Effective pricing is based on sharing the value created by the use of the product between buyer and seller. To do this effectively, at scale, and over time, requires a value model. Value models are the foundation of value based pricing.

What is a value model? Simply put, it is a system of equations that estimates the economic value (dollar value) that a solution provides to the buyer. In other words, it is the impact of a solution on the profit and loss statement and the balance sheet.

Each of the equations is a value driver. So a value model is a bundle of value drivers. The parts of an equation are

Constants: Values that don't change, plain numbers.

Terms: A part of a sum in an algebraic expression; A single number, variable, or a number multiplied into a variable.

Operators: A symbol that represents a math process like addition, subtraction, multiplication, or division.

It is the variables that make the value driver come alive. They represent difference, the differences between customers, the impact of the solution, impacts that the solution has in the external operating environment. We have found it important to call out these variables, or inputs, in the value models we build.

Calling out the variables makes it easier to customize a model for a specific customer or competitive situation. Let’s look at the different variables/inputs.

Customer Inputs

These describe the customer. They capture everything about the customer that is needed to understand how the solution has an impact. What matters about the customer will depend on the solution. Sometimes it is the number of employees, or the number of processes that the company carries out, or the number of times it executes the process.

If the solution is a CRM, the relevant customer inputs could be the number of contacts managed or the number of prospects in the pipeline. The customer characteristics that are relevant, and need to be included in the value model, are dependent on the nature of the solution.

Improvement Claims

These are the explicit claims that are being made about the solution. Again, they depend on the nature of the solution. A skill management solution may be able to close the skill gap (this still needs to be translated into a value impact in a value driver, the improvement claim on its own is not a value driver).

A marketing application may attract more opportunities into the pipeline (but until you know the conversion rate and the value of an opportunity you do not have a value driver). A QA system may capture more bugs (but one has to know the economic cost of a bug before you have a value driver).

External Assumptions

Sometimes in order to build the value model you have to make assumptions outside the customer x solution interaction. These range from macroeconomic factors (interest rates, energy prices, labour rates come to mind) to competitors (the Next Best Competitive Alternative in the Economic Value Estimation approach). Having these called out as variables in the model helps monitor them and run different scenarios.

Solution Assumptions

These are the assumptions one needs to make internal to the solution to model value. They are the behind-the-scenes logic that is often not surfaced. In my experience, this often takes the form of ratios and usage metrics that one needs to track. They are often used together with variables in improvement claims to create value drivers.

Variables are potential pricing metrics

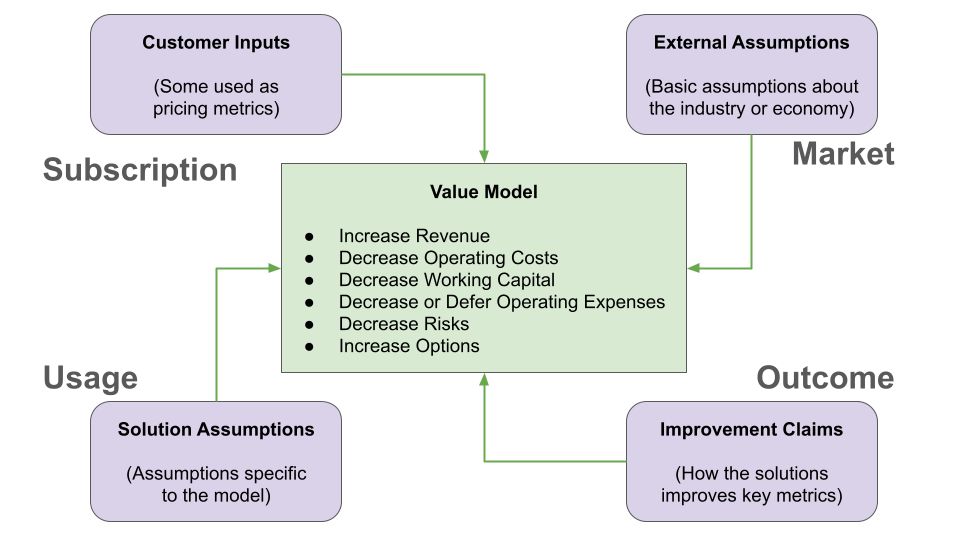

Each of the different types of inputs could be used as a pricing metric.

Subscription pricing

Subscription pricing models often scale off one or other of the customer inputs. One can often calibrate this to the value created (hold other things constant, see which customer inputs correlates best with changes in value, and choose one or more variables that track value). This has the advantage of being predictable and easy for the customer to understand.

Usage pricing

Most software only has value when it is used, and usage based pricing is one good way to capture the value in use. The variables available for usage pricing are found in the solution assumptions. Again, the goal is to find the usage that correlates with value. The impact of usage on the value model is what matters.

Outcome pricing

Long term, pricing is moving to outcome or results based pricing. Next-generation predictive models and causal inference (see Judea Pearl’s work) are making this possible. This means that pricing will be based on improvement claims and economic value delivered. Having clear statements of improvement claims is a critical part of this.

The variables in the improvement claims are the ones that customer success needs to track. Product investment should be focused on strengthening these claims and adding new claims.

Market Pricing

There are some cases where value is heavily dependent on external factors. In this case, one often wants to reference these factors in pricing. Prices that are tied to interest rates, or energy prices, or carbon prices are all examples of this.

In some cases, where there is a powerful competitor, one can also align prices to the competitor’s prices (“we will not be undersold” sends a message to competitors that there is no point in launching a price war as you will meet their aggression).

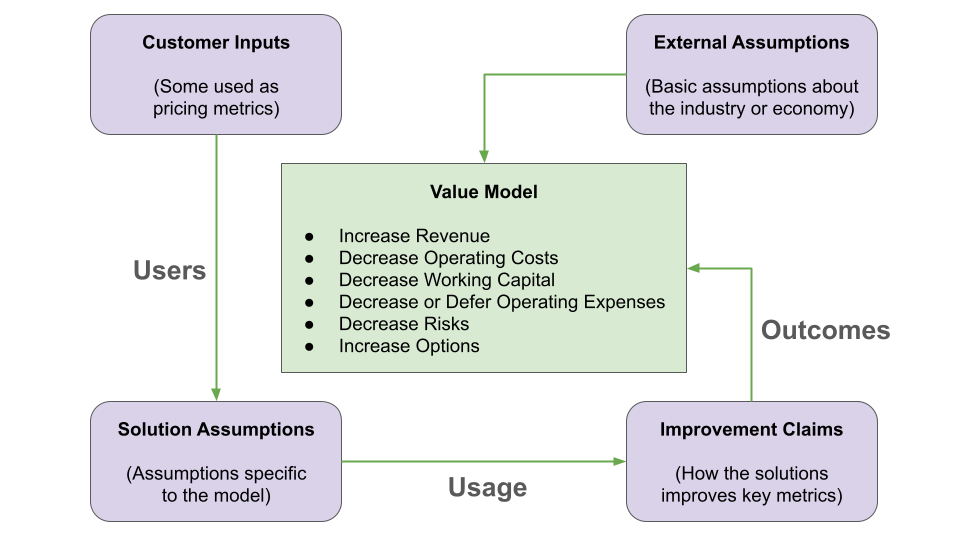

Users to Usage to Outcomes (Value)

Putting these pieces together, one follows the system from the characteristics of customers (which is why pricing begins with understanding the customer) to the solution, how the solution is used, the improvements this generates and the outcomes measured in the value model, with all of this conditioned by external factors like competitors and the overall state of the economy.

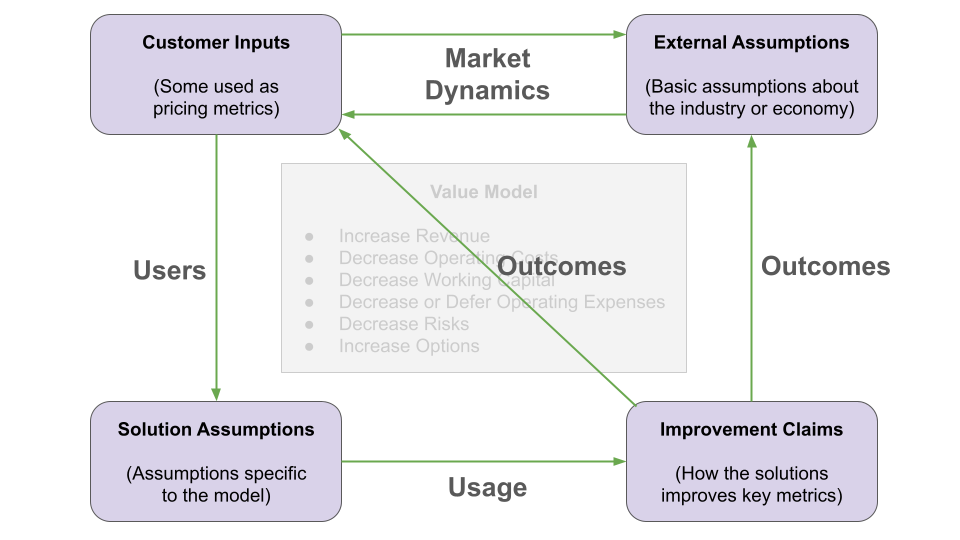

A Dynamic System

The linear flow sketched out above is of course too simple. In the real world these variables can interact and understanding these interactions, and using them to shape the market, is at the heart of strategic pricing.

Outcomes change the customer and change the external reality. If the solution is not going to change the customer, hopefully for the better, why bother with it? The outcomes for one company will also change the competition, and if the companies involved are large enough this can even change the overall economy. At the highest level, pricing is about shaping market dynamics in one’s favour, tilting the playing board so to speak. A value model, with its various inputs, is one of the tools needed to craft an effective strategy.

See also SaaS pricing is model driven