Why are AI applications priced conventionally?

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

We are well into the first generation of generative AI for B2B. Almost all enterprise software companies have launched, are about to launch, or are working on innovation built on generative AI. Let’s pause for a moment and see how this is playing out from a pricing perspective.

Before going on, let’s take a look at the range of AI products being offered.

Compare the different approaches of:

Hubspot and SalesForce

Hubspot is using an enhanced existing product strategy while Salesforce is building a new platform, Salesforce Einstein.

Other companies have transformed themselves into generative AI companies,

Acquia and Pyramid Analytics with Acquia launching product extensions and Pyramid injecting AI deep into its product.

And of course, there are brand new business AI applications companies, such as:

Tome and Jasper and Dialpad - each of which are solving a narrow and well-defined problem.

Several observers have noted that most AI applications are being priced using very conventional pricing metrics.

Ibbaka found this in its survey AI Monetization in 2024. The results for pricing metrics are shown in the below table.

Ibbaka Survey AI Monetization in 2024, data collected October and November 2023, N = 308

The most common pricing metric was Per User, followed by a Usage Metric. When AI model and AI infrastructure companies are removed from the data the pricing metrics are even more conventional.

This data was collected almost six months ago and things move quickly in the generative AI space. Has the approach to pricing changed?

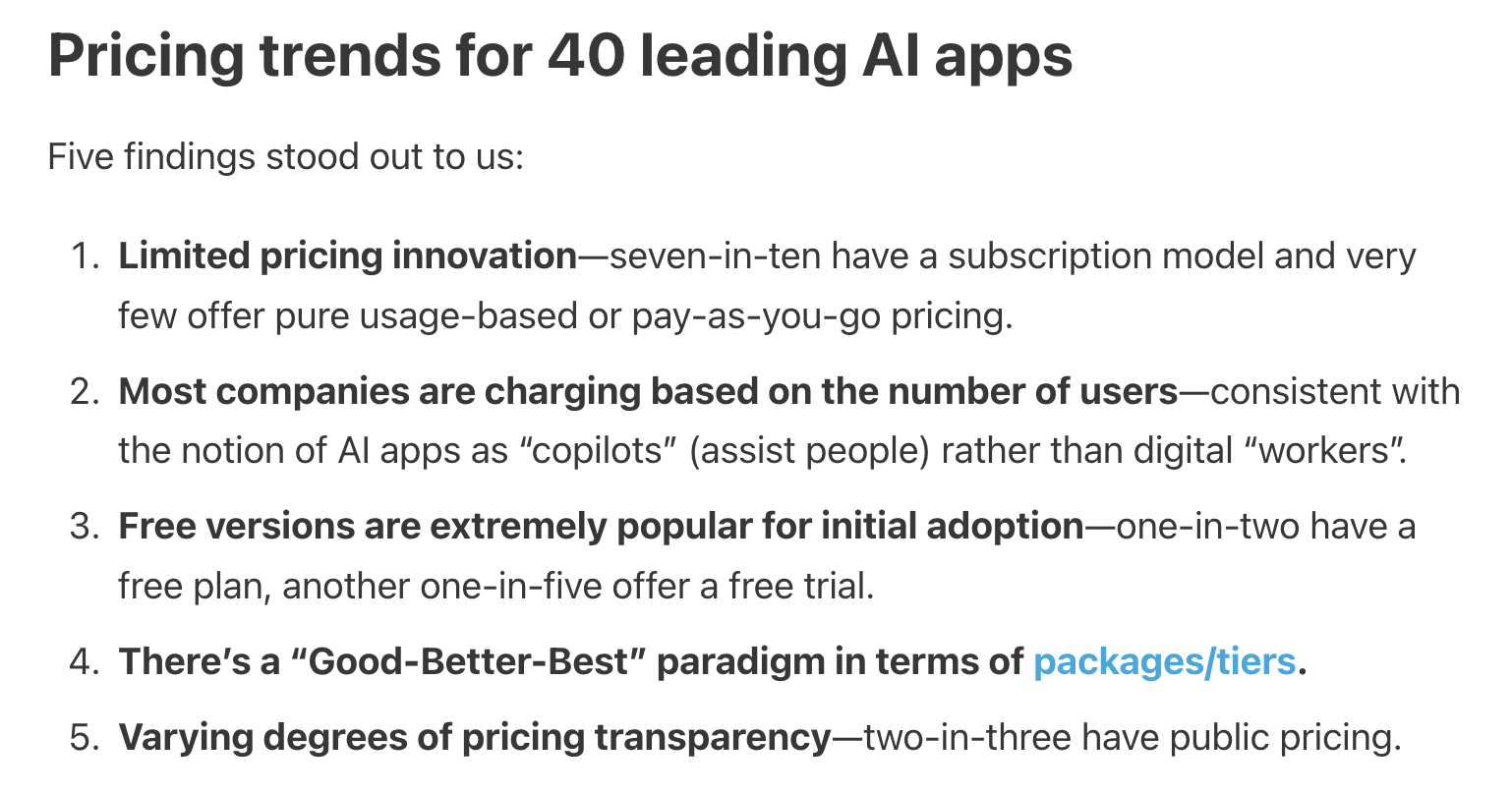

Not according to Kyle Poyar and Palle Broe. In a May 1 post to Kyle’s Growth Unhinged site, How AI Apps Make Money, they identified five trends for AI Apps.

Note points 1 and 2. “Limited pricing innovation” and “Most companies are charging based on number of users.”

This is basically what Ibbaka found as well. Why might this be?

When we think about pricing, we start by looking at how value is created. There are really only four strategies here, depending on whether one is enhancing existing value drivers or creating new value drivers, and whether these are for existing markets or for new markets.

Value Driver: A value driver is an equation that estimates one part of the economic impact of a solution for a customer.

Value Model: A value model is a system of equations built from value drivers.

At this point, most companies are trying to improve existing value drivers and not to introduce new value drivers. Established vendors are focused on their existing customers, disruptive new vendors are applying well-established value drivers to new markets. This will all sound very familiar to students of Clayton Christensen’s work on disruptive innovation. It is also typical of the introduction of a new technology. Begin with what people already know.

That is a good place to start but it should not be the destination. Generative AI represents a profound change in how we generate, share, and apply knowledge. It will reconfigure everything we think we know about how software gets developed, distributed, and supported and the user experience. And this will change how we price.

As Kyle and Palle note …

“We are seeing signs of very innovative pricing structures among the second wave of AI companies; these pricing models could unlock faster customer adoption while capturing more overall revenue. Heck, even Microsoft is testing innovative pay-as-you-go pricing for their new AI Copilot for Security.”

Long term, AI is going to enable outcome based pricing, where the user only pays for a successful outcome. This will lead to higher overall prices. Although many people are not aware of it, a risk discount is implicit in B2b pricing. Buyers are not sure they will get the value claimed and this reduces their willingness to pay. Outcome-based pricing takes this off the table. Outcome-based pricing becomes more doable with generative AI.