Prioritizing NDR growth choices

Steven Forth is a Managing Partner at Ibbaka. See his Skill Profile on Ibbaka Talio.

This is the final post in our eight-part survey of Net Dollar Retention or Net Revenue Retention. We started with a general overview and motivation in Managing package performance to optimize SaaS NDR and then worked through each of the six levers that you can use to achieve your NDR goal (three to accentuate the positive, three to eliminate the negative).

The 6 NDR Patterns

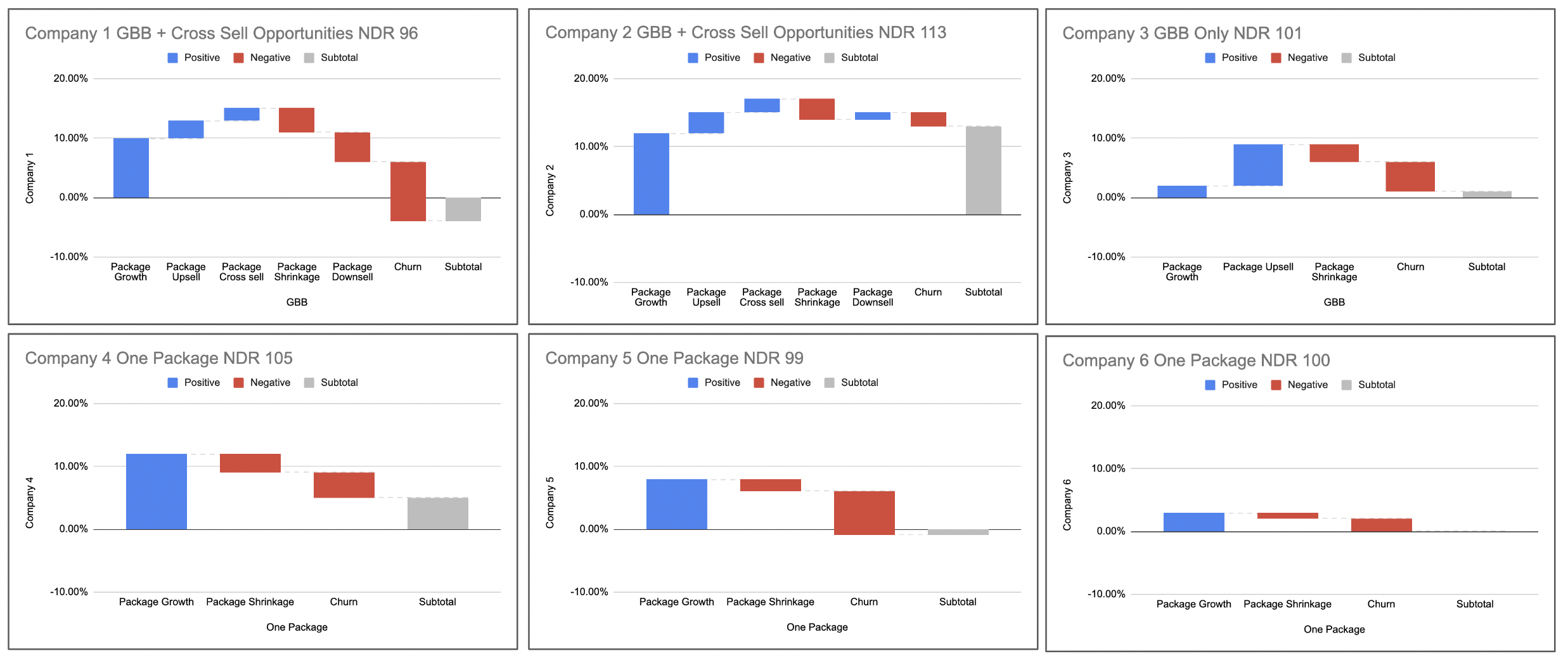

Six levers are too many to try to pull all at once, so you are going to need to prioritize. Before you do that though, you need to see how each of these factors is impacting your NDR. The way to do this is with an NDR waterfall. Here are 6 NDR waterfalls showing some common patterns.

A few things to note.

Not all companies have all 6 NDR factors. Only companies with multiple packages, so that upsell is possible, and more than one product line or service offer, so that cross-sell is possible, will have all 6. The 3 basic patterns are as follows:

Multiple packages and product lines - all 6 factors

Multiple packages but just one product line - five factors (remove cross-sell)

One package - three factors (remove upsell, down-sell and cross-sell)

The three key factors are in-package growth, package shrinkage, and churn. These are the three factors to focus on first.

The second thing to do is to compare pairs of factors that work against each other.

In-Package Growth vs. Shrinkage

Upsell vs. Downsell

Obviously one wants to see Growth > Shrinkage and Upsell > Downsell.

Churn pairs with new logo wins. It is also important to compare revenue growth from new customers vs. revenue loss from churn.

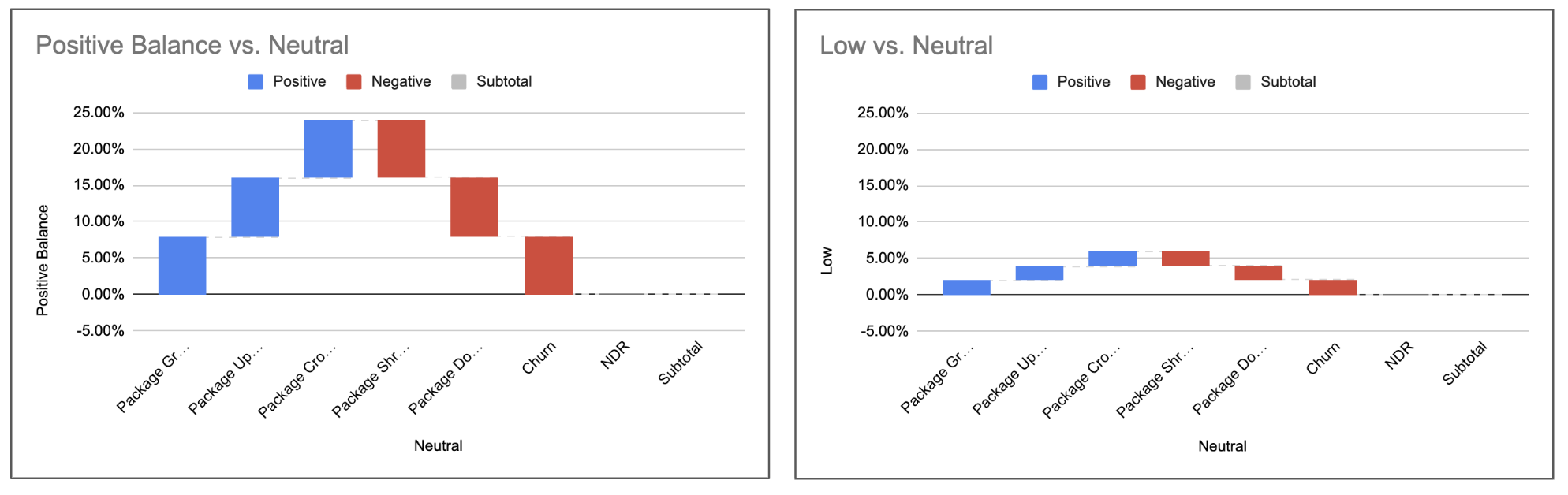

Studying NDR composition reveals a few common patterns.

Positive NDR Patterns

One positive factor overwhelms all the others

The positive side outweighs the negative in pairwise comparisons

Neutral NDR Patterns

All factors are low

Positive and negative factors are balanced

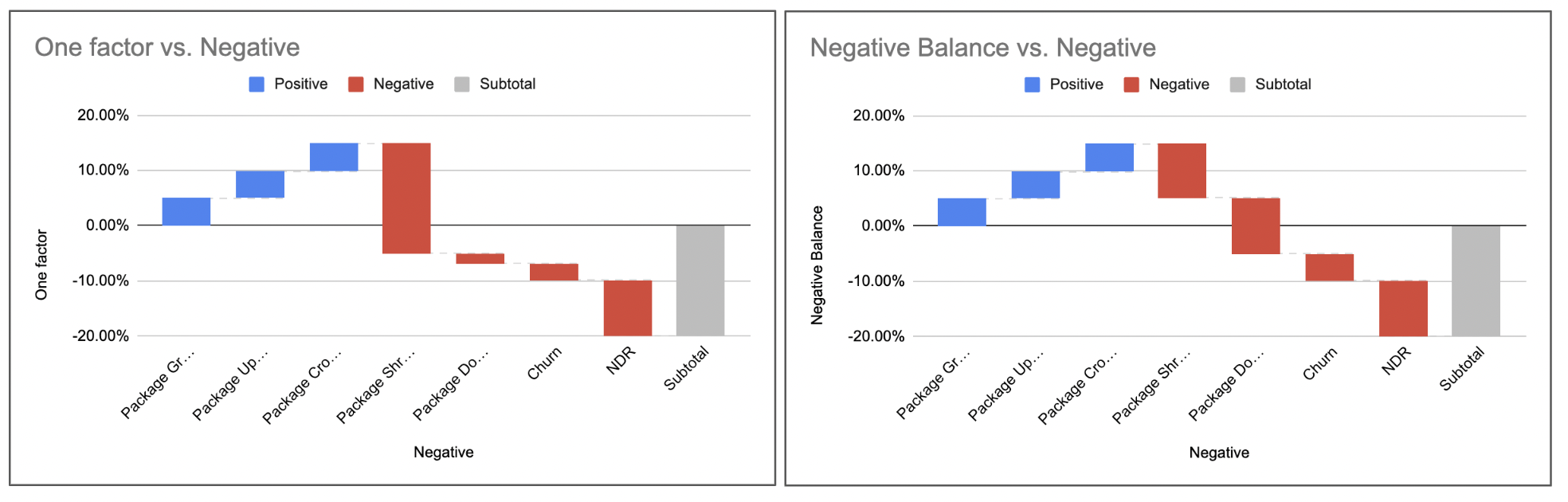

Negative NDR Patterns

One negative driver overwhelms all the others (most often churn or shrinkage in package)

The negative side outweighs the positive in pairwise comparison

In the real world, the patterns are usually not this sharply differentiated, but asking which pattern you fall into can help guide your work.

Which pattern describes your NDR composition?

Once you understand the composition of your NDR number you may want to segment each of the groups.

The first thing to do is to segment by extrinsic vs. intrinsic factors.

Extrinsic factors are those that you can do nothing about. These are things like

Customers going out of business

Customers merging

Economic conditions that result in lower use or fewer potential users

Intrinsic factors are all of those things you can control.

Packaging and pricing

Value to Customer (V2C)

Value Ratio (how much of the value you create that you claim)

UX (User Experience) and Customer Experience (CX)

How well you have designed and connected value paths

How well you have designed your packaging

Are there easy-to-understand paths from Good to Better to Best?

Is the value proportionate as you move from Good to Better to Best?

How effectively you are using scaling metrics (usage metrics)

Do the scaling metrics reflect the current usage patterns?

Do the scaling metrics track value?

Try segmenting your customer base by extrinsic vs. intrinsic for each of the six factors (be honest and when uncertain assume that the factor is governed by intrinsic factors, things you can do something about).

Look at each NDR factor for the two groups. Ask questions like …

What is your Extrinsic NDR vs. your Intrinsic NDR?

How much of churn is intrinsic (you can do something about it) vs. extrinsic (you can’t do anything about it)?

How much package shrinkage is intrinsic vs. extrinsic?

Does the relative importance of factors change for the intrinsic vs. the extrinsic segments?

What is the most important factor for intrinsic NDR?

Order of operations in NDR management

There is a logical order of operations to improve NDR.

Perform your factor analysis

Segment by intrinsic vs. extrinsic

Focus on the results for intrinsic

Begin with churn

> 10% This is your top priority - you need to fix this before worrying about other factors

5 to 10% Consider as a priority but look at other factors as well

< 5% Probably not your top priority, some churn is inevitable (you should know the natural rate of extrinsic churn)See which of the six patterns best characterizes your intrinsic NDR

Depending on the pattern

Positive and dominated by one factor

Is there room for further improvement or is this factor maxed out?

Positive with many factors at play

Assess which of the three positive factors is easiest to improve; do a simple ROI exercise and calculate how much you need to invest for a one percent improvement for each factor, focus on the factor with the highest ROI

Negative dominated by one factor

Fix that one factor first, it is usually churn or in-package shrinkage, but not always

Negative with many factors at play

Assess which of the negative factors is easiest to improve; do a simple ROI exercise and and calculate how much you need to invest for a one percent improvement for each factor; focus on the factor with the highest ROI

Measure the impact of your NDR actions on each of the six components (or five if you have no upsell or three if you have no cross-sell)

Measure the ROI of the actions

Iterate and redo the analysis regularly

Improving NDR is not something that you do once and are done. It is a constant part of managing a SaaS business.

Download the New 2023 NDR Report here

Read other posts on Net Dollar Retention

Prioritizing NDR growth choices (this post)

Pricing Diagnostics and Rapid Response (Master Class with PeakSpan)

Using Pricing to Optimize NDR (Master Class with PeakSpan)

Net Revenue Retention (NDR) impacts the value of your company