Things are changing in technology services - an interview with Laura Fay of TSIA

By: Steven Forth

Things are changing in the technology industry. What was once a world of technology asset sales with attached support and implementation contracts, delivered by customer support and professional services whose concern was with post sale break/fix support, installation, configuration and support of systems, has become something fundamentally different.

This was clear at last month’s (May 2019) Technology and Services World event in San Diego. The main themes of the event were customer success (over on the People Insights side of our business we are developing a competency model for customer success) and the need for companies to find ways to sustain scalable and profitable growth with a healthy recurring revenue business model. One prescription given was to do this by augmenting subscription offers with the complementary services that would assure customer success.

Customer success delivers real value in the form of adoption services. Monetizing that value is what should be priced. This got our attention as value-based pricing nerds. We reached out to Laura Fay, VP Research & Advisory, XaaS Product Management, at the Technology Services Industry Association (TSIA) to get her insights into the changing nature of technology and services offerings and how this will impact pricing. We first met Laura in Chicago at the Product Development and Management Association (PDMA) back in November 2018.

Ibbaka: What do you bring from your past experiences into your current role at the TSIA?

Laura: I bring three decades of technology, products and services experience to TSIA. I started by career in engineering. I got my first degree in computer science and worked in big tech at the beginning of my career. From there I went on to product management positions and then to general management. I have worked on everything from a raw startup with two people and an idea to very large companies like IBM. I’ve experienced the cycle of starting a company, growing it, going through an acquisition, and then starting again. It is useful to see the full range of challenges over companies at different stages of growth and scale.

I lived the transition from perpetual technology license deployed on-premise to SaaS (Software as a Service) twice. It can be a tough transition for product people. Shifting to a service mindset and accelerated release cadences is a big culture change. Sales, finance and all the other functions have to change as well. Overall this experience opened my eyes to how challenging that can be for companies and their customers.

Just prior to joining TSIA I made a pivot to focus on value realization by starting and scaling a customer success function. The world begins to look quite different when you focus on customer value realization as opposed to the Product Management world of value creation.This is especially important with subscription models. Companies will only be successful if the subscriber experiences value you’ve created and renews the relationship. There are huge implications for the business.

The opportunity to join TSIA’s research & advisory team came along at the right time. I wanted to take all of the knowledge and experience I have gained over the past years in the technology industry and apply them to a wider range of companies. TSIA let’s me do this.

Ibbaka: What is your current role and what impact would you like to have?

Laura: TSIA’s mission is to increase revenue and profit performance of technology companies. We engage in primary research across the industry and uncover patterns of success - that is, proven practices that correlate with positive business results. We then help our members to understand and apply these proven pacesetter practices. We help our members move from identifying business challenges to the people, process and technology capabilities they need to succeed. We do this through data, frameworks and actionable guidance that lead to improved performance. Further TSIA’s trusted community of business leaders 600+ memberships from 35 countries and including 80% of theFortune 100 Tech firms is an unparalleled resource for our members.

My role is VP Research and Advisory for XaaS Product Management. This research practice focuses on aligning and optimizing practices in product management to accelerate scale of the XaaS business resulting from success of the XaaS offers in market. I help companies understand where the opportunities are in XaaS (you could call this ‘anything as a service’) and product management’s role at the epicenter of impact in the as-a-service revolution.

Product organizations are often horizontally oriented and focussed on building features and functions of benefit to the widest possible range of customers. Their businesses are often selling technology to an IT buyer. In most of these cases, the purchase comes out of the customer’s CapEx (capital expenditures, that get amortized over time). The customer support function is an afterthought to cover for gaps in QA and design. Basically, once the sale is done the job is done.

XaaS models are completely different. Services have to be repeatable. The focus is on the value proposition to a new, and often additional, business buyer. The buyer comes from the line of business and is buying out of OpEx (operating expenses). Real value has to be delivered for services to be consumed on an ongoing basis. In services, you have a lot more skin in the game. With XaaS, the sale is the beginning and not the end. Success depends on getting adoption, supporting engagement and then making sure that value is actually being realized by the users of the service.

In XaaS, the vendor has to be proactive and shape the customer experience. The metrics that matter are ARR (Annual Recurring Revenue), retention and churn (how much recurring revenue is retained or lost in any period), adoption and engagement, and above all, customer outcomes. Customer success is about delivering customer outcomes.

The most successful services business’s business are vertical not horizontal. Success depends on a deep understanding of the customer.

Ibbaka: What are the key trends you are seeing in XaaS? (We can supplement this with links to your publicly available research).

Laura: The first thing people need to accept is that SaaS companies have struggled to get operating scale into their models. It has taken Salesforce more than 18 years to deliver operating profits. Most of the best known SaaS companies are not profitable on a GAAP basis.

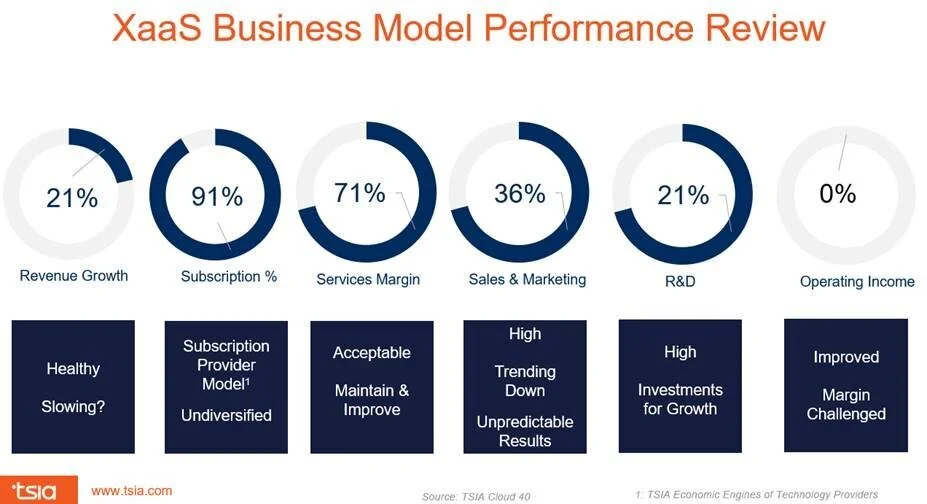

TSIA’s Cloud40 Index identifies the performance attributes of companies with a XaaS business models. It is a representative sample of 40 companies including PaaS, IaaS, SaaS categories. I reviewed the XaaS performance model recently at Technology & Services World Conference and recently wrote about the critically important role that Product Management plays in shaping and accelerating XaaS success.

The Cloud 40 index tells an interesting story. When the vast majority of revenue is derived from the technology subscription, we’ve seen that it’s very hard to make money with that model. Why?” Embedded., non monetized support costs in addition to hosting costs are eating away at gross margin and revenue growth is propped up by high sales and marketing spend. We can see this when we look at XaaS Business Model Performance Review.

The answer may be in providing a ‘Complete Offers,’ one that combines the technology with data, analytics and services. A historic equivalent was referred to as ‘Whole Product”.

Ibbaka: How does this relate to ‘product led growth’?

Laura: I see product led growth as very complementary to complete offers. The offers must be complete and they have to deliver value. Product led growth can be a powerful go-to market strategy to complement the complete offers that cost effectively and predictably drives sales, customer adoption, expansion and long term growth. The technology solution must continually unlock value for the customer.

Ibbaka: How are these trends impacting pricing?

Laura: Value and outcome based pricing depend on having a Complete Offer. As mentioned earlier, Complete Offers are offers that include the necessary technology, services, data and analytics to ensure the customer realizes value and achieves the desired business outcome.

Market based pricing remains the most popular pricing model today, reflective of ‘me-too’ offers highlighting feature function priced by user by volume. Born in the cloud companies tend to talk about value but use market based pricing. There is a disconnect here. These companies have to make the move to value based pricing.

Companies are establishing their pricing model close to product launch time rather than coincident with the offer and product design, potentially missing the opportunity for pricing to have a strategic impact on design to drive the desired customer behavior.

Customers have demonstrated willingness to pay for the value delivered in the ‘complete’ offers. When they exist, see less price erosion from discounting.

When transitioning to XaaS, companies need to completely rethink the price-value package. Too often they just take the old license and divide by five. When you factor in the ongoing support and the other costs that are part of the model this leads to pricing that will not deliver sustainable profits.

And just offering the same technology as a perpetual license to offering it in subscription license form does ignores the ongoing commoditization trend of many technologies.

Effective XaaS pricing must be built on the value proposition.

The offer has to deliver the promised outcomes.

In XaaS a vertical go-to-market strategy takes on increased importance to the profitability picture. In this context, verticalization and segment specific pricing becomes core.

To do this, you have to deeply understand your customer’s business. It’s delivery domain specific value that drives a willingness to pay.

TSIA can help with data, best practices, outcomes and community of peers as companies walk along this path.

As mentioned earlier, many born in the cloud companies tend to talk about value and outcomes but really are providing access to technology offered with market based pricing. There is a disconnect here. These companies have to make the move to value based pricing built on thier complete offers.

Giving away too much for too little undermines business viability, which is what we are seeing in a lot of first generation cloud companies. The only way to avoid this is to put pricing at the beginning of innovation. Doing this will change the solution. We are starting to see this change. People are starting to think about pricing earlier in the value creation phase of their product lifecycle.

Ibbaka: What new skills will be needed to respond to these trends?

Laura: Based on our research, there are new skills needed around offer management and pricing design management. (Ibbaka’s People Insights business is also working on a competency model for pricing design).

Success requires having a dedicated pricing function with deep skills. Pricing skills support many parts of the organization. They inform offer design, but they also contribute to value-based communications in marketing and sales. When value is effectively communicated to the buyer we see less price erosion from discounting.

Some of the skills needed for pricing are financial modeling, which is more than just spreadsheet manipulation, understanding the psychology of pricing and willingness to pay, market segmentation, solution imagining and design, customer knowledge and of course marketing, sales and product management basics.

Ibbaka: How will these changes lead to better business practices?

Laura: As they say, what gets measured gets managed. So we need to start measuring the value being delivered. This means we have to model the ROI (Return on Investment) for the customer.

Too many companies think that scale and profit will just come with top line growth, but the experience of the first generation of SaaS companies shows that this is not necessarily so. (Tom Nagle, author of The Strategy and Tactics of Pricing, made a similar point in our interview with him “Value-Based Pricing’s Senior Statesman Tom Nagle on the Skills Needed for Pricing Expertise”).

Managing profitability requires good pricing strategy and execution. Companies need to pay close attention to their revenue mix and proactively determine the real profit contribution of each component. This is turn depends on their customer mix, which will reflect their market segmentation.

Pricing has to be an ongoing effort. It is not something that is set once and then done. Market understanding, the product design, the complete offer (technology, services, data and analytics), and pricing need to evolve together.

Ibbaka: And what do you do when you are not leading the transformation in XaaS?

Laura: I love to cycle and hike. Recently I completed the Portuguese Camino route. It was a 227 kilometer (140 mile) ride from Porto, Portugal to Santiago de Compostella, Spain.

It was really great. I met people from all over the world and experienced great food and wine along the way.

Closer to home, I like to hike particularly alpine hiking. I have recently completed 60 of 167 miles of the Tahoe Rim Trail. I am doing that in a series of long day hikes.

Being outdoors for extended periods gives me time to relax and refuel.