NRR Performance Analysis: 4 Examples

Steven Forth is CEO of Ibbaka. See his Skill Profile on Ibbaka Talio.

In our recent webinar with Zenskar, we shared some examples of NRR performance from the PeakSpan Ibbaka NRR Survey for 2024 (the full report on the survey will be published in September 2024). Let’s look at these examples to see what we can learn about trends in NRR performance.

You can see the Zenskar webinar here.

Understanding Net Revenue Retention requires more than a simple reporting of topline NRR, or even NRR and churn. To really understand NRR one must look at trends. At Ibbaka, we use our analysis software NRR Analyze to parse NRR performance into six factors and analyze trends. See A quick guide to NRR factor analysis. See the end of this post for more details on the six NRR factors.

Let’s look at the range of performance in NRR by studying four examples.

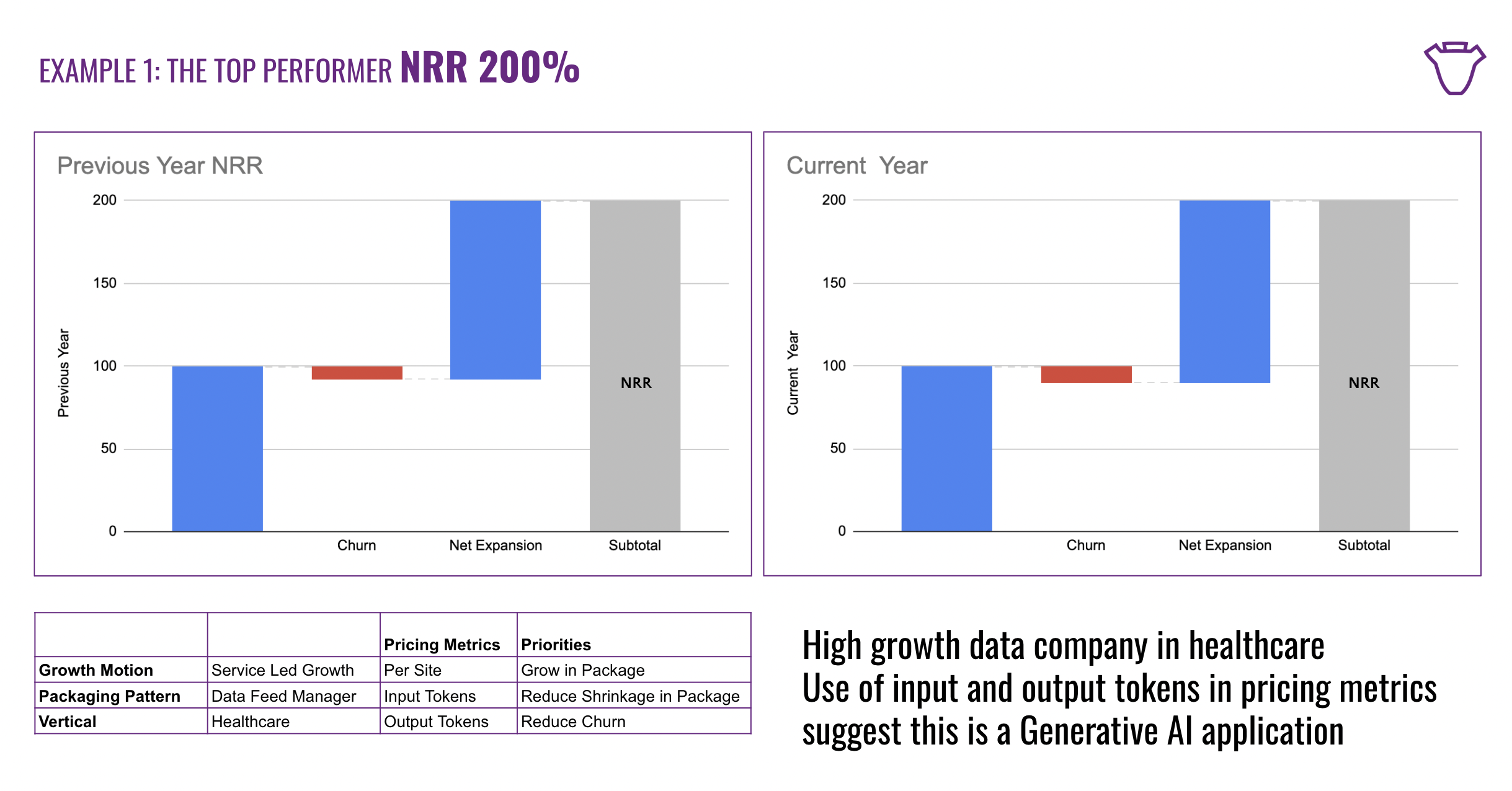

Example 1: A Top Performer

What does exceptional look like? Here is the top performer from the 2024 survey. NRR is reported at an impressive 200%. This means that even if the company closes no new sales its revenue will double over the course of a year. Wow.

How is it doing this? The company operates in the healthcare data space and appears to have a compelling value proposition. In the previous year, churn was only 5% while revenue growth from existing customers was 105%. This year the company expects to keep NRR at 200% even though it expects churn to edge up to 7%.

The company’s growth priorities are (i) to increase growth in package and (ii) to reduce shrinkage in package (see below for an explanation). It has a hybrid pricing model combining the number of sites with input tokens and output tokens. It grows by adding sites and increasing usage.

What kind of company is this? It provides a service managing data feeds to healthcare providers. Given that it uses input/output tokens as pricing metrics this is almost certainly a generative AI company. Not a general-purpose generative AI company, but a vertical AI company. Vertical AI has been identified by Bessemer as the most important growth sector in State of the Cloud 2024: The Legacy Cloud is Dead - Long Live the AI Cloud.

Example 2: The Worst Performer

What does the company with the lowest NRR look like?

This company offers a CRM solution to SMBs (Small and Medium Businesses) and has NRR of only 78%. This means that if no new customers are added the company will be gone in less than five years. Note that this company had significant churn, at 18%, and that revenue among those customers that were staying was going down by 4% per year.

The company expects things to get better in the current year, with churn improving to 15% (still a worrying number for a SaaS company) and net revenue expansion improving from -4% to 2%. If they achieve these targets they will get NRR up to 83%.

The business model at this company appears to be somewhat antiquated. It relies on per-user pricing and does not have a hybrid pricing model. The package architecture is Good Better Best but without a free offer or an enterprise offer.

This is the kind of company that Bessemer is discounting. It will need to find a new pricing and packaging model in the near future and will likely need to find some way to leverage generative AI.

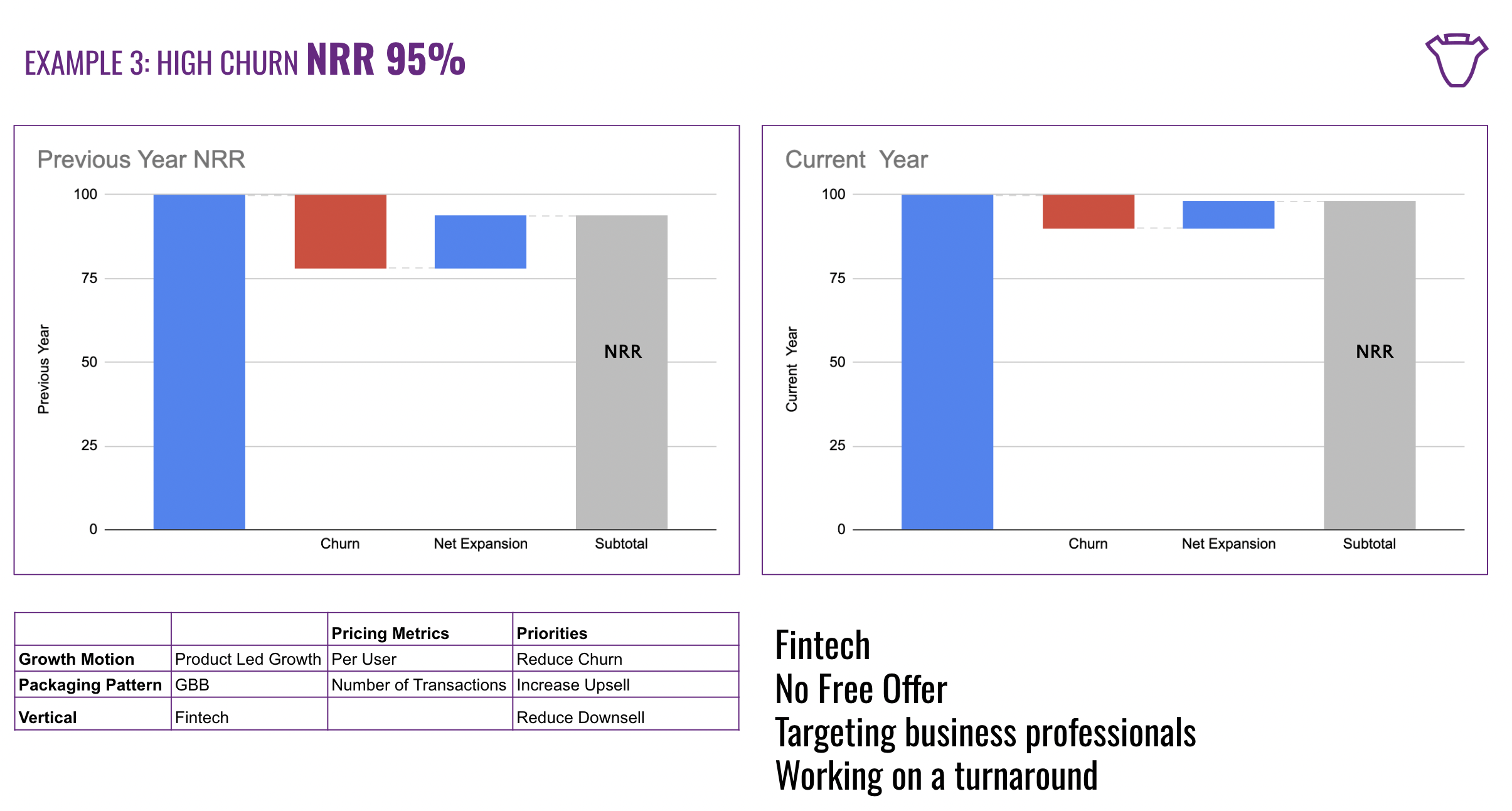

Example 3: High Churn

The company with the lowest NRR was not the company with the highest churn. There was one company that lost 23% of its revenue from existing customers last year. That gives a Gross Revenue Retention of 77%. Despite this, this company had a Net Revenue Retention of 95%. Not good, but not disastrous. They did this by expanding revenue to the customers they did keep by 18%.

This Fintech (financial technology) company has the tools it needs to manage NRR. It has a hybrid pricing model, pricing is per user and per number of transactions, and there are four packages in its tiered pricing model (Good, Better, Best, and Enterprise).

Unlike the company in Example 2, this company had the tools it needed. There is a hybrid pricing model, Per User and Number of Transactions, and had four tiers in its tiered pricing model, giving room for framing effects and upsell.

In the current year, it is looking to improve NRR to 98%. It will do this by reducing churn to 10% but it is also expecting growth in revenue from existing customers to go down by almost 50% to 10%.

Its number one priority for the current year is reducing churn, followed by increasing upsell (which is what generates a lot of the revenue growth with existing customers, and reducing downsell. That reducing downsell is a priority suggests that it is something that is happening. Downsell happens when a customer moves from a more expensive package to a less expensive package.

Example 4: High Growth Generative AI

Some of the generative AI companies are showing an unusual pattern of high churn and high Net Revenue Retention.

Look at the below company, which in the previous year delivered an impressive NRR number of 142%. It did this while managing a revenue churn of 22%. This is one of the highest churn numbers reported in the survey, while 142% is among the top performers for NRR. It did this by driving an impressive 64% in revenue growth from existing customers. What does this mean?

We often associate high NRR with product-market fit. Product market fit implies low churn and solid growth in revenues from existing customers. This is not what is happening here.

The company does not even identify churn reduction as a priority, being focused on growth in package, reducing shrinkage in package and cross sell.

Note that the pricing model is pretty standard for a horizontal generative AI application: input and output tokes model size and model speed.

We believe that this pattern, high growth with high churn, shows a market-seeking behavior. There is a market for generative AI and a group of users that get a lot of value and expand use. But this is hit-and-miss. There are other buyers who try the solution, do not find value, and then churn out. This may be a more general pattern for new technologies that have a lot of potential value but are still exploring where that value lies and who it can be delivered to.

The key business questions for value based pricing and value selling are

How do we create value

Who do we create value for

How do we capture a fair part of that value back through price

Note that this company is expecting to reduce churn in the current year, evidence that it is moving towards product market fit.

NRR Factor Analysis

Managing Net Revenue Retention depends on NRR factor analysis. In the fall Ibbaka will be launching a tool to help with this. NRR Analyze decomposes NRR into six factors and looks at the trends for each factor.

Positive NRR Factors

Growth in Package: Revenue growth attributed to increased use. This generally requires some form of usage based pricing. In the example below, the number of connections and the number of calls on those connections are used (this is for an API connector-style application)

Upsell: This is for movement to a higher tier in a tiered packaging architecture like Good Better Best.

Cross-sell: This is for the sale of other products and services. It is not always included in NRR, but when there is a tight coupling between products or a product and service it makes sense to include it.

Negative NRR Factors

Revenue Churn: This is revenue lost when customers cancel or fail to renew subscriptions. Many people obsess about churn, but there is a natural level of churn for most companies, and trying to do better than that churn can be a challenge.

Shrinkage in Package: When it is possible to grow in package it is also possible to shrink if usage goes down. It is important to analyze growth and shrinkage and not to combine them into one metric. Growth drivers, and customers, and shrinkage drivers, can be quite different and the actions taken to encourage growth and discourage shrinkage are often quite different.

Downsell: We want customers to move up the ladder from Good to Better and Better to Best. That is what upsell refers to. But sometimes buyers move in the other direction, from Best to Better or Better to Good. That is downsell.